Today’s EUR/USD Signals

Risk 0.75%.

Trades may only be entered before 5pm London time today.

Short Trades

- Go short following a bearish price action reversal on the 1H1 time frame H1H1H1 time frame immediately upon the next touch of 1.1640 or 1.1725.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade

- Go long following a bullish price action reversal on the 1H1 time frame H1H1H1 time frame immediately upon the next touch of 1.1540.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

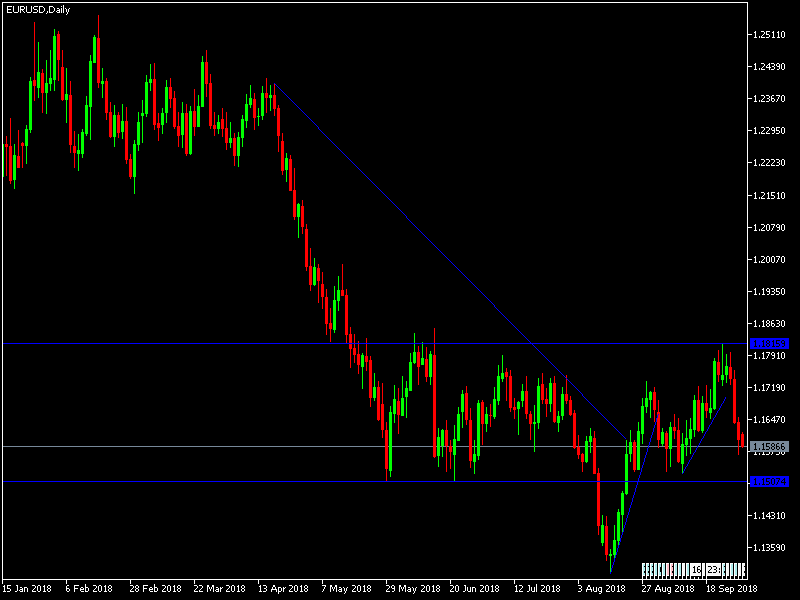

EUR/USD Analysis

The pair settled down below the 1.1600 level early in the week, amid a stronger bullish momentum for the US dollar following the interest rate hike by the US Federal Reserve and hints from the bank for further rate hikes. The euro has suffered a setback recently due to raising concerns about the political and economic situation in Italy. The pair is currently close to the 1.1545 and 1.1480 support areas, which confirm the strength of the bearish move and may be a first step before the pair completes its way to psychological support and the 1.1300 level recorded in August.

Regarding the EUR, there will be the release of the German Retail data and the Industrial Purchasing Managers' Index for the Eurozone economies alongside the unemployment rate. Regarding the USD, there will be the release of the ISM industrial index and spending on construction.