BTC/USD

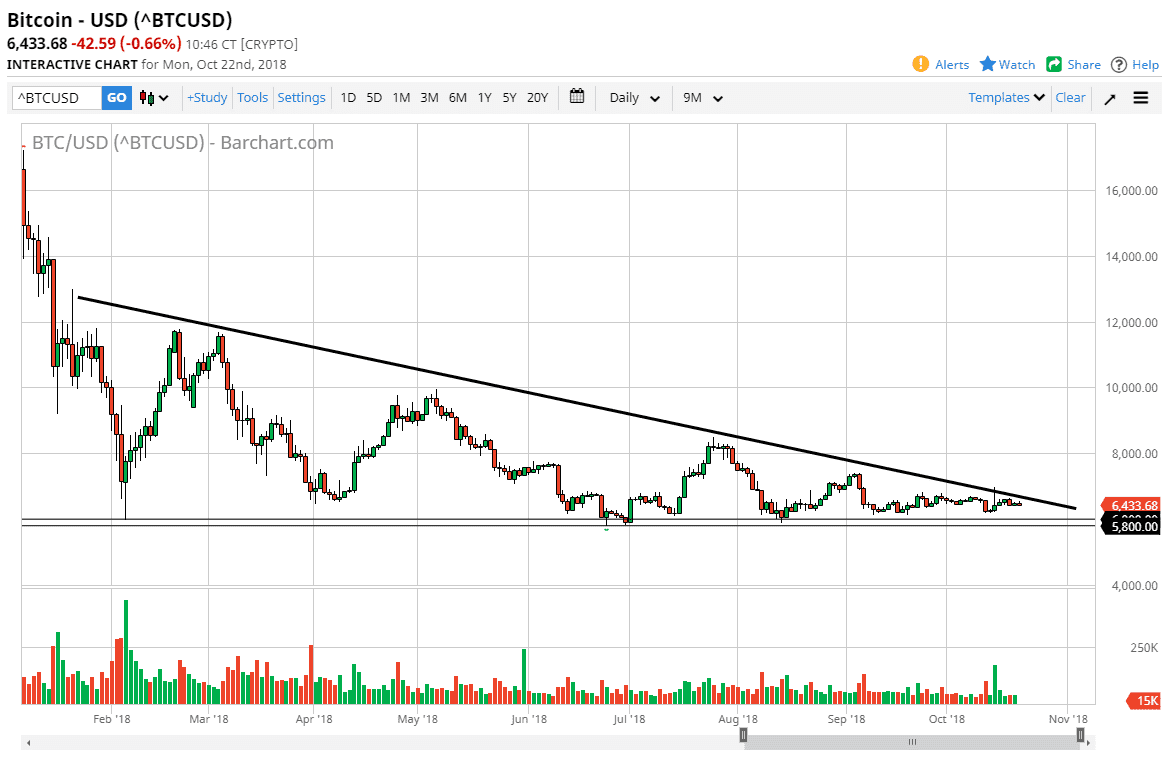

Bitcoin continues to go sideways overall in very uninspired trading. The market has been in the descending triangle since the beginning of the year, and as such the analysis has been very similar most days. The down trending line of course is crucial, so if we were to break above that it would be a bullish sign. However, we had a spike in price last week that I think shows just how crucial the $7000 level is. If we can break above that $7000 level, then I think we may be looking at a scenario where we can start buying. Until then, it’s only the true believers that are willing to hold on to bitcoin for years that are interested.

Now that institutions are starting to set up trading mechanisms, this market will enter a mature phase. Unfortunately, for many retail traders that will be the last thing they want to see, because it suddenly is in the hands of the very institutions that they did not want to be involved with. This market will move like a currency, or perhaps even a stock or commodity. Long gone will be the days of 15 and 20% gains in 24 hours. The “to the moon” aspect of bitcoin trading is now history.

Looking at this chart, I believe that we are not going to break out to the upside but rather simply drift sideways through the apex of the descending triangle. If that’s the case, then you can expect even more lackluster and sideways trading going forward until we get some type of catalyst to move things. The alternate scenario of course is that we break out to the upside, clear the $7000 level, and then go looking towards the $8000 next. Otherwise, we would break down below the $5800 level, and then perhaps unwind to the $5000 level. It’s not until we make one of these three decisions that money should be put here.