Gold prices fell $6.05 an ounce on Monday, pressured by a rally in the U.S. dollar index. A rebound in Chinese stocks and a weaker euro also worked against the precious metal. Gold is likely to continue trading in its recent range ahead of two key economic events that lie just ahead: Thursday’s European Central Bank meeting and Friday’s U.S. GDP report. The ECB is not expected to change its monetary policy at this meeting, but Mario Draghi’s press conference will be closely monitored for any potential clues on future moves by the central bank.

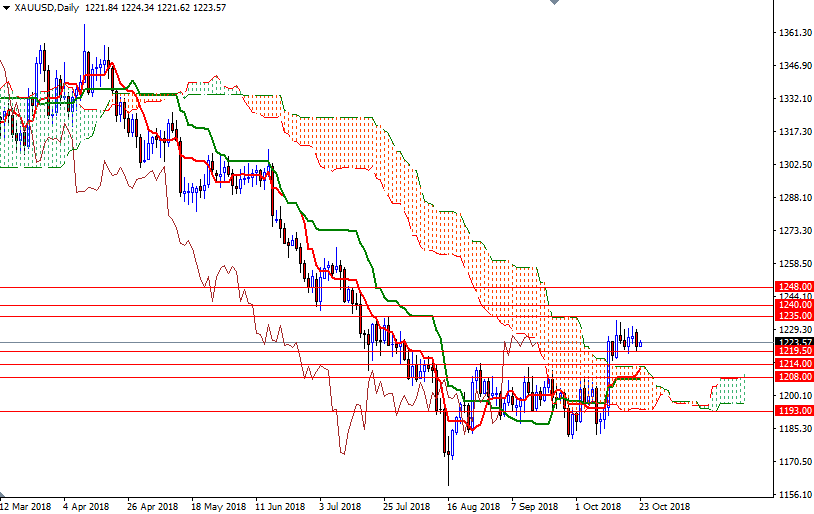

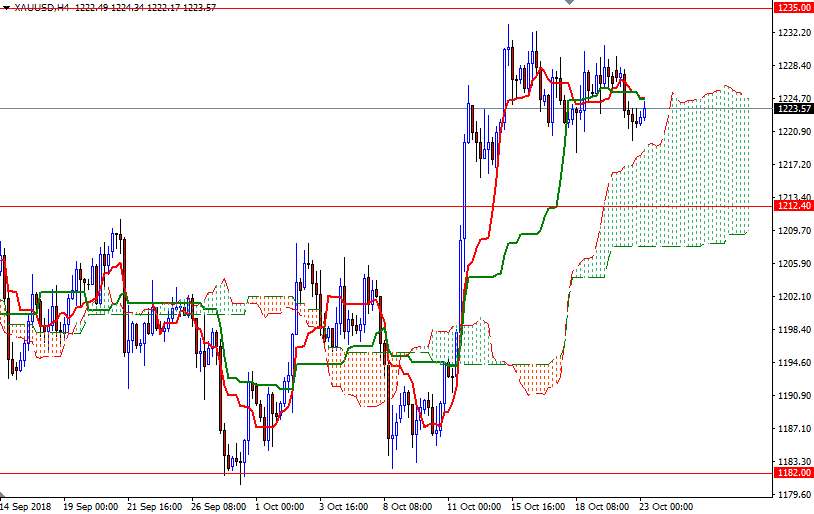

XAU/USD is still trading above the daily and the 4-hourly Ichimoku clouds, suggesting that the bulls have the near-term technical advantage. The first upside barrier comes in around 1225, the confluence of the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) on the H4 chart. That is followed by the 200-week moving average at around 1235. The bulls have to lift prices above 1235 to set sail for 1240.

To the downside, keep an eye on the support at 1219.50, the top of the 4-hourly Ichimoku cloud. If this support is broken, look for further downside with 1216 and 1214-1212.40 as targets. The top of the daily cloud sits in the 1214-1212.40 area so the bears have to capture this strategic camp to make an assault on 1208/5.