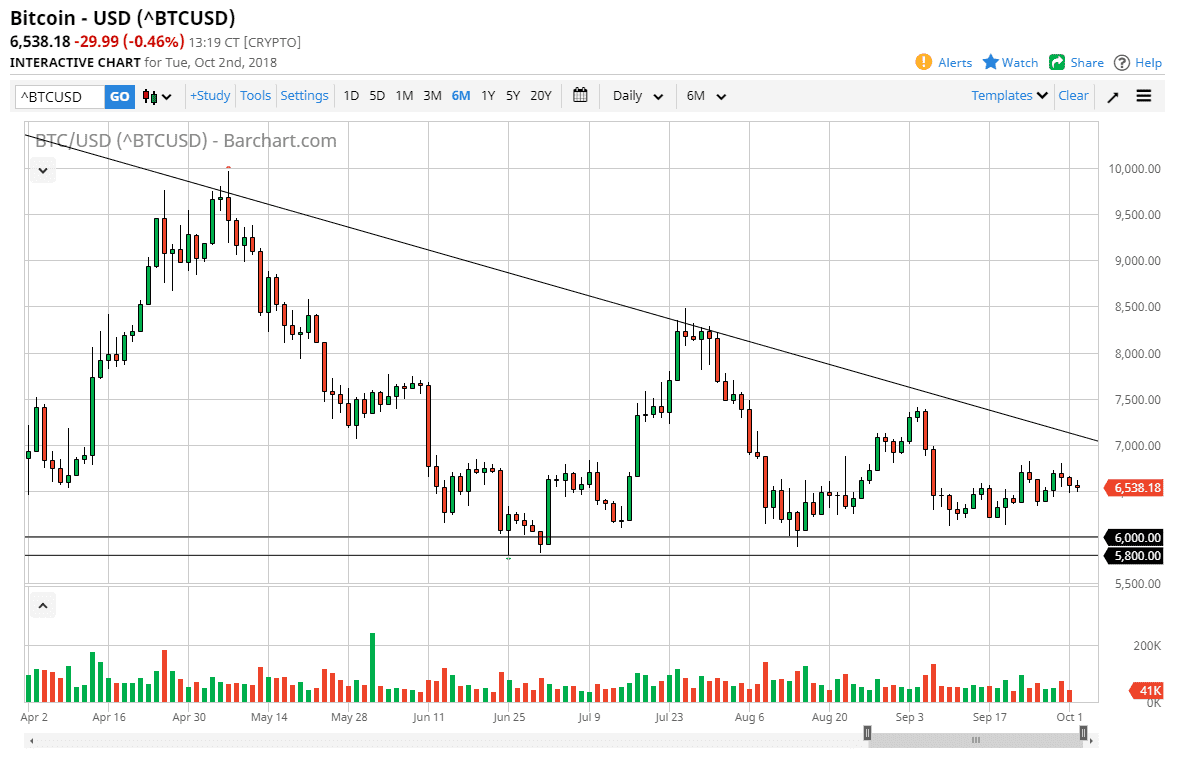

Bitcoin markets did very little during the day on Tuesday, as we continue to dance around the $6500 level. The market looks very negative overall, as we have a downtrend line that still keeps the market down. Ultimately, I think that the market has a couple of different possibilities at this point going forward, but ultimately I think we are going to look at one of three things happening. Ultimately, it certainly looks very negative, and if we can break down below the $5800 level I think that the market will go looking towards the $5000 rather quickly. However, there are couple other possibilities going forward.

There is the possibility that we go sideways overall, as we would break the apex of the triangle, which would more than likely send this market sideways than anything else, as the market would have to look towards a new reality, the fact that the market may simply go nowhere. If that’s the case, $6000 will continue to be support and the $7500 level will probably be resistance. At that point, I think you would look at short-term range bound trading more than anything else.

The third possibility is that we break the downtrend line to the upside, sending the market towards the $7500 level, and then eventually the $8250 level after that. That of course could turn the tide of negativity against Bitcoin, but right now we don’t have the catalyst for that to happen. Longer-term, it’s hard to tell what will happen next we have three clear possibilities, all of which tell us how to trade next. At this point, bitcoin has been money, a store of value, gold 2.0, a new way to transact business, a speeding up of the international currency transaction markets, and probably about 10 things I can’t remember. At the end of the day, price is the only thing that matters.