The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 7th October 2018

In my previous piece last week, I forecasted that the best trades would be long USD/JPY and long of WTI Crude Oil with a profit target of $75.00. These trades finished positively: the USD/JPY currency pair rose by 0.02% over the past week, and WTI Crude Oil easily hit $75.00 and beyond after opening at $73.50, producing a profit of 2.04%, totalling an average win of 1.03%.

Last week saw a rise in the relative value of the British Pound, and a fall in the relative values of the Australian and New Zealand Dollars.

Last week’s Forex market was dominated by weaker than expected U.S. economic data releases, and a perceived growing likelihood that the U.K. and the E.U. will agree a Brexit deal over the forthcoming weeks.

Fundamental Analysis & Market Sentiment

Fundamental analysis tends to support the U.S. Dollar, as American economic fundamentals continue to look strong. Sentiment seems to be still in favor of the U.S. Dollar, and is increasingly in favor of the British Pound on Brexit. Fundamentals are bearish on the Japanese Yen.

The week ahead is likely to be dominated by British GDP and U.S. inflation data releases, as well as any possible developments on a Brexit deal which may arise.

Technical Analysis

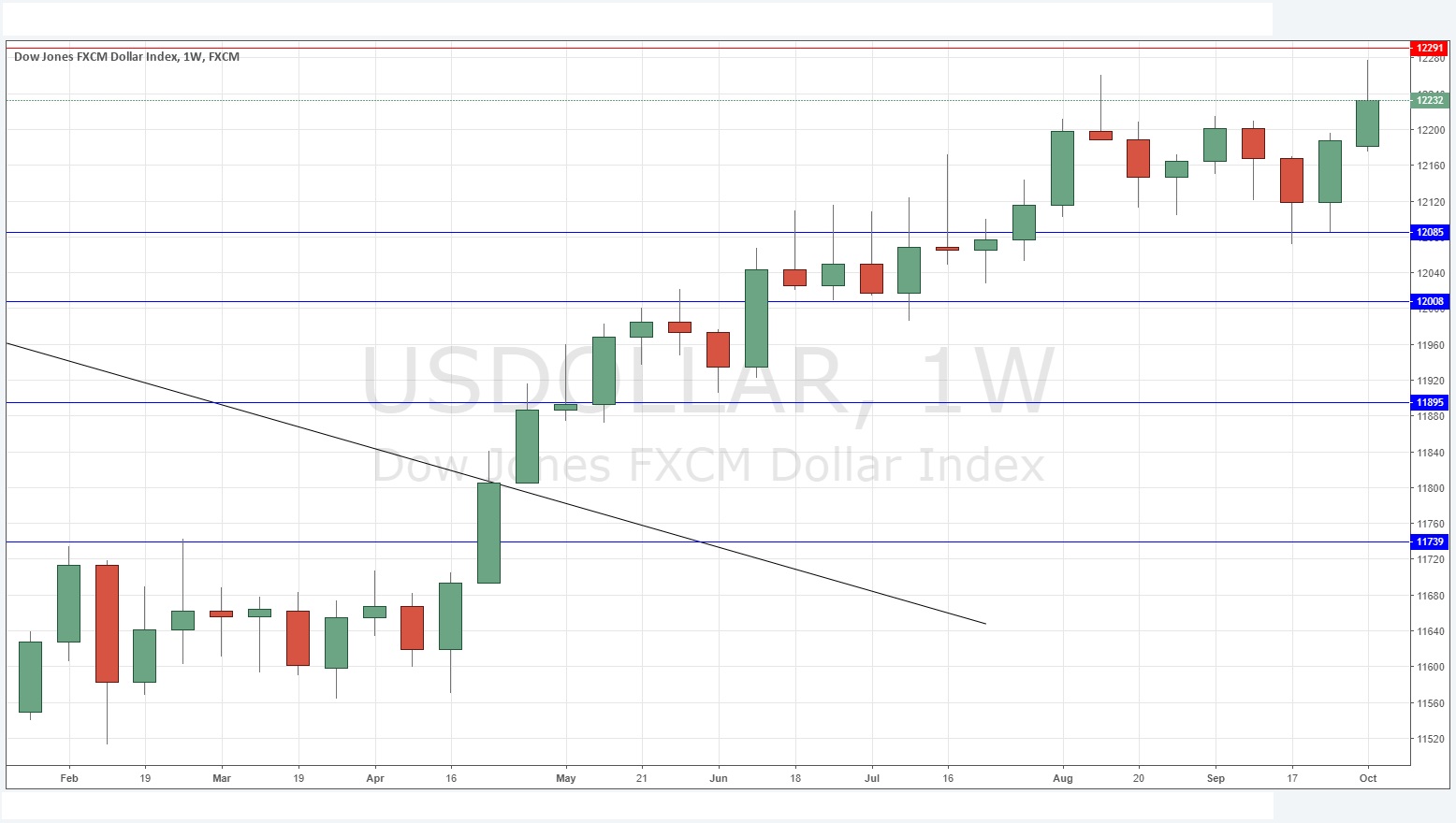

U.S. Dollar Index

The weekly price chart below shows that after last week’s very bullish candlestick, the price rose again over the week, printing a bullish candlestick, which closed in its top half and above the former resistance level at 12219. These are bullish signs, but the upper wick and the nearby resistance level above it suggest a possible note of caution for USD bulls.

