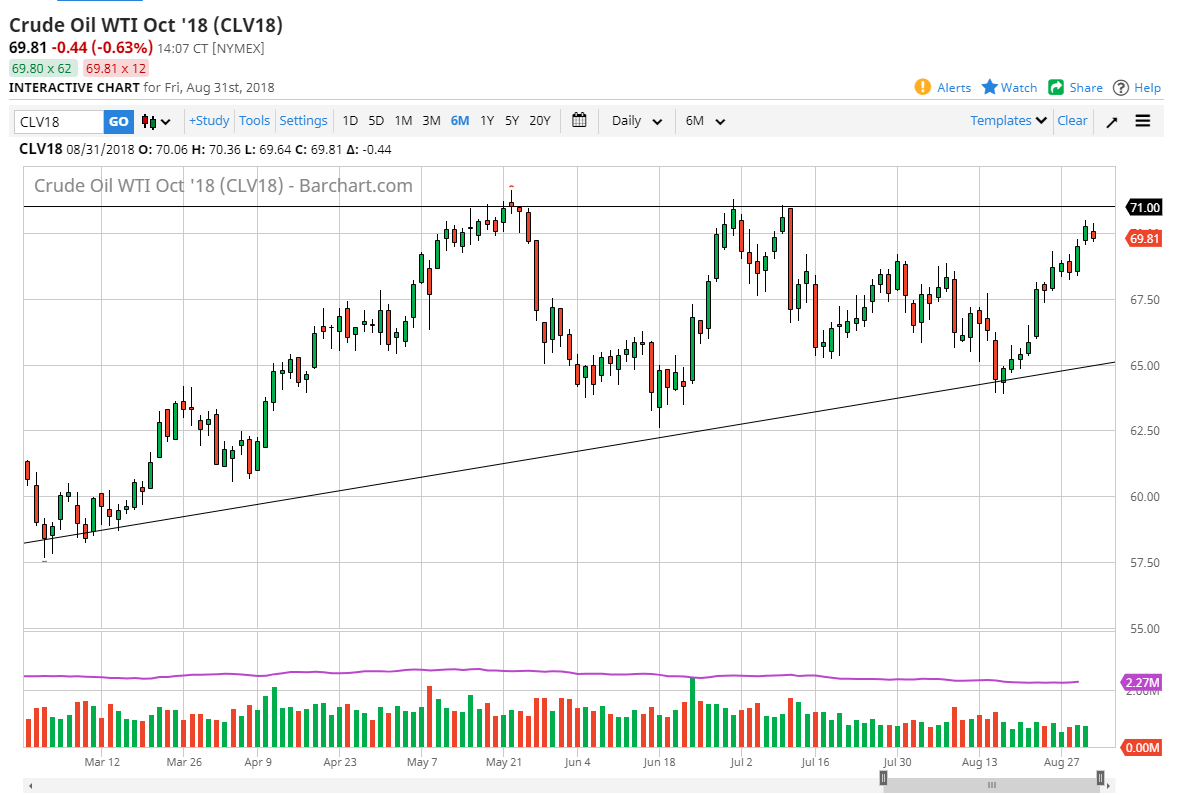

WTI Crude Oil

The WTI Crude Oil market tried to rally during the day on Friday, but then turned around to form a bit of a shooting star. Ultimately, the WTI Crude Oil market probably breaks out to the upside but we are still concerned about US/Canadian conversations, and of course the trade war with China. It seems as if it’s likely that the overall attitude of the marketplace will continue to be bullish, but that’s the longer-term sentiment, not something that can withstand this type of bearish attitude and of course negative headlines. Overall, I believe in buying dips, but it may take some time to offer itself. The alternate scenario is of course just simply breaking above the resistance at the $71 level, which would be a very strong play. The US dollar strengthening certainly is not helping the situation either.

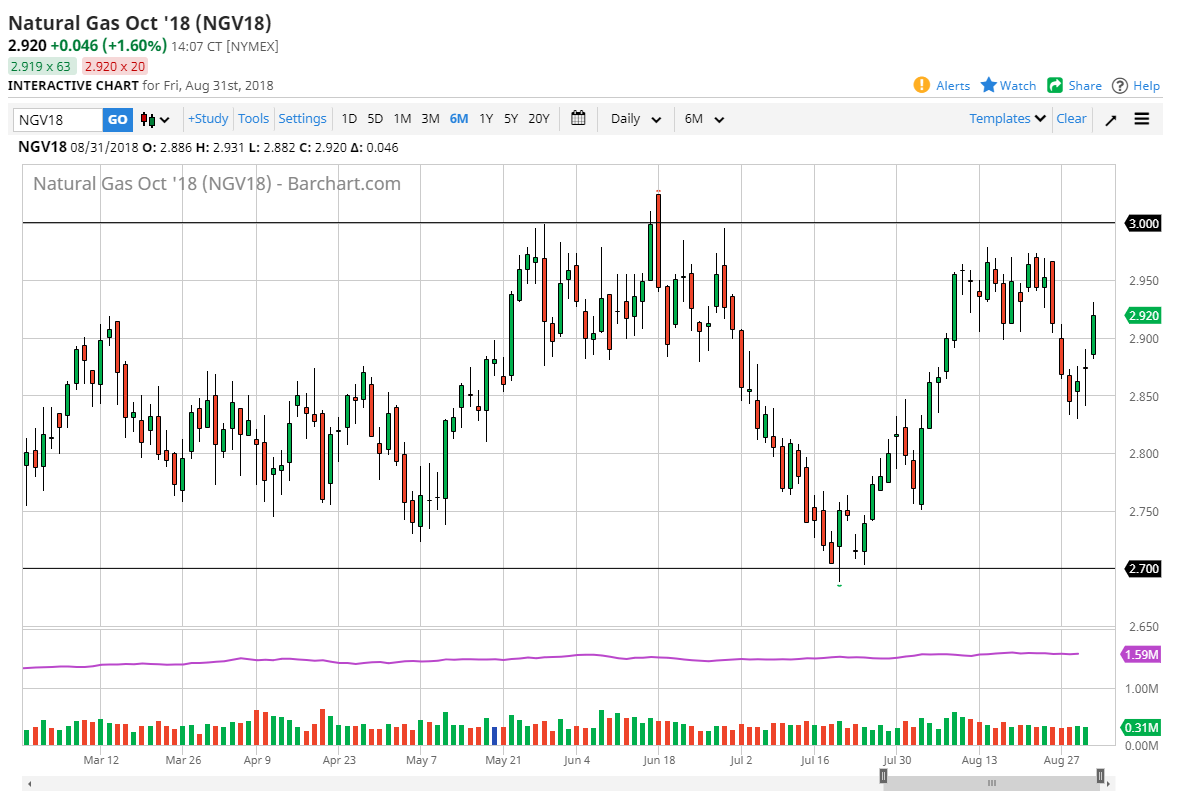

Natural Gas

Natural gas markets broke higher during the trading session, reaching into the previous consolidation area. I believe that it will not have the strength to break through it though, and I also believe that eventually selling will be possible. I would do so cautiously though, and probably over several different trades, finally combining to make a full size position. Natural gas markets have been range bound for ages, and at this point I don’t think that’s going to change. The $3.00 level has been reliable resistance are far too long. I think that we will see selling soon, so keep an eye on exhaustion. Remember that the Americans away for Labor Day on Monday, and therefore the trading will be thin to say the least.