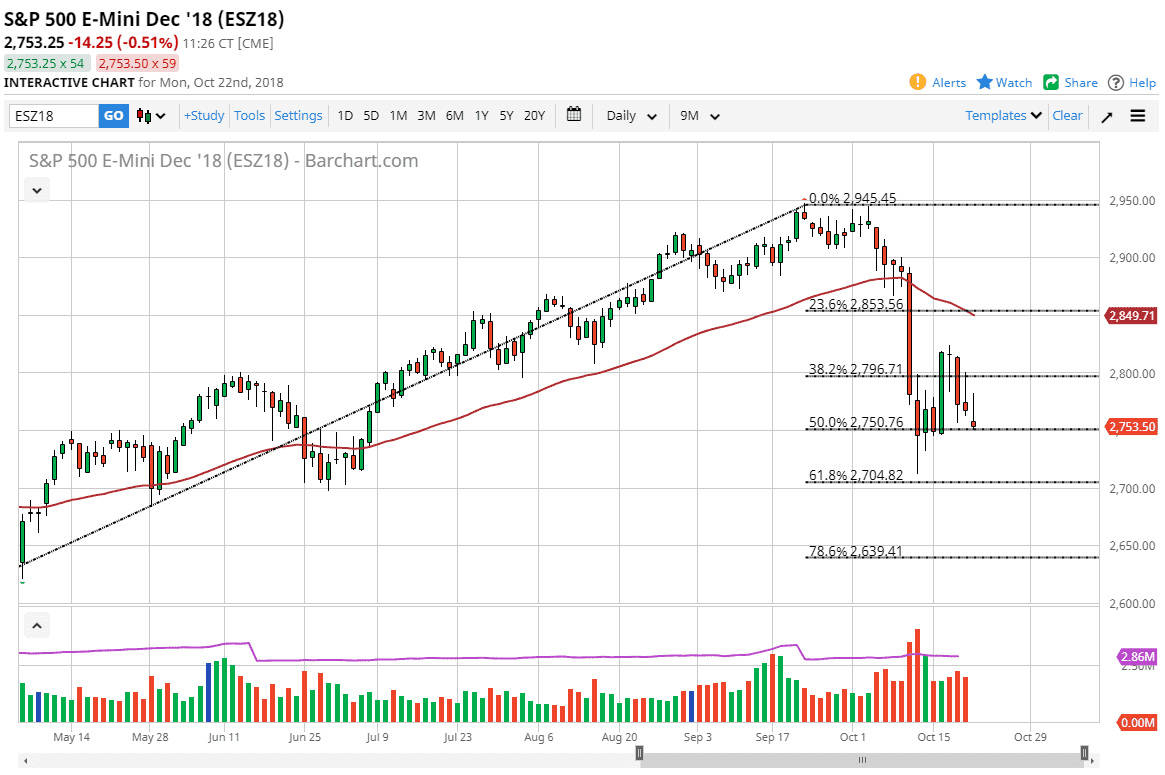

S&P 500

The S&P 500 gapped lower in the E-mini session on Monday, reaching down to the 2750 level before turning around to fill the gap, and then rolling over again. As I record this, we are midday and it looks rather troubling. It seems that there is still a significant amount of overhang of supply in this market, so I think that rallies at this point are to be sold until we can break above the 2800 level substantially. That being said, there does seem to be a massive amount of support just below at the 2750 level. In other words, I want to see a break out to the upside before I put money to work in a more comfortable manner. Otherwise, I would need to see the low taken out at 2700 to start shorting. I think this is a market that probably is going to continue to be very noisy, but it also looks like one that could suddenly reverse on you.

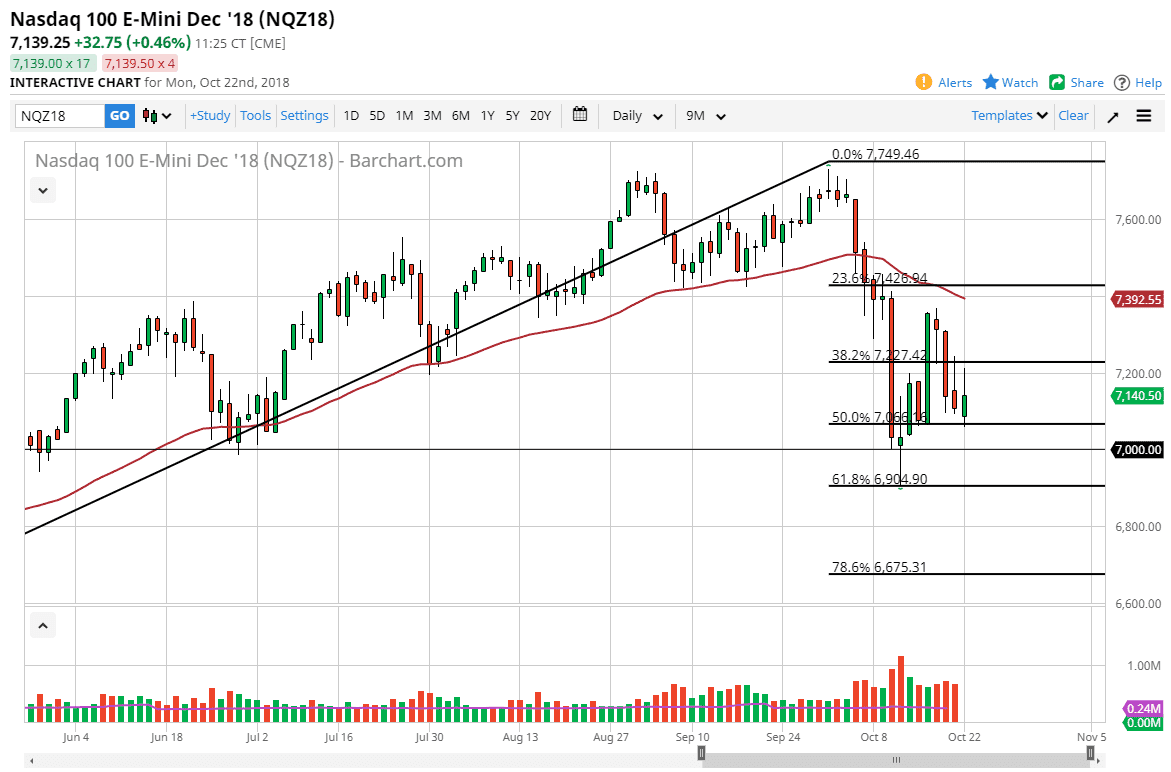

NASDAQ 100

At midday, the NASDAQ 100 is still positive and even though it rolled over a bit it at least shows more signs of strength in the S&P 500. It is because of this that I believe trader should have both charts open, recognizing that a move above the 7200 level for a couple of hours could be a very positive turn of events and even if you miss the trade in the NASDAQ 100, in theory the S&P 500 should probably follow right along. This could be the canary in the coal mine if you will, but I also recognize that the 6900 level underneath is massive support and if we were to break down below there, that would be a very negative sign, perhaps accelerating the selling.