Gold prices rose $14.16 an ounce on Tuesday as heightened risk aversion spurred safe-haven demand. World stock markets were mostly lower yesterday. Concerns about Italy’s financial and economic problems weighed on European stock markets. U.S. economic data due for release Wednesday includes the ADP national employment report and the ISM non-manufacturing report on business.

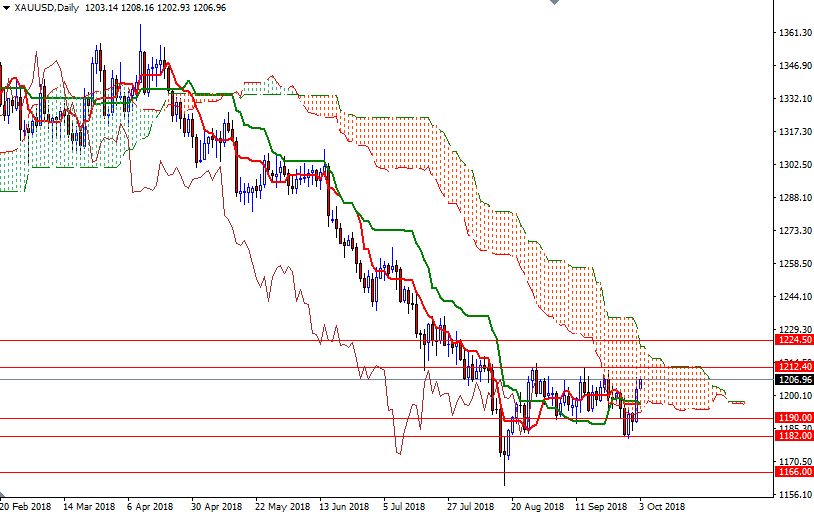

XAU/USD edged higher as anticipated after the resistance in the 1193/0 zone was broken. The short-term charts are slightly bullish, with the market trading above the Ichimoku clouds on the H4 and the H1 charts. The Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) are negatively aligned on both charts.

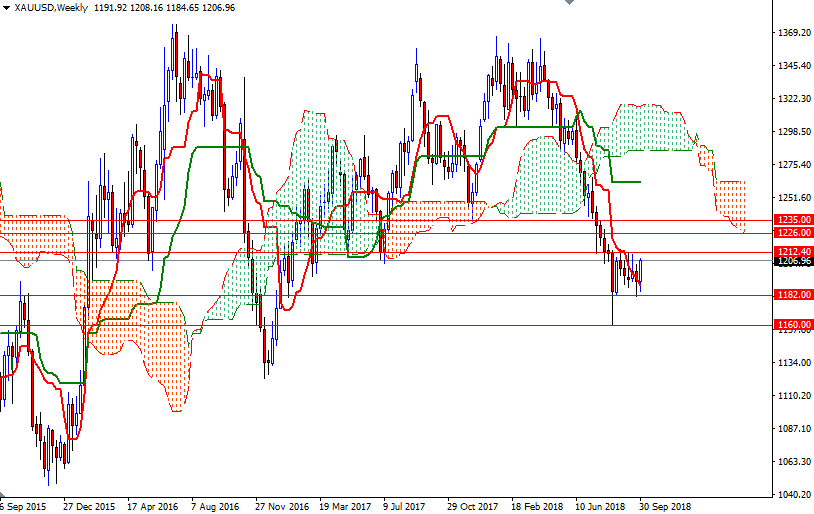

It looks as if the market will revisit the key resistance in 1214-1212.40, but in order to reach there, the bulls have to lift prices above 1208 first. A daily close above 1214 would be a positive sign and open the door to 1226-1224.50. A failure to break through 1208, on the other hand, could trigger some long-side profit taking. In that case, keep an eye on the support in 1202/0. If this support gives way, the market will be targeting 1197/6. The daily Tenkan-Sen and Kijun-Sen converge it this area so the bears have to push prices below there to challenge the support at around 1190.