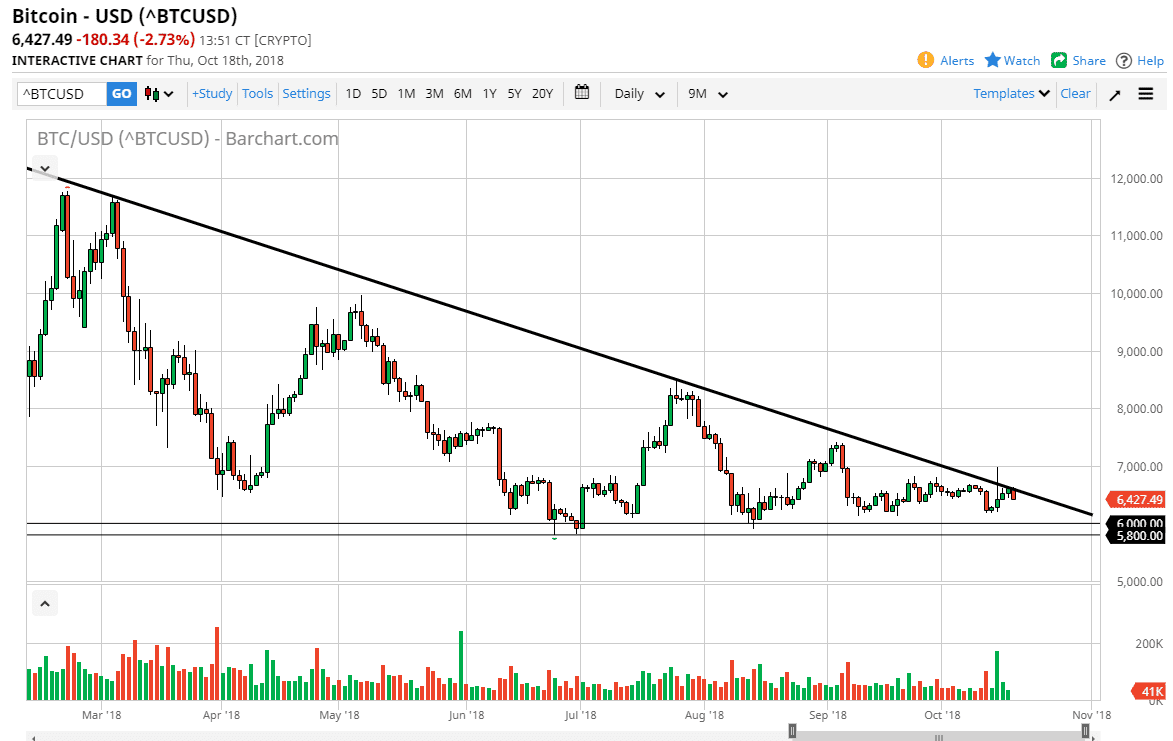

Bitcoin continues to grind lower, losing almost 3% by the time I got to my desk to record this video. That’s not to say that we are breaking down any more than we have been, we are simply following the downtrend line as you can see. Ultimately, this is a market that I think continues to reach towards the lows, perhaps towards the $6000 level. I think that level extends down to the $5800 level, an area that I think is crucial. If we were to break down below that level, that would unleash a new wave of selling pressure, and at this point I think probably would allow this market to drop down to the $5000 level. That of course is not only a psychologically significant number, but a structurally significant figure as well.

We could break out to the upside, but I think if we were to do that I would feel much more comfortable above the $7000 handle, as it would take out the massive spike that was turned around a few days ago. Ultimately, if that happens I think that could be a bit of a trend changing event, but even then I think it is still going to be very difficult to hang onto this trade to the upside. Because of that, you must simply go long and forget about it. You would obviously have to have a stop loss underneath the support level, but at this point I think that it’s difficult to break through there, so that obviously could help.

The alternate scenario is that we go sideways, and if that’s the case we simply negate the descending triangle and the market will go looking towards something else for direction. Right now, we simply just don’t have any.