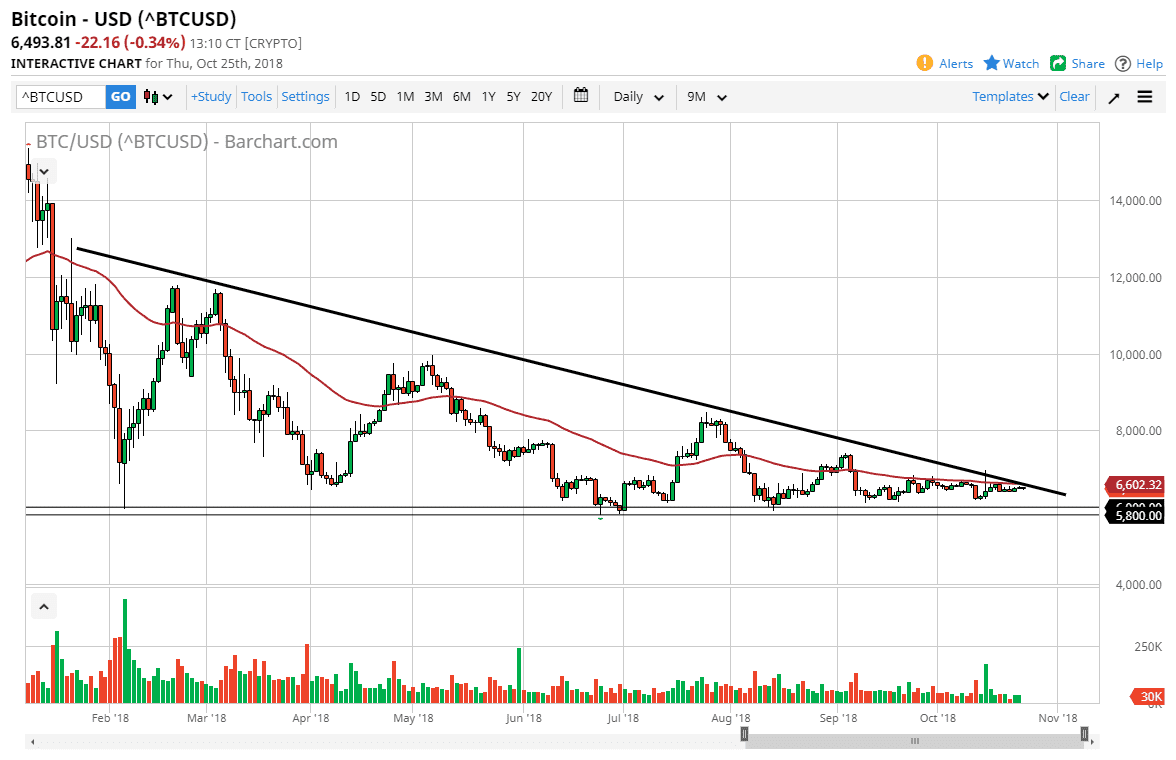

Bitcoin markets continue to do very little during the day, and it looks very likely that we are entering a sideways market. I think that the descending triangle is about to be broken, but unless it’s some type of explosive move in the next couple of days, it simply going to be a failed pattern. Ultimately, if we break above the uptrend line with significant volume, then we can be talking about a move above $7000 in towards the $8250 level. At this point, I suspect that what we are looking at a market that simply has no catalyst for movement. That would jibe well with the idea of the market slicing through the end of the triangle and go sideways but keep an eye on headlines obviously.

If we were to break down below the support level underneath at the $6000 level, once we clear the $5800 level, then I think the market could break down rather rapidly, and probably towards the $5000 handle. Ultimately, that would be a very bearish turn of events and would suggest that perhaps the market was ready to fall apart completely. Obviously, there’s a lot of psychological importance attached to a number like $5000 though.

I believe at this point bitcoin has become essentially “dead money”, as people don’t really know what to do with it. The reality is that there isn’t much use for it in the real world, at least not yet. It most certainly has gotten ahead of itself as far as value is concerned, and if bitcoin doesn’t become widely adopted, there’s no way that a single coin is going to be worth $6000, let alone $20,000. Keep that in mind and pay attention to adoption. Ultimately, this has become a speculators market, nothing more.