The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 21st October 2018

In my previous piece last week, I forecasted that the best trade would be long of the S&P 500 Index at the next daily close which was higher than the previous two days’ closing prices. We had such a higher close on Tuesday, but unfortunately the Index closed down by 1.75% from that point, producing a loss.

Last week saw a rise in the relative value of the New Zealand Dollar, and a fall in the relative value of the Canadian Dollar.

Last week’s Forex market was dominated by very strong New Zealand inflation data and very weak Canadian inflation data, as well as the ultimate failure of the U.S. stock market to bounce back from its recent fall and a minor recovery in the U.S. Dollar.

This week is likely to be dominated by central bank input from the European Central and from the Bank of Canada.

Fundamental Analysis & Market Sentiment

Fundamental analysis tends to support the U.S. Dollar, as American economic fundamentals continue to look strong. Sentiment seems to be still in favor of the U.S. Dollar. Fundamentals remain bearish on the Japanese Yen, but this currency can benefit from safe-haven “risk off” money flow.

The week ahead is likely to be dominated by the performance of stock markets and particularly the American stock market. There will also be central bank input on the Euro and the Canadian Dollar.

Technical Analysis

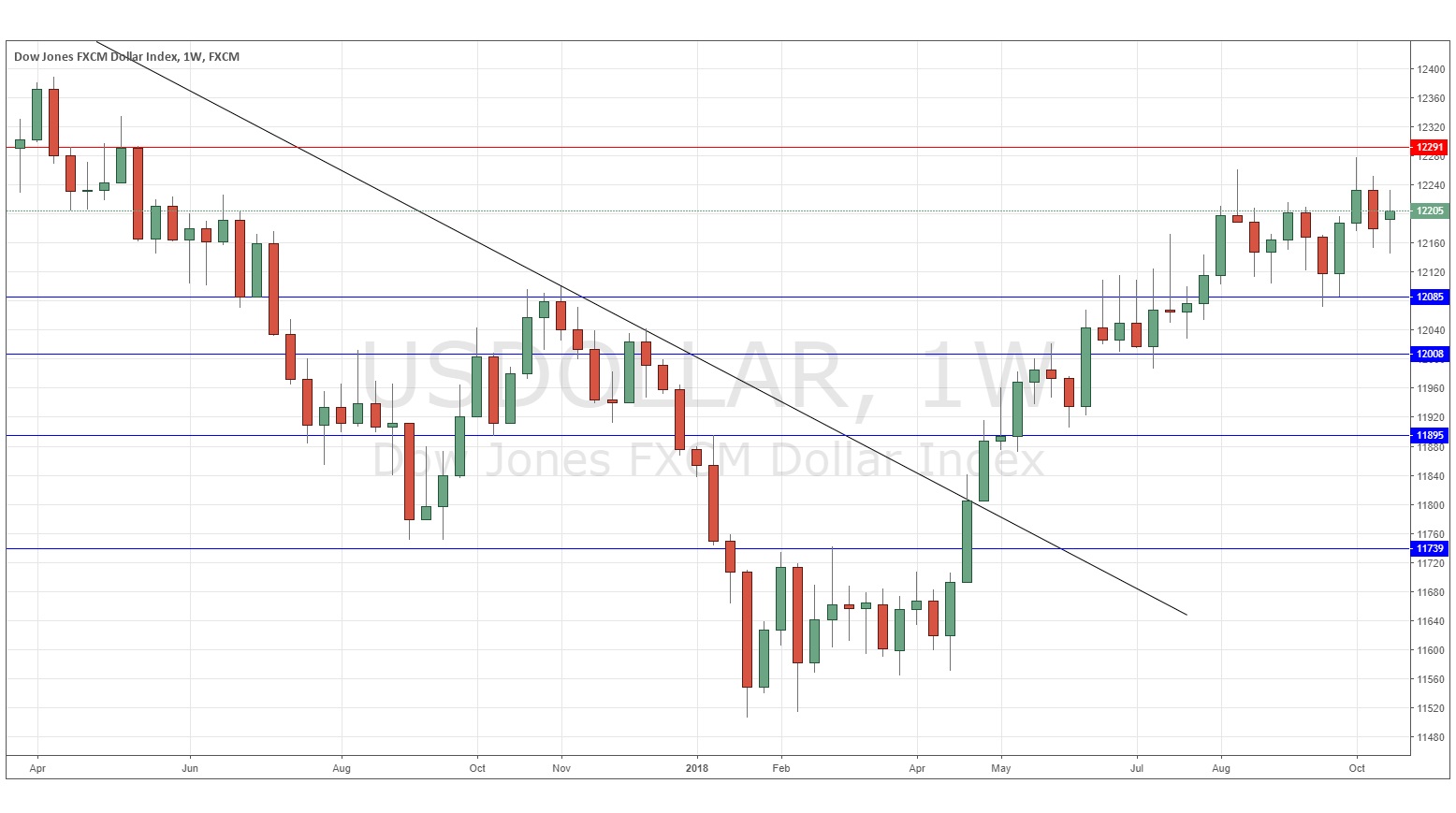

U.S. Dollar Index

The weekly price chart below shows that after last week’s bearish candlestick, the price remained mostly unchanged over this week, printing an inconclusive doji candlestick, which closed above the support level at 12085. The price remains within a multi-week consolidation between support and resistance and I have no strong confidence as to short-term direction, although the edge is still technically in line with the long-term bullish trend, which remains intact.

