Gold prices fell $2.65 an ounce on Thursday as the U.S. dollar strengthened ahead of key U.S. economic data. The euro edged lower after European Central Bank President Mario Draghi said interest rates could rise after next summer. World stock markets were mixed to lower yesterday. Asian stocks continued to slide on Friday. Investors are awaiting third quarter gross domestic product data due later today. XAU/USD tested the support in the $1230-$1229 area after it failed to break above the key $1240 level.

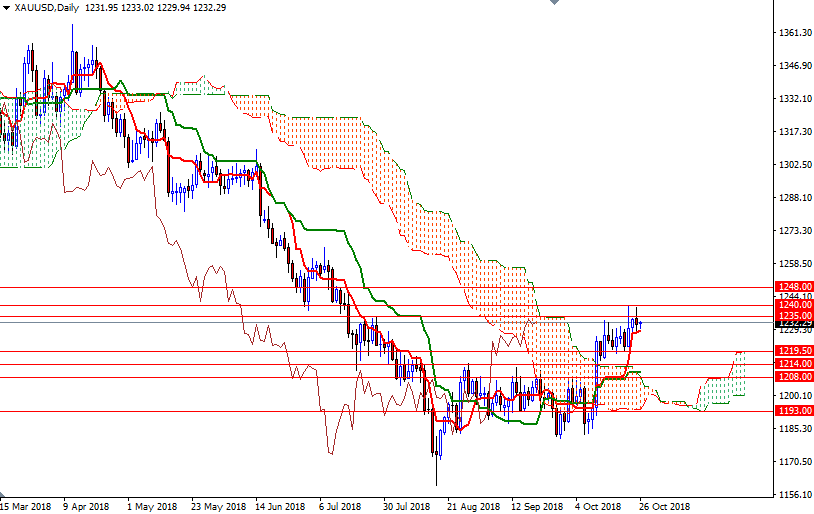

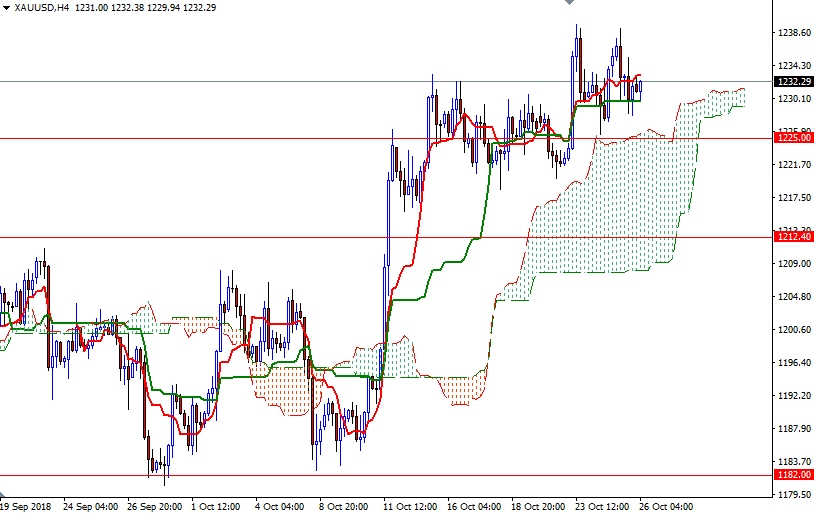

The market is trading above the Ichimoku clouds on the daily and the 4-hourly charts to suggest that the bulls have the near-term technical advantage. The Chikou-span (closing price plotted 26 periods behind, brown line) is above prices, but it hasn’t penetrated the daily cloud yet. It seems the sideways price action will persist ahead of U.S. economic growth data.

The first upside barrier comes in around 1240. If XAU/USD successfully climbs above 1240, the bulls will be aiming for 1245.50 and 1252/48. A break through there brings in 1260. The top of the 4-hourly cloud sits in the 1225/4 area so the bears have to drag the market below there to gain momentum for a test of 1220.50-1219.50. If this support is broken, the market will be targeting 1216 and 1214-1212.40.