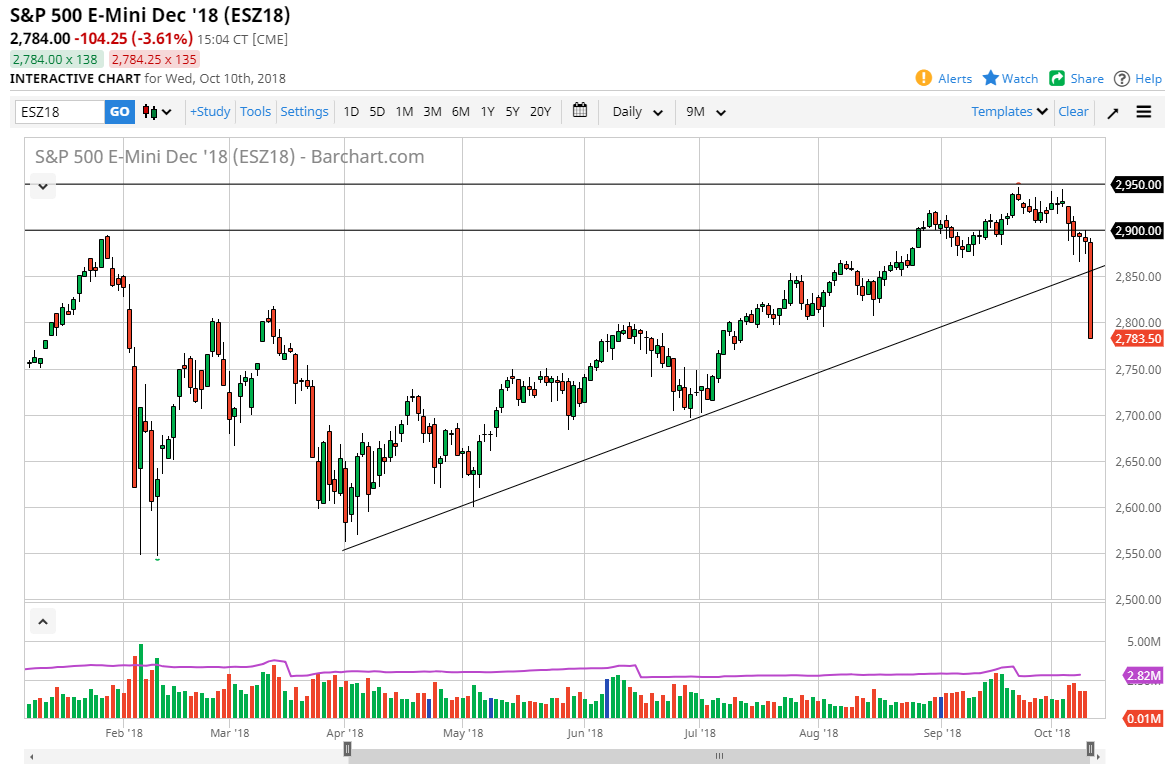

S&P 500

The S&P 500 got absolutely hammered during the trading session on Wednesday, breaking through a major uptrend line, and smashing through the bottom of several hammers. That’s a negative sign, and since we are seeing the market close at the very bottom of the candle stick, it shows that there should be negative momentum. I think at this point, it’s likely that we will continue to find sellers and I think there is more to go after this type of brutality. It’s likely that any rally at this point in time will probably attract more sellers, and we could see a lot of negativity jumping into the marketplace rather rapidly. For some time now, the Americans have been the bright spots but it seems as if the global nervousness and the bond market has finally taken its toll on American stock markets.

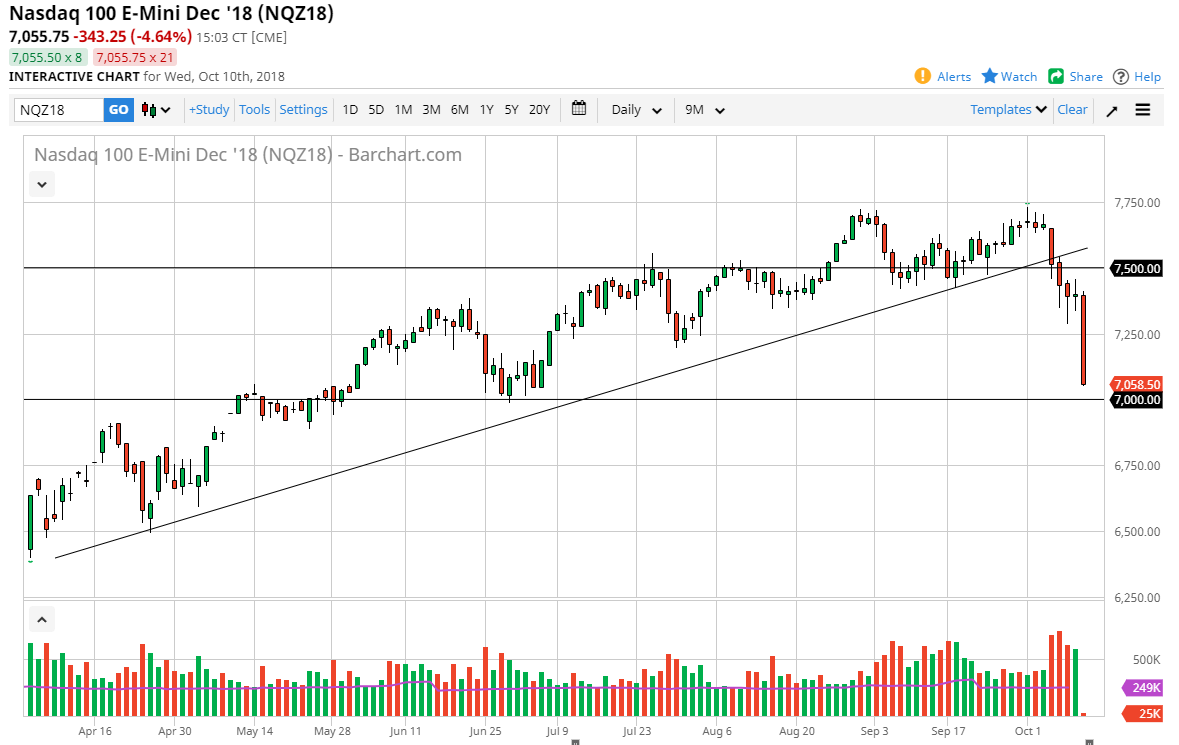

NASDAQ 100

If the S&P 500 looks horrible, the NASDAQ 100 looks like it’s on fire. At this point, it looks as if we will test the 7000 level, and if we break down below there we will probably sell off even more rapidly than we did during the day on Wednesday. At this point, I think that short-term rallies are going to end up being selling opportunities as we show signs of exhaustion. This market looks horrible and has been worse than the S&P 500 for several days now. I think that the market will probably go looking towards the 6750 level underneath, but we may get a little bit of a bounce between now and then. Overall, I think it is going to take quite a bit of a shift in momentum to lift this market for any length of time.