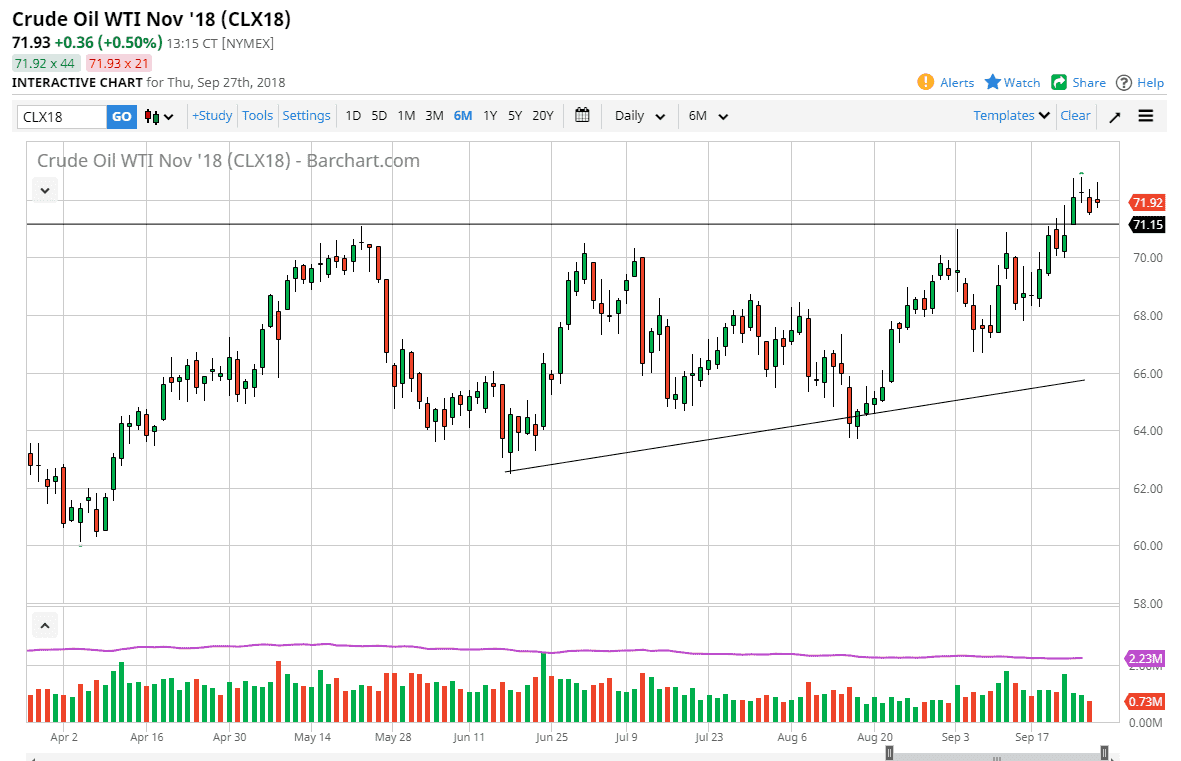

WTI Crude Oil

The WTI Crude Oil market was very volatile during the trading session, rallying quite significantly but then turning around to form a bit of a shooting star. The shooting star is of course a negative sign, and although we did blow out some stops during the day, we gave back the gains to show just how choppy and difficult this market is going to be in this area. At this point, I think that we probably need to pull back towards the $71 level to find the massive support that had been part of the market. When you look at the short-term charts, it is very choppy and sideways, and most of all range bound. I do think that the upward proclivity remains though, so selling isn’t something I’m looking to get involved with.

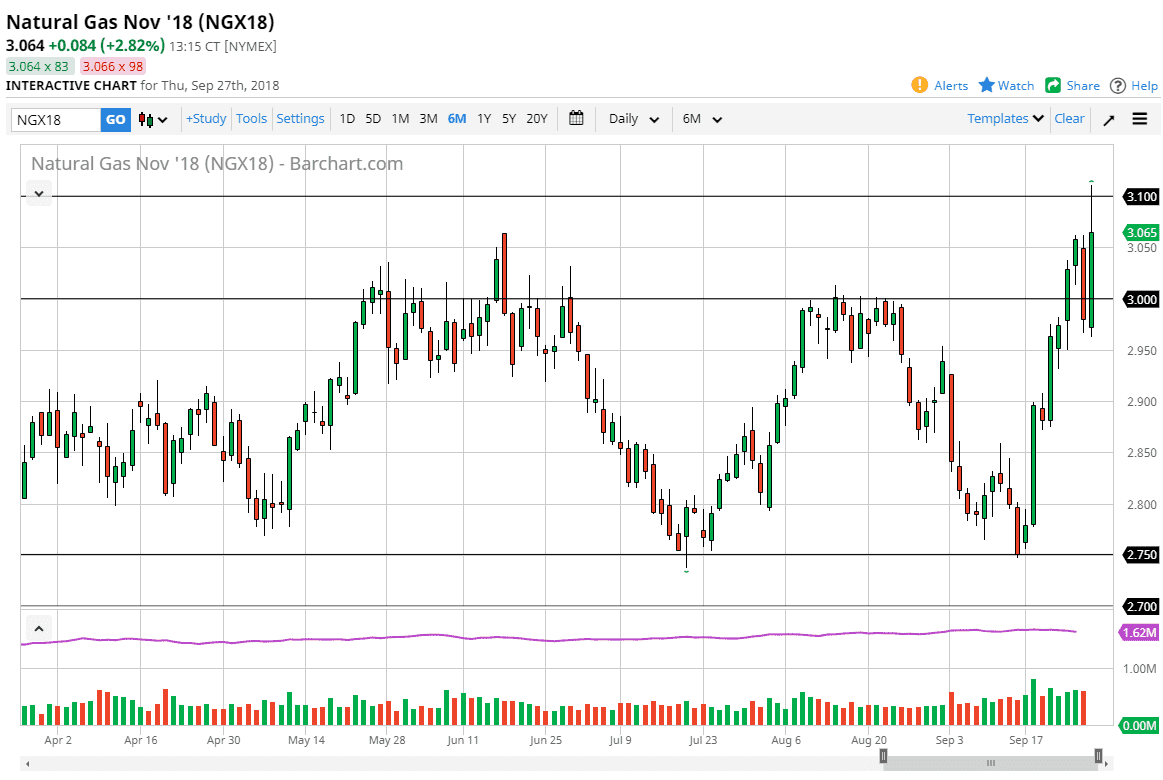

Natural Gas

Natural gas markets exploded to the upside during the day on Thursday, wiping out the losses from the previous session. The bullish candle of course is a good sign, and the bullish inventory number of course helped the momentum to the upside. We even touched the $3.10 level, and that’s an area that has been important more than once. At this point, I think the market will try to continue to go higher, but at this point we most certainly need to have a pullback in order to find a bit of value. If we were to break above the $3.10 level on a daily close, then it opens the door to the $3.15 level. Otherwise, if we turn around and wipe out this candle it should simply continue more sideways action. A break down below the $2.95 level should send this market even lower, perhaps reaching back into the previous consolidated area.