The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 28th October 2018

In my previous piece last week, I forecasted that the best trade would short of the EUR/USD. This was a good call and a profitable trade, with the currency pair falling over the week by 0.95%.

Last week saw a rise in the relative value of the Japanese Yen, and a fall in the relative value of the British Pound.

Last week’s Forex market was dominated by a continuing selloff in stock markets which is boosting safe havens such as the Japanese Yen, while there is continuing nervousness over a no-deal Brexit which is impacting the British Pound. The Bank of Canada raised its interest rate, but this had relatively little market impact.

The U.S. Dollar remains mildly bullish as GDP came in slightly higher than expected, at 3.5% compared to the consensus forecast of 3.3%.

This week is likely to be dominated by central bank input from the Bank of Japan and from the Bank of England, as well as by U.S. Non-Farm Payrolls data.

Fundamental Analysis & Market Sentiment

Fundamental analysis tends to support the U.S. Dollar, as American economic fundamentals continue to look strong. Sentiment seems to be still in favor of the U.S. Dollar as despite quite strong selloffs in the stock market, the economic fundamentals are still seen as quite strong, although there is perhaps a greater feeling that the continuing rate hikes are going to weigh on growth sooner or later. Fundamentals remain bearish on the Japanese Yen, but this currency can benefit from safe-haven “risk off” money flow and has been benefiting while stock markets continue to sell off.

The week ahead is likely to be dominated by the performance of stock markets and particularly the American stock market. The Non-Farm Payrolls data is likely to be important in continuing or reversing the USD bullish trend, while central bank input On the Pound and Yen may have major impacts.

Technical Analysis

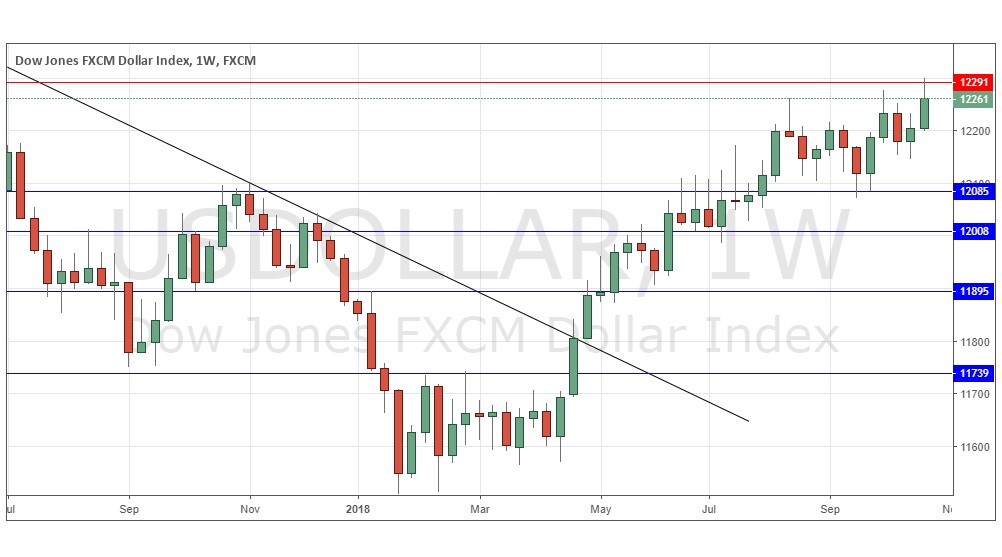

U.S. Dollar Index

The weekly price chart below shows that after last week’s bearish candlestick, the price remained mostly unchanged over this week, printing an inconclusive doji candlestick, which closed above the support level at 12085. The price remains within a multi-week consolidation between support and resistance and I have no strong confidence as to short-term direction, although the edge is still technically in line with the long-term bullish trend, which remains intact.

