Gold prices rose $5.26 an ounce on Wednesday as a weaker dollar and a sharp selloff in U.S. stocks lured investors back into the market. Asian stock markets are lower this morning, still pressured by rising world government bond yields and concerns over the U.S.-China trade war. The dollar lost ground following U.S. President Donald Trump’s comments on the Federal Reserve’s interest rate hiking path. U.S. economic data due for release Thursday includes the weekly jobless claims report and the consumer price index.

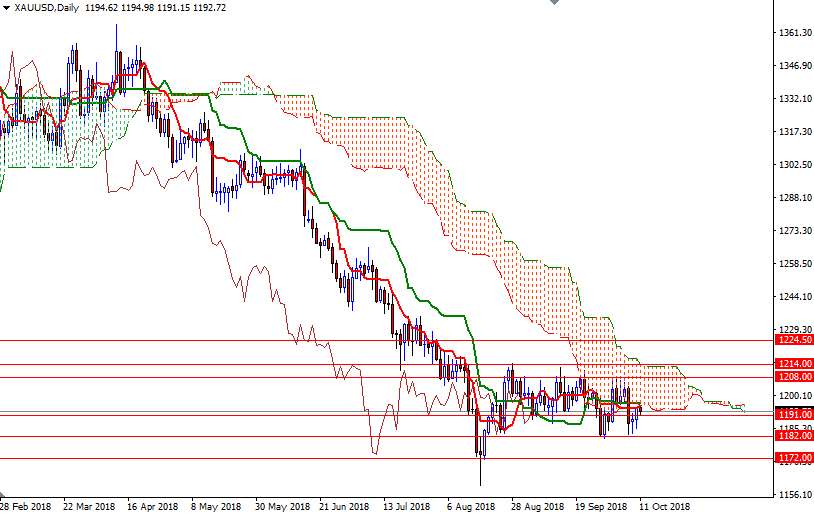

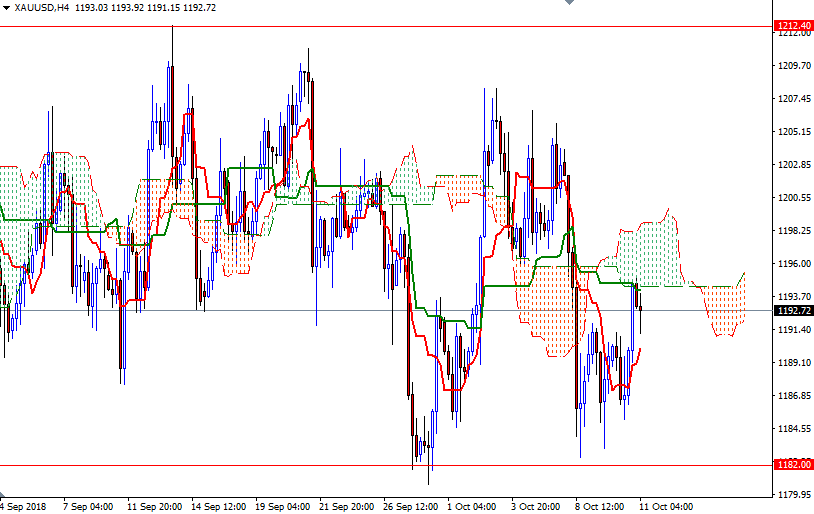

XAU/USD reached the 4-hourly cloud as expected after prices climbed above the 1191 level. The short-term charts suggest that the market will continue to respect the sideways trading range that has been in place on the daily chart for weeks. To the upside, the initial resistance sits in the 1196.60-1195.40 area, the confluence of the daily Tenkan-sen (nine-period moving average, red line) and the bottom of the daily cloud. If this resistance is broken, it is likely that prices will grind higher towards 1202/0, the top of the 4-hourly cloud. The daily and the 4-hourly clouds overlap in this are so a daily close above 1202 is essential for a push up to 1208/6.

The bears, on the other hand, have to push prices below the 1191/0 zone to challenge the support at around 1185. Below there we have a solid technical support in 1182/0. Closing below 1180 on a daily basis would suggest a move back down to 1173/2.