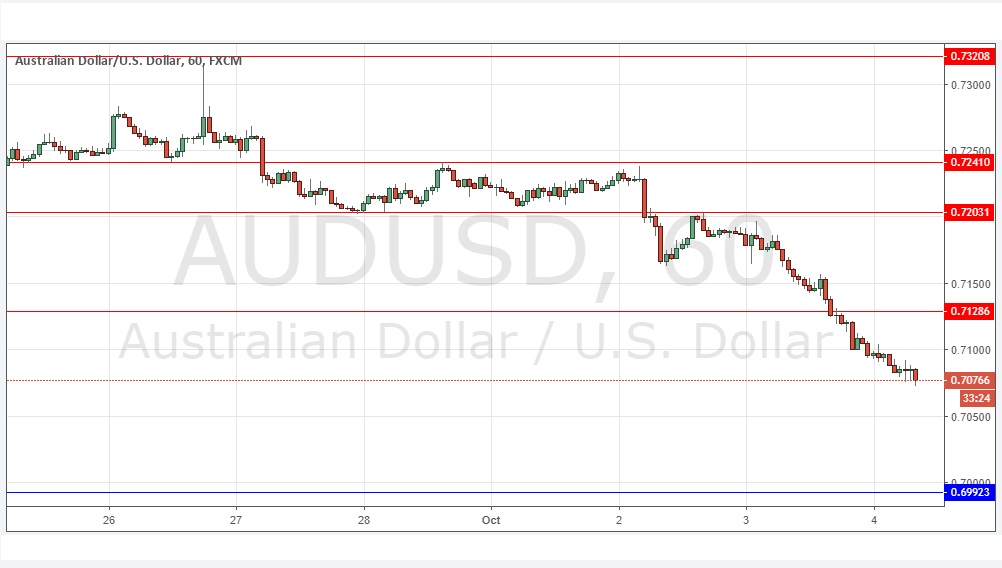

Yesterday’s signals were not triggered as there was no bullish price action at 0.7129.

Today’s AUD/USD Signals

Risk 0.75%.

Trades must be entered from 8am New York time until 5pm Tokyo time, over the next 24-hour period only.

Long Trade

Long entry following some bullish price action on the H1 time frame immediately upon the next touch of 0.6992.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade

Short entry following some bearish price action on the H1 time frame immediately upon the next touch of 0.7129.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote yesterday that as the outlook was bearish on all time frames and the Australian and New Zealand Dollars were easily the weakest currencies right now, so I had a bearish bias on this pair below 0.7175 and above 0.7129. This was a good call as the price has continued to fall steadily and has even broken easily below 0.7129. There is every reason to remain bearish on this pair today as the USD is still advancing very strongly here on the short-term time frames. This price is at a 2.5-year low and looks set to continue down to the psychologically important 0.7000 level where the fall might halt.

Regarding the AUD, there will be a release of Retail Sales data at 2:30am London time. There is nothing important due today concerning the USD.