S&P 500

The S&P 500 had a decent recovery towards the end of the day on Friday, as we bottomed out on Thursday at the 61.8% Fibonacci retracement level. This is a good sign, and we may be starting to show signs of stability again. However, we should not get too complacent here, because there was a massive uptrend line that was broken. If we can break above the top of the range for the Friday session, we will probably go looking towards the 2850 handle. Otherwise, we will probably fall again and if we break below the lows on Thursday, and perhaps even more importantly the 2700 level, this market could unwind rather drastically. This could be the beginning of a very nasty drop lower if we do make a fresh new low.

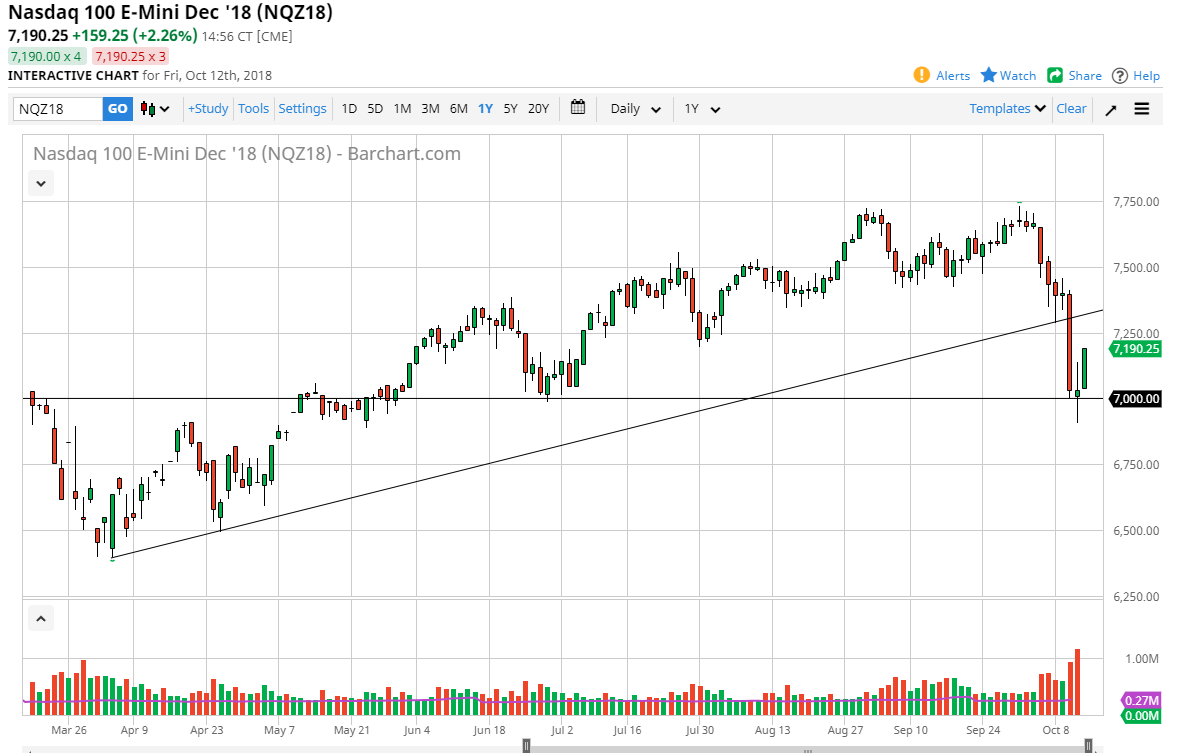

NASDAQ 100

The NASDAQ 100 had a very strong move during the day on Friday, breaking above the neutral candle from the Thursday session. This is a good sign, but we need to get past the major selloff from the Wednesday session in order to be comfortable. At that point, then I think it would show that the NASDAQ 100 is ready to go much higher, perhaps taking out the highs. Alternately, if we close on a daily chart below the 7000 handle, I think we would see this market unwinds rather drastically, perhaps reaching down to the 6500 level after that. Tech stocks are particularly vulnerable to the Sino-American relations that are deteriorating, so keep that in mind as well. Look for signs of exhaustion, you could find a selling opportunity near 7250. Alternately, if we take out the highs from Wednesday then I think you start buying dips as they occur.