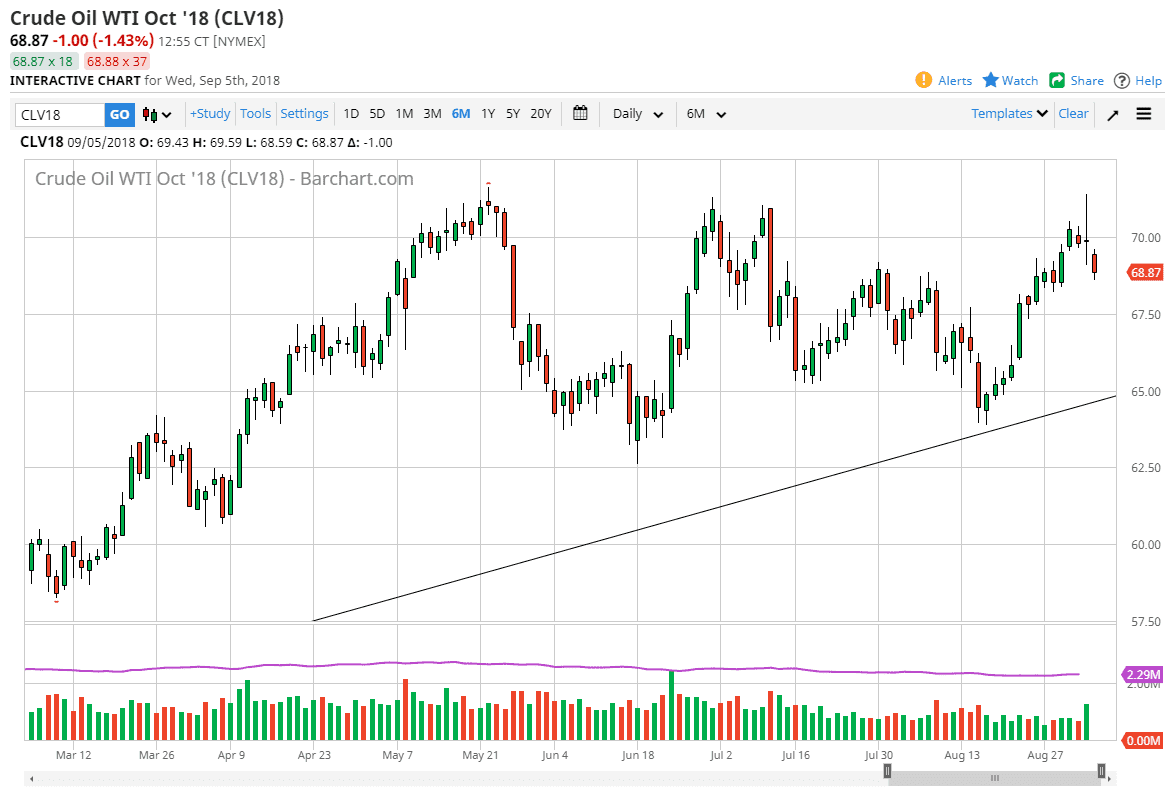

WTI Crude Oil

The WTI Crude Oil market broke down a bit during the trading session on Wednesday, breaking the back of the shooting star from the Tuesday session. Traders are starting to worry about a potential global slowdown due to trade tariffs, and quite frankly we probably just got a little bit ahead of ourselves. At this point, I suspect there’s probably some support at the $60.50 level, and most certainly the $67.50 level. However, if you step back and take a look at the big picture, I believe that we are probably going to find a bit of a pullback over the next several days. I think ultimately, this market will probably need to show a little bit of value before big money comes back in. The alternate scenario of course is breaking above the recent highs, which of course would show a return to bullish pressure.

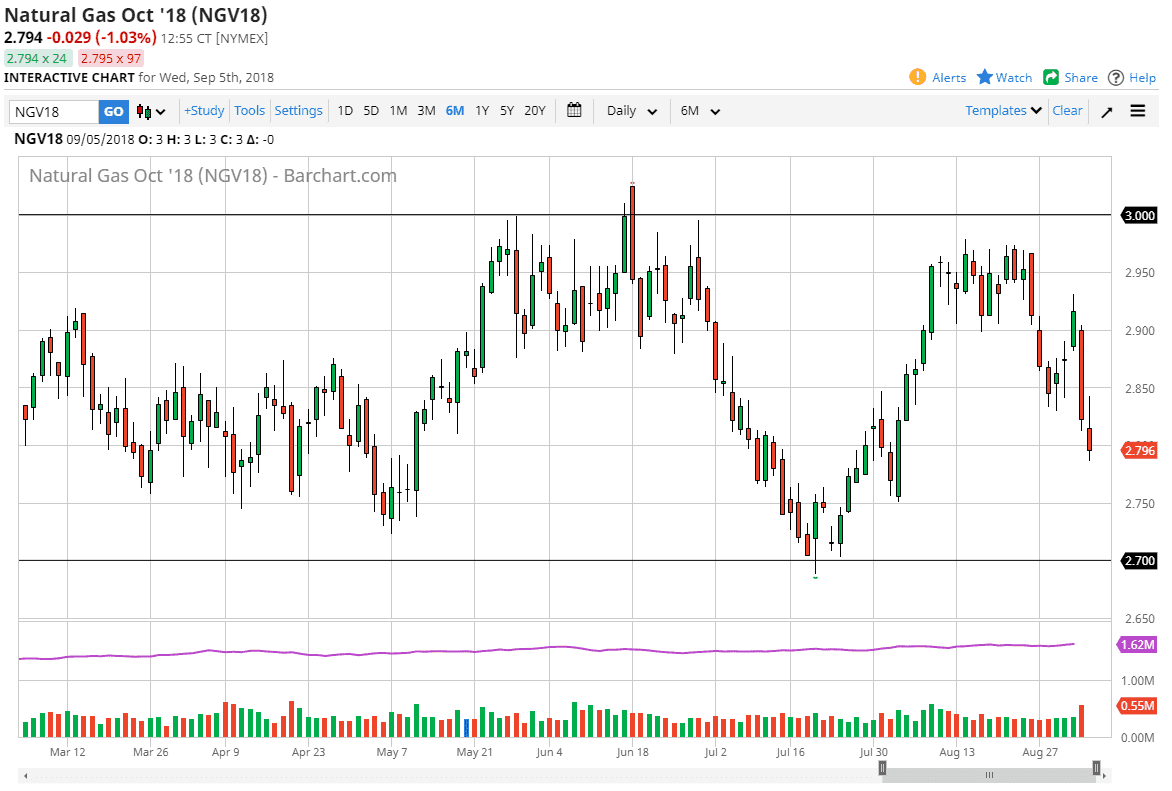

Natural Gas

Natural gas markets initially tried to rally during the day on Wednesday, but then turned around at the $2.85 level. We turned around and broke down below the $2.80 level. I believe that the market will continue to try to drive lower though, and at this point I think the next target would be the $2.75 level, and then the $2.76 level which is the bottom of the overall consolidation area. Otherwise, if we break above the highs from the day, I think that the market will probably go looking towards the $2.90 level. That’s an area where I would expect to see a lot of resistance, and I would not hesitate to sell it that region. With the lack of major infrastructure damage after the hurricane, I think natural gas markets continue lower.