Gold prices ended Thursday’s session up $29.46 an ounce as sliding global stock markets spurred demand for the metal. A weaker U.S. dollar index was also a supportive daily element for gold. The dollar index fell to its lowest since September 28 in the wake of weaker-than-expected U.S. economic data. The consumer price index report for September came in at up 0.1% from August. A separate report from the Labor Department showed the number of people filing new claims for unemployment benefits increased by 7K to 214K.

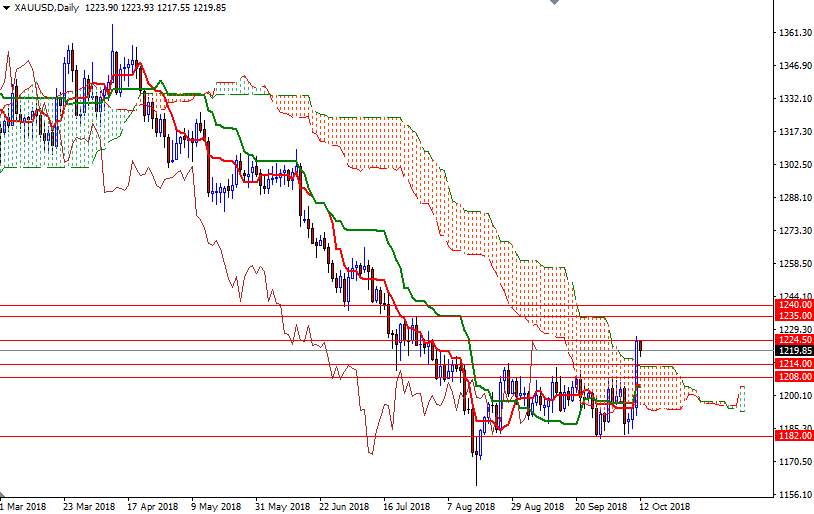

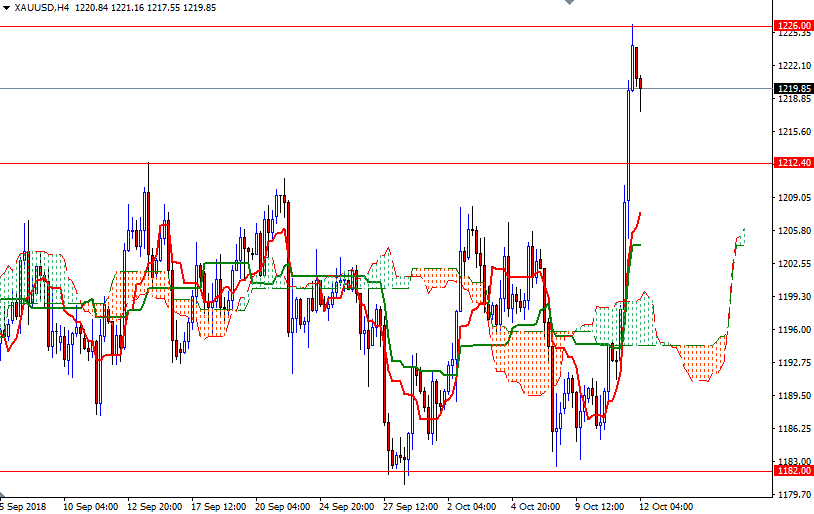

XAU/USD saw a bullish upside breakout from the sideways trading range. Gold bulls gained fresh upside technical momentum as prices pushed through the 1214-1212.40 area. Consequently, the market was able to reach the next barrier in 1226-1224.50. The market is trading above the daily and 4-hourly Ichimoku clouds, suggesting that there will be more upside price action.

To the upside, keep an eye on the aforementioned resistance in the 1226-1224.50 area. If the bulls can confidently lift prices above 1226, it would be a sign of a stronger recovery and pave the way for a test of 1235. A break through there brings in 1240. However, if prices can’t climb above the 1226, the market will probably return to the daily cloud to revisit the 1214-1212.40 zone. The bears have to push prices below there to challenge 1208/6.