Gold prices fell $7.06 an ounce on Tuesday as a rally in the dollar put downward pressure on gold. A rebound in the U.S. stock market also dented safe-haven demand for gold. Global stock markets were mostly higher yesterday. Traders are now awaiting Friday's non-farm payrolls report, which is the most important U.S. data point of the week.

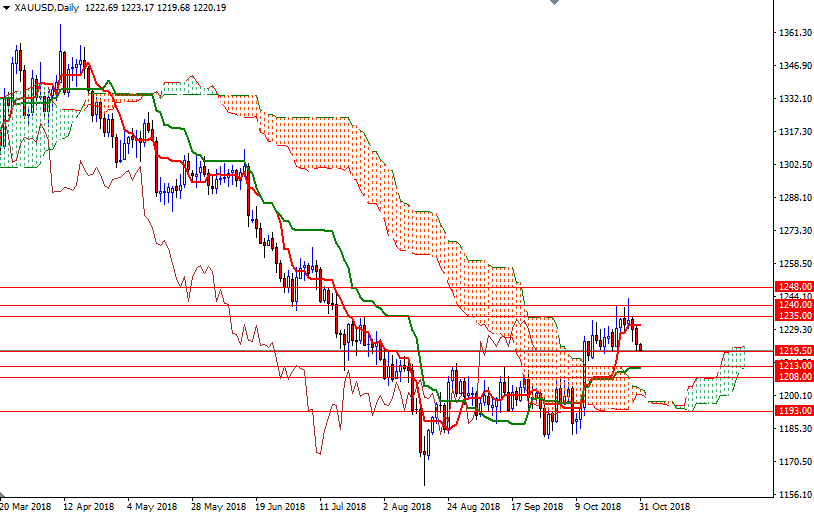

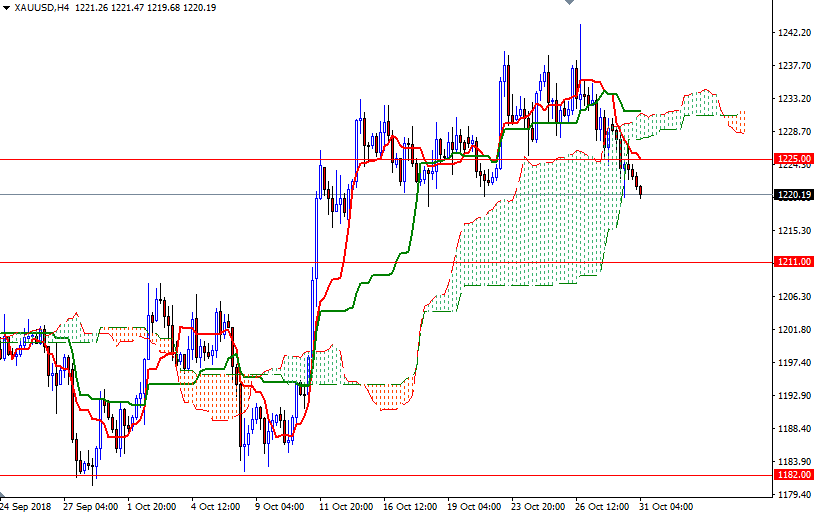

The short-term charts are bearish at the moment, with the market is trading below the Ichimoku clouds on the H4 and the H1 charts. In addition, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are negatively aligned on both charts. XAU/USD is in the process of testing the support in the 1220.50-1219.50 zone. If this support gives way, prices will probably head lower towards the 1231/1 area, where the daily Kijun-sen resides. The bears have to capture this strategic camp to make an assault on 1208.

The bulls, on the other hand, have to lift prices above 1225 to make a run for the 1232/29 area occupied by the 4-hourly Ichimoku cloud. If this resistance is broken, XAU/USD may revisit the next barrier sitting at 1235. Beyond there the 1240 level stands out as a strong technical resistance. The bulls have to produce a daily close above 1240 to challenge 1252/48.