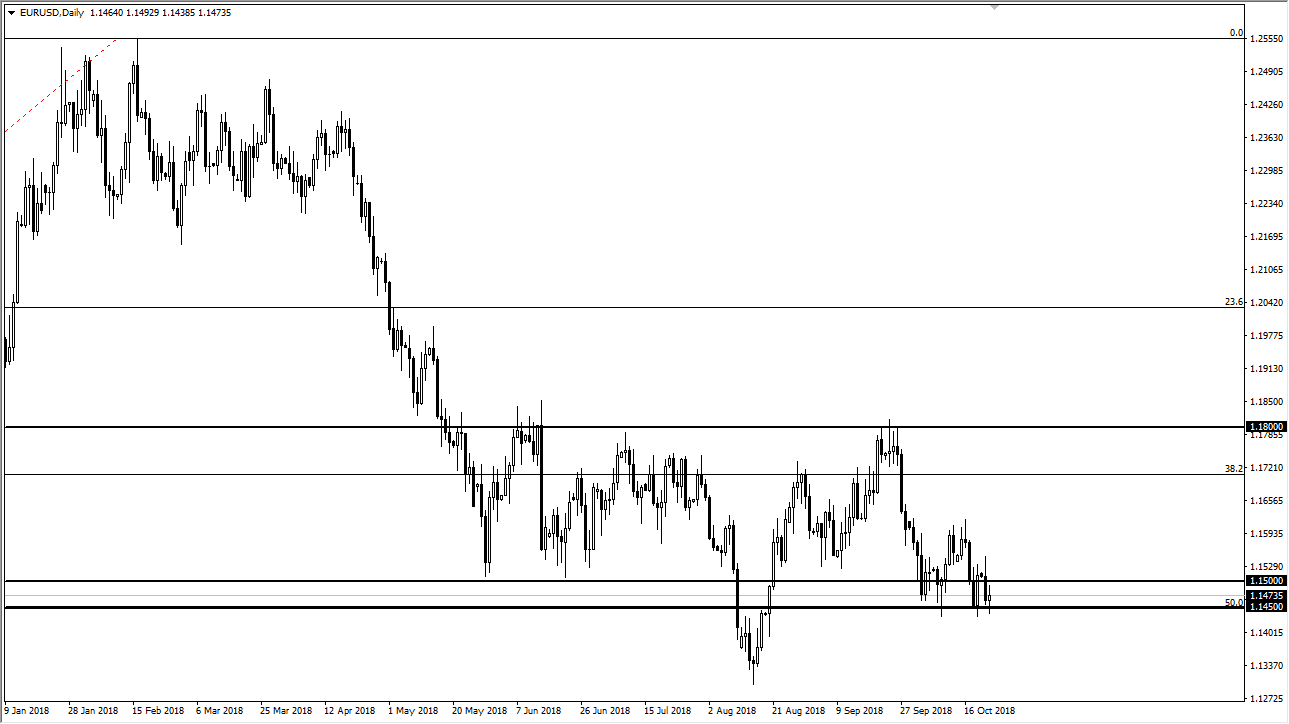

EUR/USD

The Euro went back and forth during the trading session on Tuesday, dancing above the 1.1450 level yet again. However, we didn’t exactly break out either so I’m not necessarily excited about the Euro. I think basically at this point the Brexit has made the Euro and the British pound almost impossible to trade against the greenback. While this is supportive, the reality is that we continue to make lower highs and that of course is a negative sign. There are many currency pairs that you can trade, this is the only one. If we break down to a fresh new low, then I think we go down to the 1.1350 level after that. I break higher and above the 1.15 level would be bullish, but quite frankly I don’t see the market breaking above the 1.16 level in the short term.

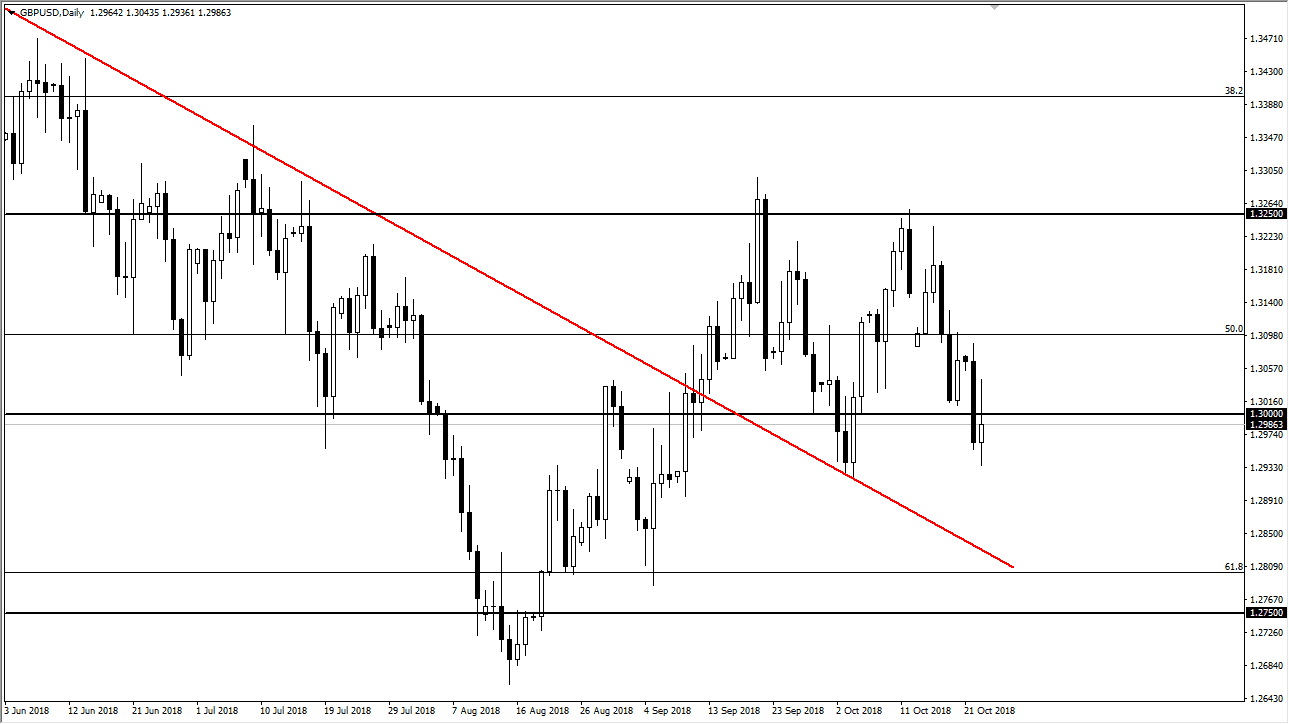

GBP/USD

The British pound rallied significantly after initially falling during the day on Tuesday, as more rumors come out occasionally about the Brexit. Quite frankly, every time we get a rumor the market shoots higher, and then sells off again. This is a market that simply cannot make up its mind to go higher, and I don’t blame traders for being suspicious because there has been so many games played with twitter headline’s and the like. The previous downtrend line being broken of course is bullish, and I think it should be supportive. However, I think that the market isn’t quite ready to take off yet. If you’re a longer-term trader and can do so with a very little leverage, then you can look at this as a bit of value just waiting to happen. I would by little bits and pieces, in anticipation for a Brexit deal down the road.