Gold prices fell $6.12 an ounce on Wednesday as the dollar rallied on the back of better-than-expected economic data. The private sector added 230000 jobs in September, according to the ADP’s National Employment Report. The Institute for Supply Management said its index of non-manufacturing activity jumped to 61.6 from 58.5 a month earlier. Market participants are awaiting the Labor Department’s nonfarm payrolls report, due out Friday.

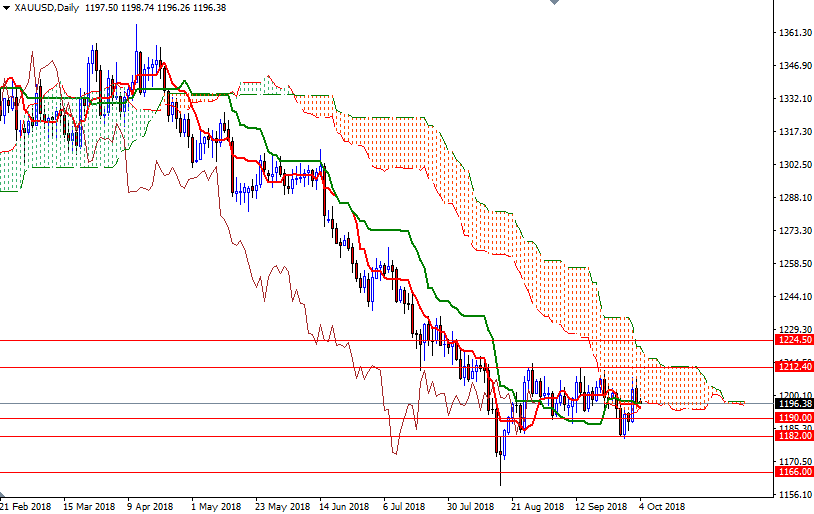

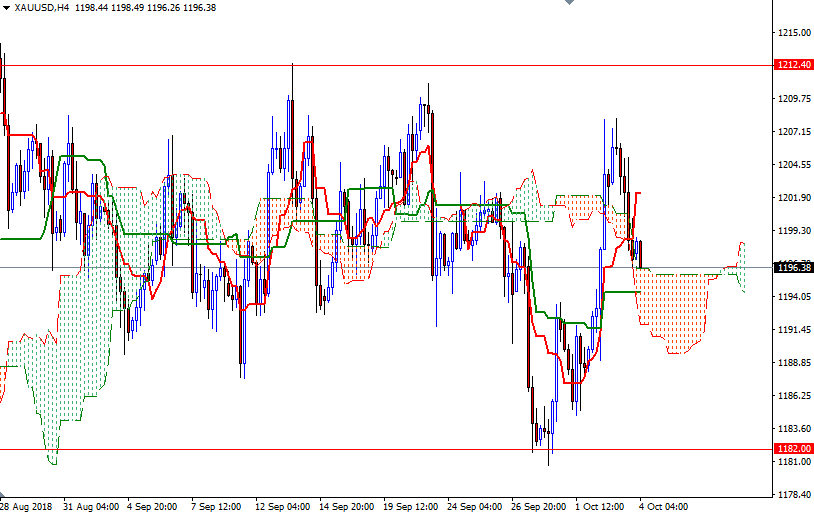

Some chart-based selling was also behind gold’s 0.5% decline yesterday. XAU/USD was unable to pass through the 1208 level and as a result, prices returned to the 4-hourly Ichimoku cloud that should act as an effective support. The Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) are flat on the daily chart to suggest sideways trading action in the near term.

To the upside, the initial resistance sits in 1202/0, and that is followed by 1208. Beyond there, the 1214-1212.40 zone stands out as a solid resistance. If this resistance is broken, look for further upside with 1218 and 1226-1224.50 as targets. The bears have to drag prices below 1196 to visit 1193. A break below 1193 indicates that XAU/USD will retreat to 1190-1189, the bottom of the 4-hourly cloud. If this support gives way, the market will be aiming for 1187/5.