Gold prices ended a two-sided trading session slightly higher on Tuesday. Gold saw mild benefit from an uptick in risk aversion, but buying interest remains subdued on expectations that the U.S. central bank will lift rates in December for the fourth time this year. The Chinese yuan, which continued to depreciate against the U.S. dollar this week, is in focus again. The International Monetary Fund lowered its forecasts for global economic growth this year and next due to the U.S.-China trade war and instability in emerging markets.

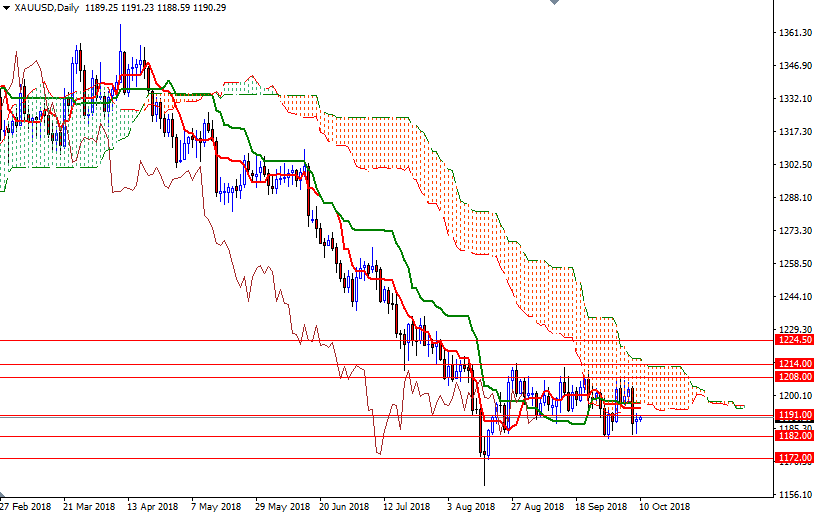

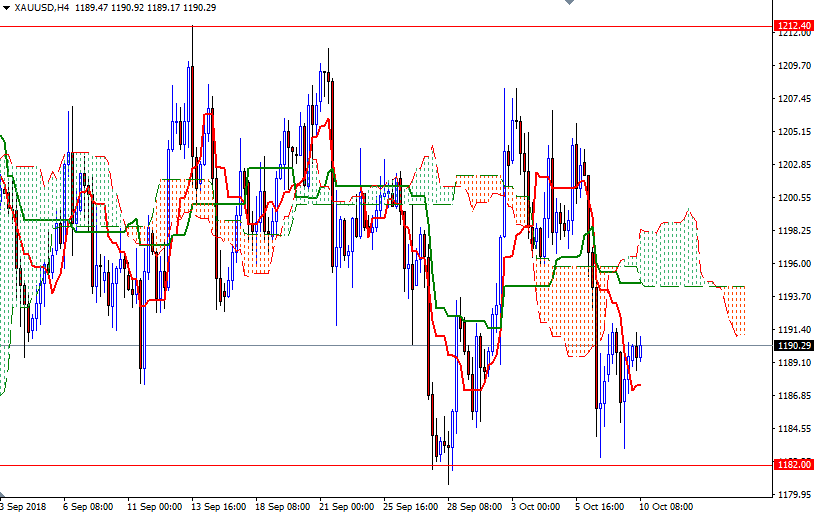

The bears have the overall technical advantage, with the market trading below the Ichimoku clouds on the weekly and the daily charts. However, the bulls continue to defend their camp in the 1182/0 area so the downside potential will be limited until the market pierces below this solid support. If the bears successfully drag prices below 1180, then the 1173/2 area will be the next port of call. A break below 1172 could trigger a drop to 1166.

To the upside, the initial resistance sits at 1191. If gold manages to take out yesterday's high, prices will be heading towards the 1197/4 area occupied by the 4-hourly Ichimoku cloud. Beyond there, the 1202/0 zone stands out as a strategic resistance. A daily close above 1202 suggests a move up to 1208/6.