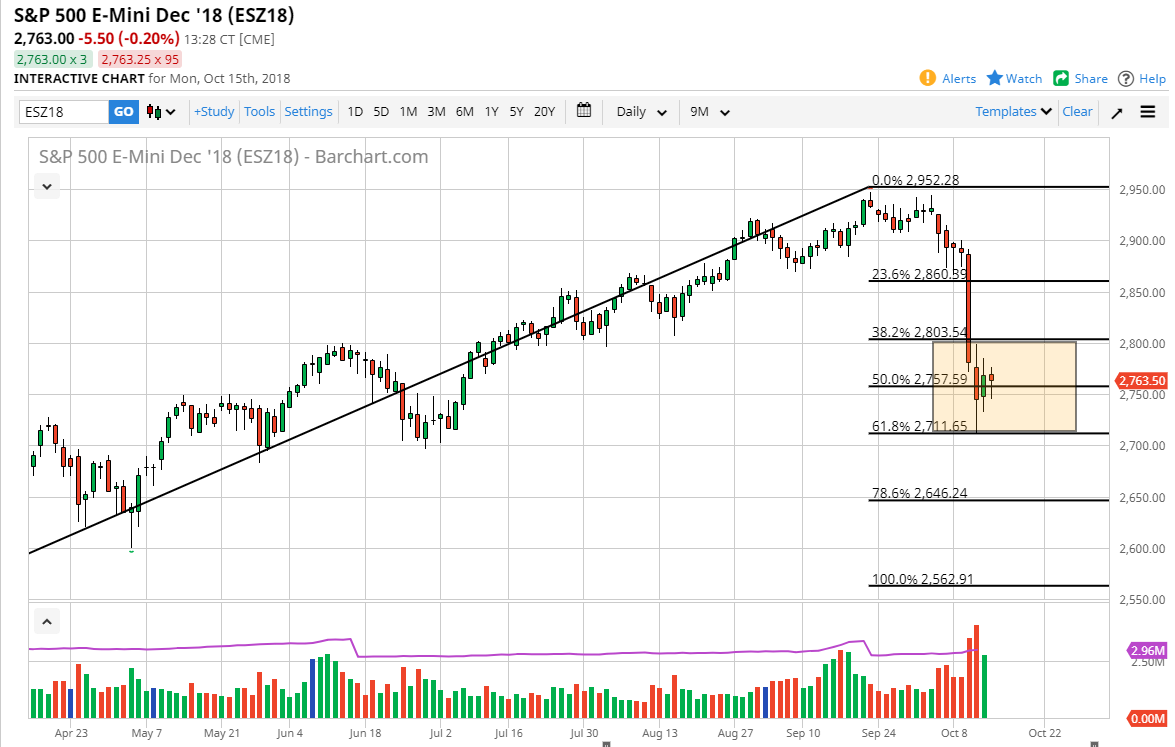

S&P 500

The S&P 500 has been very choppy during the trading session on Monday as we kick off the week. It looks likely that the 50% Fibonacci retracement level is going to continue to attract a lot of attention as traders have no idea what to do next. The 2700 level underneath is massive support, just as the 2800 level above could be significant resistance. At this point, I believe it’s only a matter time before we make a decision, but in the short term it’s very likely that we continue to go back and forth. If we break down below the 2700 level, then I think we probably go looking towards the 2550 level. Otherwise, if we break above the 2800 level, then I think 2850 would be targeted next. In the meantime, look for short-term back and forth opportunities.

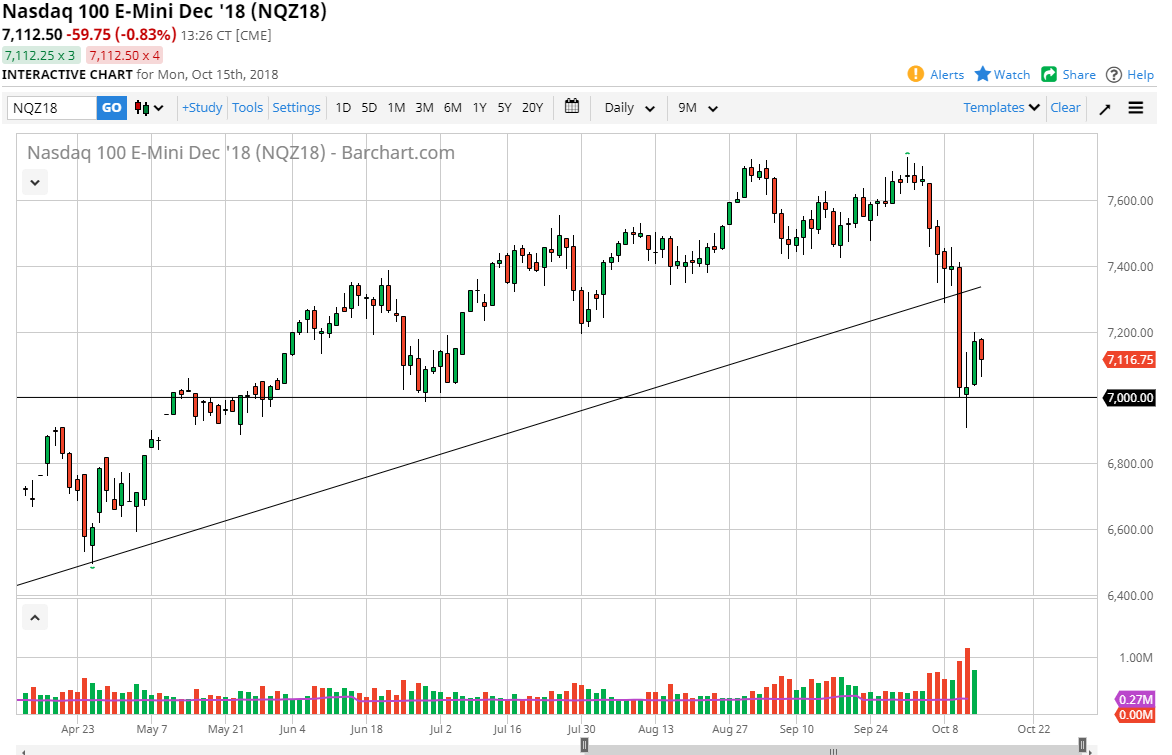

NASDAQ 100

The NASDAQ 100 had a negative session as well, bouncing from the 50% Fibonacci retracement level. The 61.8% Fibonacci retracement level at the 6900 level has caused a bit of support a couple of sessions ago, and I think we are likely going to see buyers jump into this market. However, there are a lot of concerns out there about the global economy and trade wars, and of course the Sino-American tensions will affect technology in particular. If we can break above the 7200 level, then I think the market should continue to go much higher, perhaps reaching towards the 7400 level. Otherwise, if we break down below the 6900 level, then the market probably drops down to the 6750 level, perhaps even 6500. I anticipate a lot of volatility, and although this pullback has been rather strenuous, but there is an argument to be made for a certain amount of value.