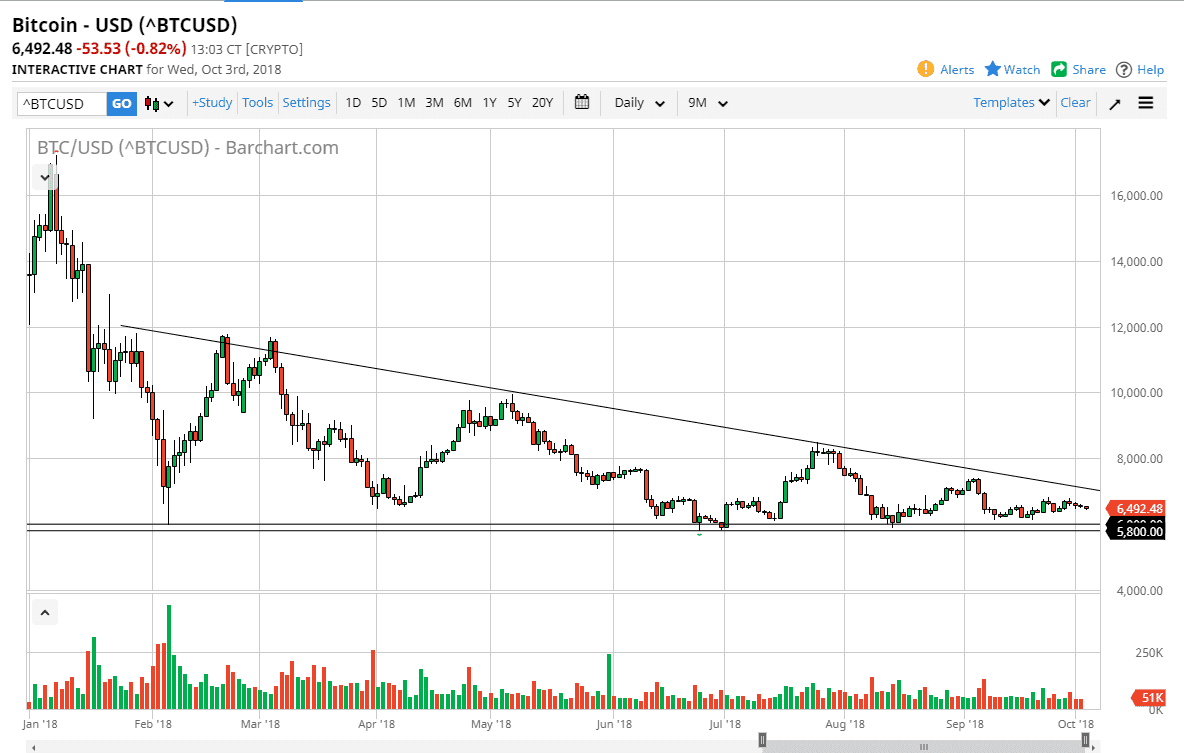

Bitcoin markets did very little again during the day on Wednesday as volatility is all but disappeared. At this point, I think it’s very difficult for bigger moves to happen, because the downtrend line is still very much in effect, but at the same time we have massive amounts of support at the $5800 level that extends to the $6000 level. In general, this is a market that is granting lower over the longer-term but could not break down through that level. If it does, that will open the trap door and we will go much lower. Ultimately, I do think we could find enough sellers to break down below there, because the market just can’t seem to get excited. However, there are other possibilities to pay attention to as well.

We could also could go sideways in break through the apex of the triangle, and that would lead us in a bit of a conundrum, as then the market would need to decide what is going to do next. We could just simply go sideways for the foreseeable future, as less people would be interested in this market. Volume has dwindled for some time now anyway, so I think that very well could happen. However, there is also another opportunity for volatility to reenter the market and that would be if we broke above the downtrend line. If that happens, I would anticipate a move to the $7500 level, and then possibly the $10,000 area after that. However, I think that it’s very difficult to do that, as there is so much negativity when it comes to bitcoin anyway. There’s no catalyst for anything to happen at this point, so I think this is essentially “dead money.”