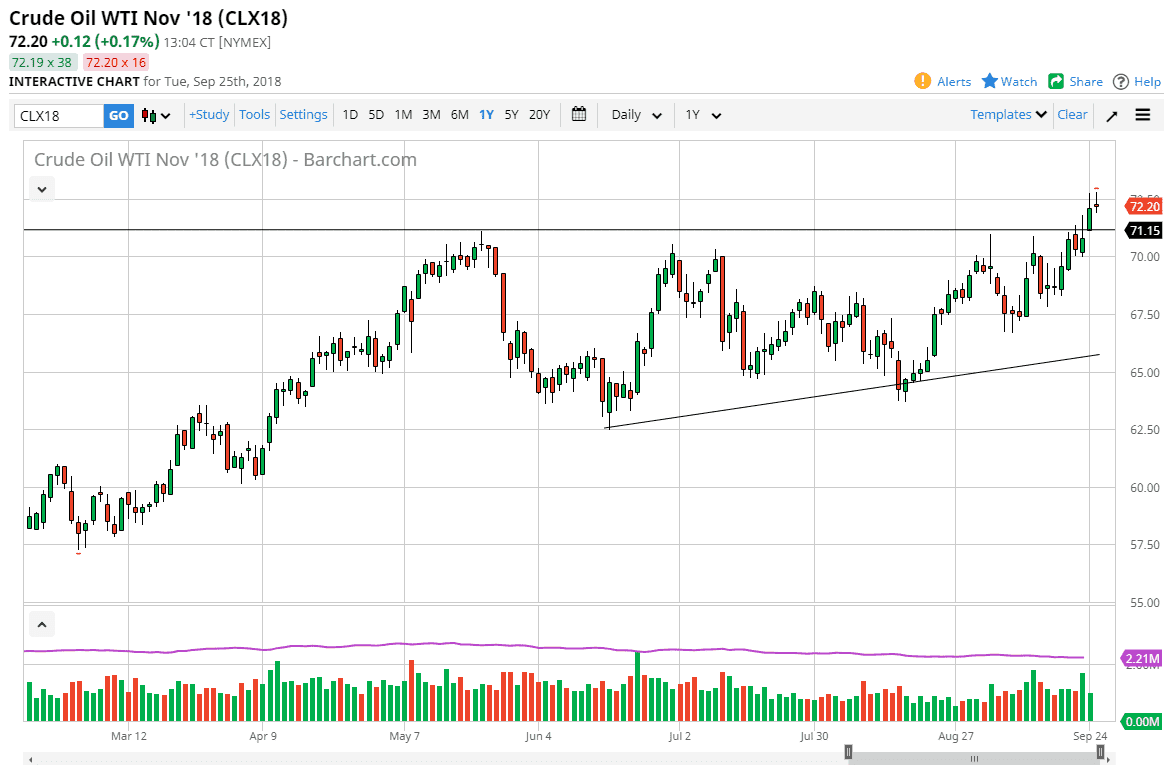

WTI Crude Oil

The WTI Crude Oil market initially rallied on Tuesday as we continue to see buyers jump into this market. With sanctions on Iran coming, it’s likely that we will see a tightening of supply, and the fact that we ended up rallying at the beginning of the session isn’t a huge surprise. However, I think at this point after forming a bit of a shooting star it’s likely that we need to pull back to continue to push higher. The volume for the day was a little bit lower than Monday, and certainly many of the other markets were the same. Because of this, I think that it is only a matter of time before a pullback attracts value though, and I believe that the gap from the open on Monday will serve as a bit of a “floor” in this market.

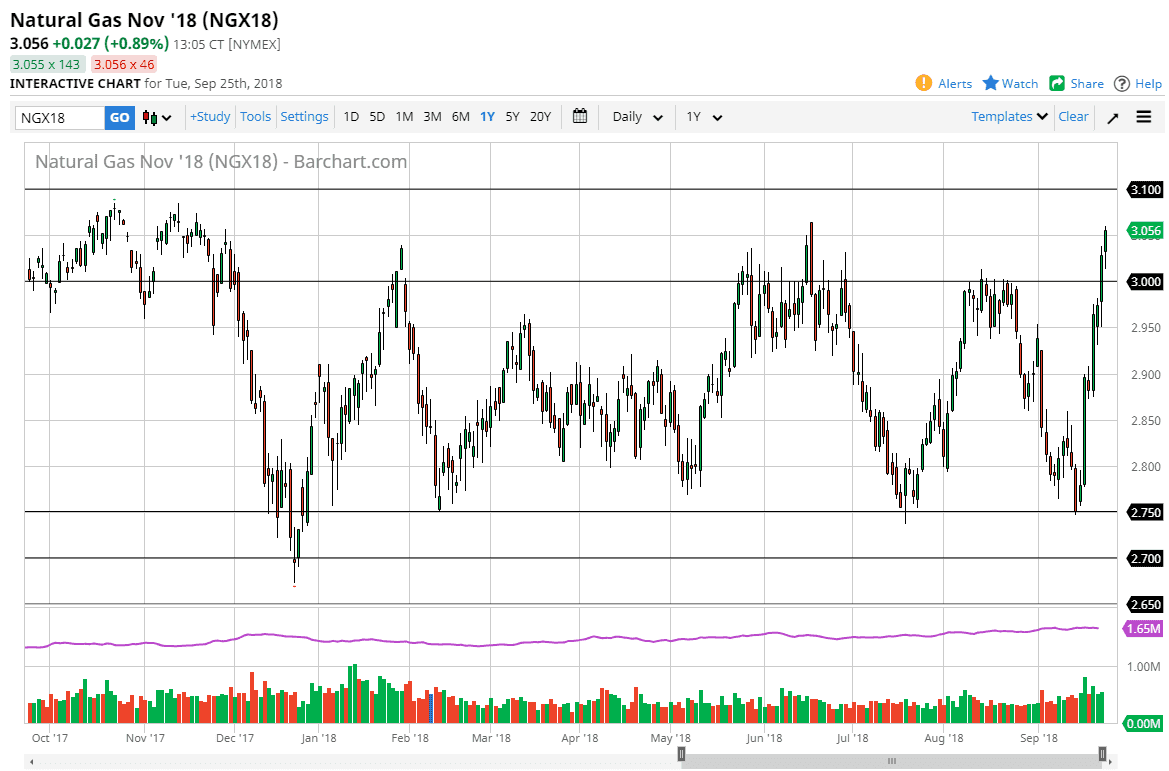

Natural Gas

Natural gas markets initially fell during the day on Tuesday but found buyers at roughly $3.02 to turn around and break above the $3.05 level. This is a market that has been extraordinarily bullish as of late, and most certainly seems to be over bought. Because of this, I’m very cautious about going long at this point as the market is most certainly stretched. I think that a pullback from here would be rather helpful, but it should end up being a buying opportunity as we are heading towards the colder part of the year. However, a break down below the $2.95 level would send this market to the bottom of the overall consolidation, sending the market down to the $2.75 level after that. Regardless, I think we are at lofty levels and that should be respected.