S&P 500

The S&P 500 exploded to the upside during trading on Tuesday, reaching above the 2800 level. The market has broken out of the consolidation range that I have been talking about, so now it looks like we will continue to rally. At this point, I think that we will probably go looking towards the 2850 handle, and perhaps even the 2900 level after that. There is a huge bearish candle that we need to take out now, and I think it will be very difficult to do so. Because of this, I think we have short term bullishness but I can’t imagine that it would take too much to scare traders again. However, we are still technically in a significant uptrend, so at this point that signifies that you are better off buying instead of trying to time the market to the downside.

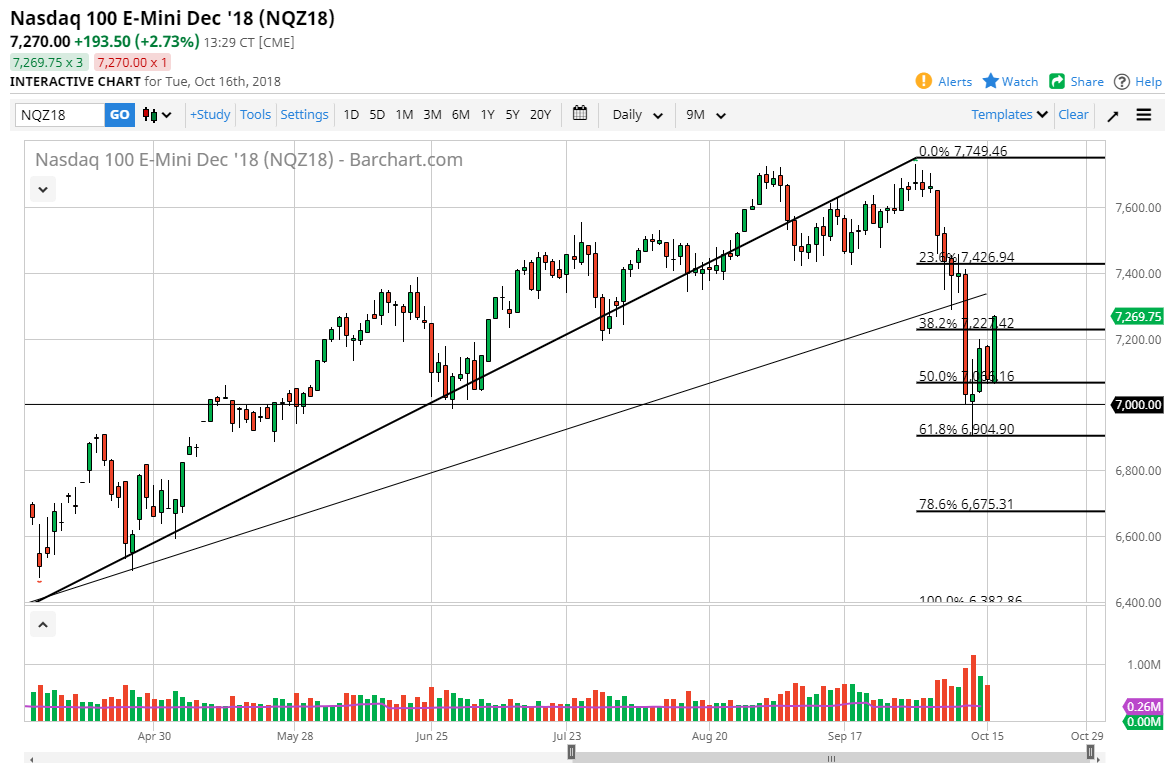

NASDAQ 100

The NASDAQ 100 also broke out to the upside, breaking clearly above the 7200 level, and even the 7250 level. It now looks as if we are going to try to reach towards the 7400 level, an area that should be somewhat resistive. This was a significant breakdown that we have seen as of late, but the 61.8 Fibonacci retracement level has held, just as the 7000 level has. At this point, I think it’s probably safer to go to the long side unless of course the panic sets back again, perhaps somewhere near the 7400 level. We have the FOMC Meeting Minutes coming out late on Wednesday, and that very well could have the markets nervous about interest rate hikes yet again. Technically speaking, this looks like a very strong bounce.