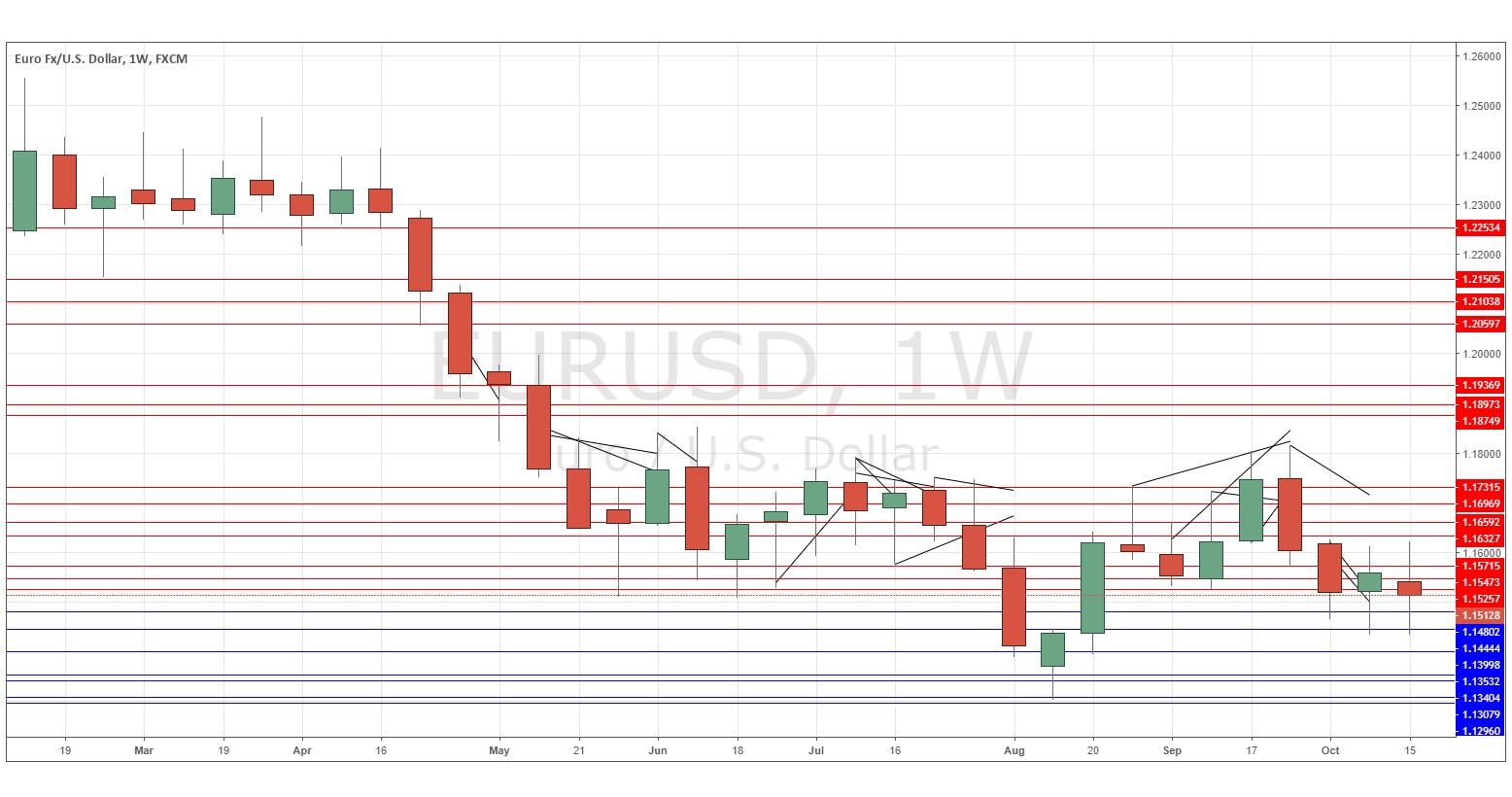

EUR/USD

The weekly chart below may not appear to show much of a trend, but in a very flat and mostly calm Forex market, and despite the relatively low volatility here, this pair is in a downwards trend. There is a small edge in favor of short trades, although last week’s candlestick was an inconclusive doji, so timing can be crucial here in going short.

Conclusion

Bearish on the EUR/USD currency pair.