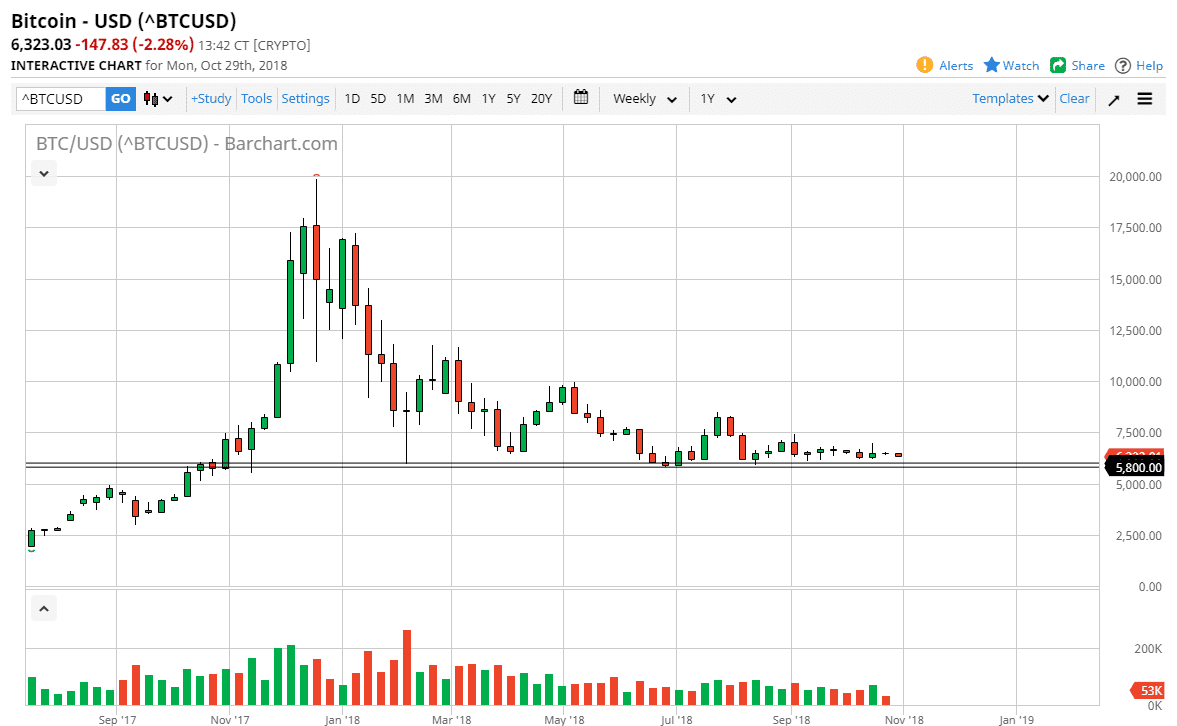

The bitcoin market fell slightly during the trading session on Monday, as we continue to see a lack of movement overall. The market continues to simply be without directionality, so I believe that short-term scalping in a back-and-forth type of manner is probably crucial. At this point it’s likely that we will continue to see a lack of longer-term movement but I also recognize that the support underneath has been crucial in of course very reliable. I find this interesting, and it is perhaps an area where longer-term investors are looking to put the money to work, but for the short term trader there’s almost no money to be made unless you can be quick about it.

If we break down below the support, that opens the door to at least $5000, possibly even $4000 after that. Volume is shrinking, and that of course is in a good sign but then again we aren’t falling apart either, so this may perhaps you show apathy more than anything else. That makes sense though, because when you think about the year 2017, you realize that most of the people who jumped in the bitcoin probably had very little in the way of financial acumen and were simply looking to get rich quick. These scenarios always end the same way, with a lot of pain as we have seen.

If we can break above the $7000 level, we could go towards the $8250 level which has been resistive in the past. I think there’s a lot of volatility just waiting to happen, but we need some type of catalyst to make the markets move. As you can see though, the entire months of September and October have seen very little in the way of action. In other words, wait for some volatility to come back into the market before putting a position on.