BTC/USD

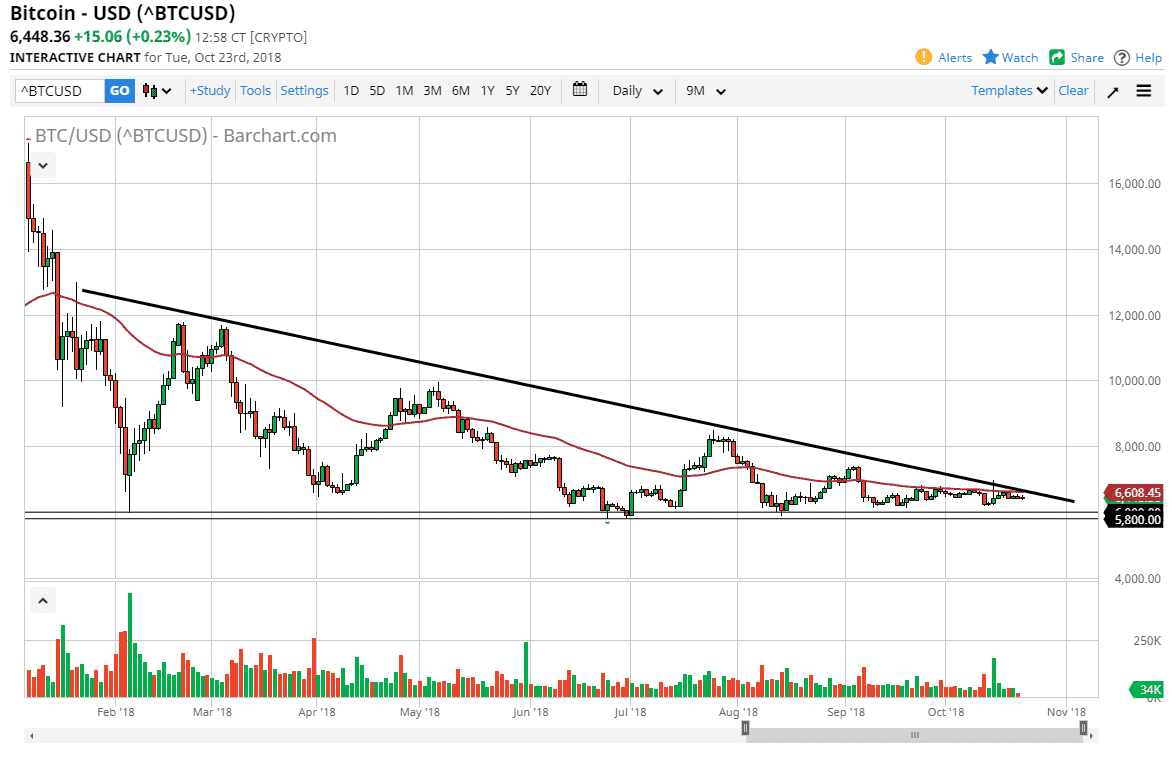

Bitcoin continues to do very little during the day as markets are essentially flat. We are following a very flat 50 EMA on the daily chart, as the market simply has nowhere to be. Looking at the down trending line, it looks as if we are trying to try to break above there, but if we did, I think it’s not until we clear the spike from the other day at $7000 level that I would be comfortable buying. At that point, then I think the market probably goes looking towards the $8000 level, possibly the $8250 level after that. There is a lot of negativity in this market, but quite frankly I think what we may see is sideways trading more than anything else, essentially wiping out the descending triangle.

If that happens, it’s likely that we will continue to go sideways longer term, as there is almost nothing to move this market one way or the other, as we are essentially treading water. The market seems very unenthusiastic, and at this point I think a lot of the retail money has left. There is the possibility of institutional money coming in and pushing the market higher, but I don’t know when that happens, or even if.

On the other hand, if we can break down below the support underneath, which I think it extends to the $5800 level, then the market could go much lower, perhaps reaching down to the $5000 level after that. Ultimately, that would be a great unwind in the bitcoin market, which had been so bullish, but recently we have seen market participants willing to jump back into this market. However, they just don’t have the momentum or the wherewithal to continue to push. I think this is essentially “dead money.”