Gold prices ended a choppy, two-sided trading session slightly higher on Thursday. Global stock markets, including major U.S. stock indexes, were mostly weaker yesterday. However, the recent strength of the dollar and rising U.S. Treasury yields continued to limit the upside in gold. Traders are looking ahead to the U.S. government’s September payroll report.

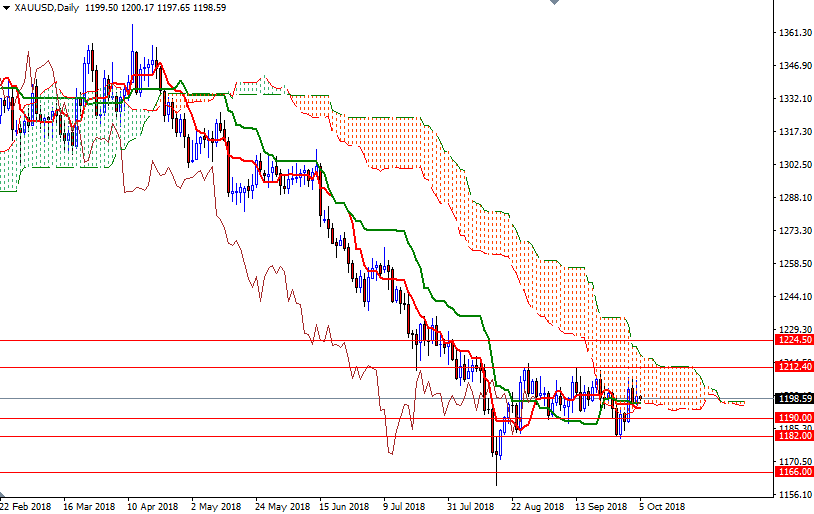

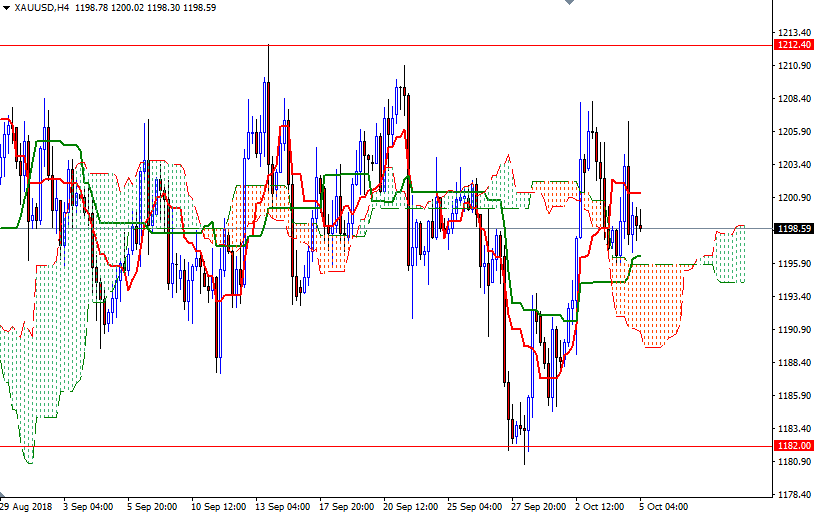

XAU/USD edged higher after prices found support in the 1197/6 zone as anticipated, but it was unable to get back above the 1208 level. The market is trading above the 4-hourly Ichimoku cloud. However, prices are still within the the borders of the daily cloud; plus, the Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) are flat.

The bulls have to lift prices above 1208 if they intend to challenge the key technical resistance in the 1214-1212.40 area. A break above 1214 would be a positive signal and open a path to 1226-1224.50. On its way up, expect to see some resistance at 1218. The top of the 4-hourly cloud sits in 1197/6. If this support gives way, then 1193 will be the next stop. Below there, the 1190-1189 zone, the bottom of the 4-hourly cloud, stands out as a strategic support. The bears need to capture this camp to tackle 1185.