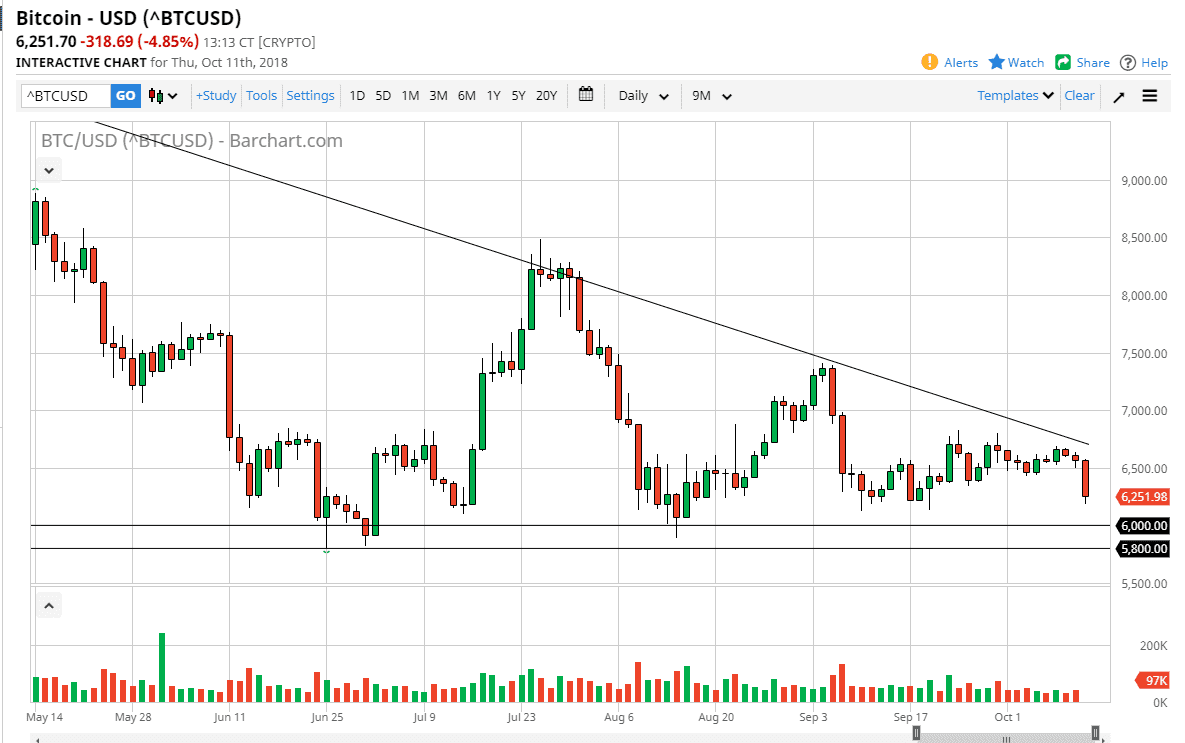

Bitcoin markets sold off rather drastically during the trading session on Wednesday, breaking the back of the hammer from the previous session and the $6500 level. By breaking through the hammer that had formed to the downside, we ended up forming a “hanging man”, showing signs of real negativity. We lost 5% during the day, but we are still well within the tolerances of the consolidation area that we have been stuck in for some time. Because of this, I think we are probably going to see buyers jumping in, perhaps pushing the market up a couple of hundred dollars. However, if we turned around and broke down below the $5800 level, the market would break down rather significantly, perhaps reaching down to the $5000 level.

The downtrend line above has offered major resistance, so if we were to break above there the market could probably go to the $7500 level, perhaps the $8250 level after that. We need some type of catalyst to push the market higher though, and quite frankly I don’t see that happening. We have course could continue to drift sideways, breaking out of the descending triangle and essentially just go sideways.

In general, that’s very possible considering that we have no real necessity to go anywhere. One thing that does concern me though is that with the US dollar getting hammered during the trading session, bitcoin could and pick up against it in that scenario. That is not a good look for the crypto currency, so at this point I still favor shorting the market rather than buying it. One thing I think you can count on is short-term trading at best, as volume has dropped drastically.