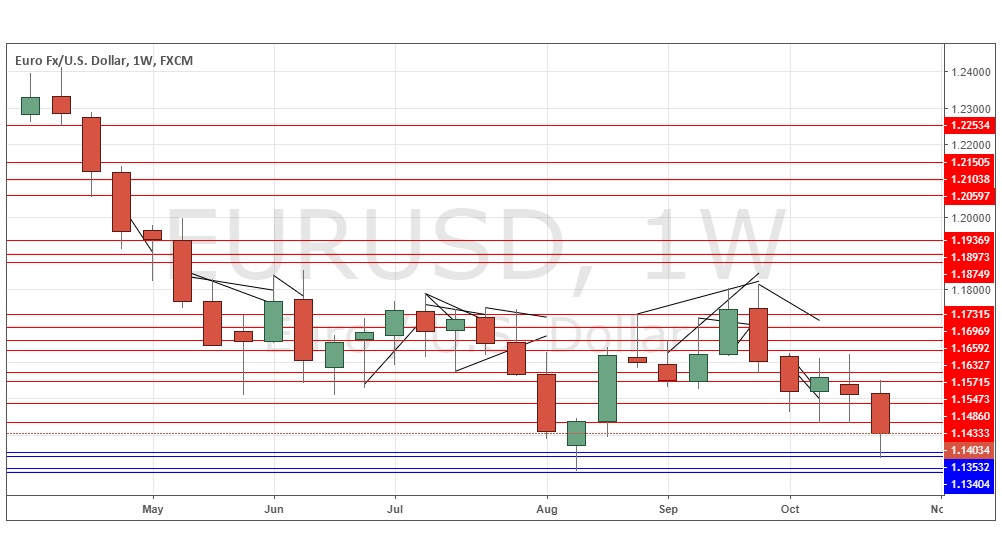

EUR/USD

The weekly chart below may not appear to show much of a trend, but in a very flat and mostly calm Forex market, and despite the relatively low volatility here, this pair is in a downwards trend, even more so after last week’s bearish candlestick despite the notable lower wick. There is a small edge in favor of short trades, although Friday saw a bullish retracement, so timing can be crucial here in going short.

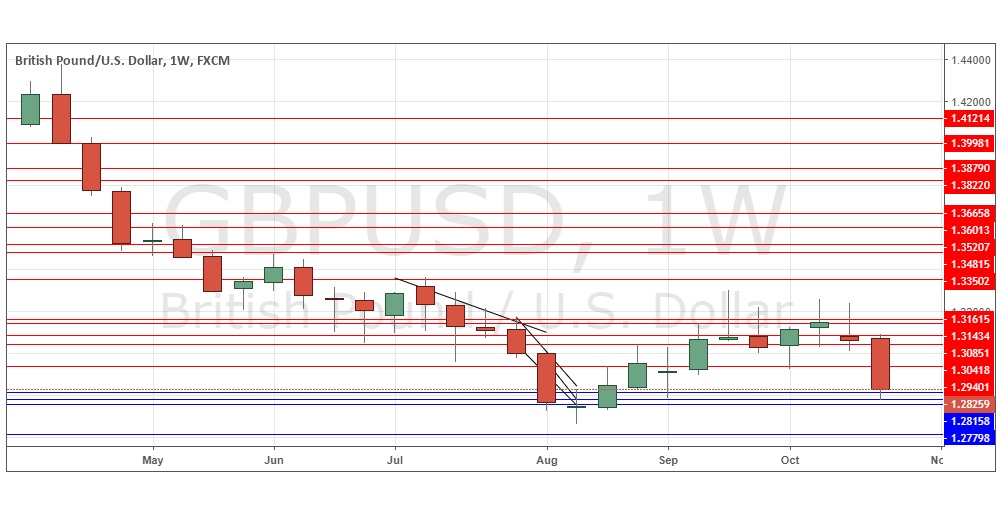

GBP/USD

The weekly chart below shows a bearish trend, and a strongly bullish candlestick from last week, suggesting a further fall is likely. The problem is that despite the long-term bearish trend, day to day price movements are currently highly focused upon Brexit developments. Therefore, I do not see a weekly short position here as a very good bet, as it would only take a strong rumor that a deal was about to be reached to send the British Pound sharply upwards.

S&P 500 Index

The weekly chart below shows something we have not seen for at least two years: the price closing below where it was six months ago. To me, this is a key sign indicating the functional start of a bear market, even though we have not yet seen a “death cross” or the price down by more than 20% off its high. It can be seen in the chart that the downward pushes are strong, and last week closed near its low. Markets are nervous, and the Federal Reserve seems happy to watch stocks fall further. Although fundamentals still look acceptable for the U.S. economy, it feels as though there is likely to be a continuation in this downwards movement over the next week at least.

Conclusion

Bearish on the EUR/USD currency pair and the S&P 500 Index.