NZD/USD

This pair just printed a long and strongly bearish candle which closed very near its low price, at a multi-year low. These are all very bearish signs. The Australian Dollar is also extremely bearish which adds to the bearishness here.

AUD/USD

This pair just printed a long and strongly bearish candle which closed very near its low price, at a multi-year low. These are all very bearish signs. The New Zealand Dollar is also extremely bearish which adds to the bearishness here.

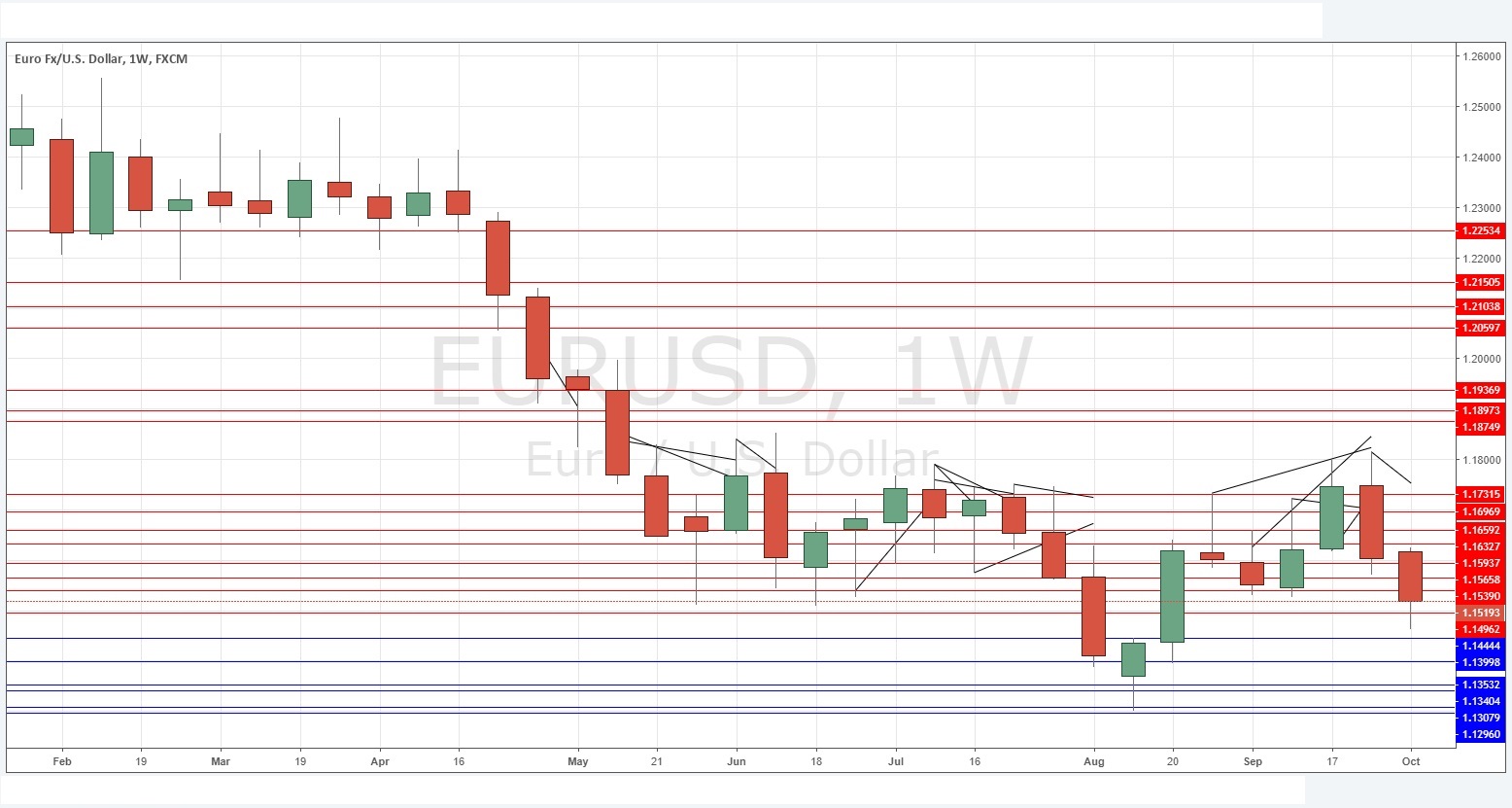

EUR/USD

This pair just printed a reasonably bearish candle which closed within its bottom half. This pair is in a weak long-term bearish trend but has been falling with some healthy bearish momentum over the past two weeks, which is a bearish sign.

Conclusion

Bearish on the AUD/USD, NZD/USD, and EUR/USD currency pairs.