S&P 500

The S&P 500 spent most of the day falling during Wednesday trading, but found the area below the 2800 level to be a bit supportive. By doing so, we continue to rally and recover from the massive selloff of last week. Ultimately, this is a market that has done a lot of technical damage as of late, but we did find support at the 61.8% Fibonacci retracement level which of course is crucial. Beyond that, earnings have been pretty strong and pleasantly surprising, and that of course attract a lot of money into the markets as well. At this point, I suspect that short-term pullbacks will continue to be buying opportunities that people are more than willing to take advantage of. A break above the top of the candle stick for the day is the next signal to start going long. That being said, we do have the previous uptrend line just above that could cause a bit of resistance.

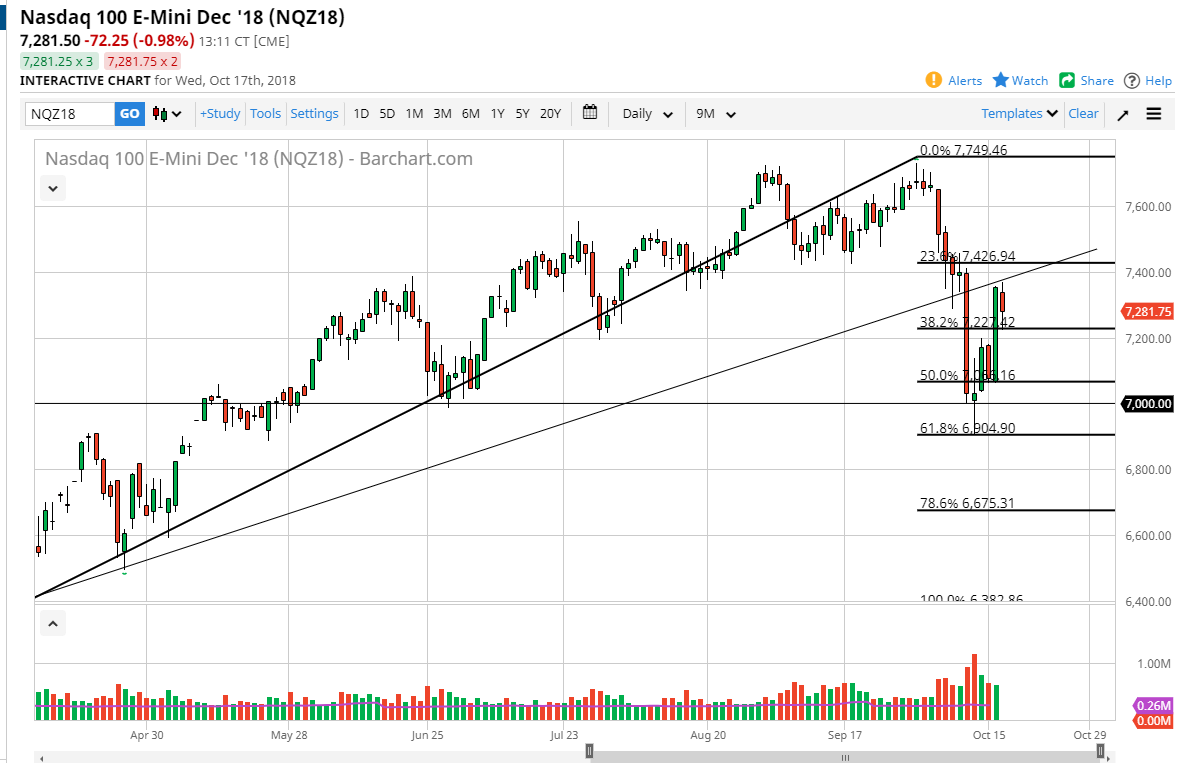

NASDAQ 100

The NASDAQ 100 went back and forth during the day as well, but did underperform the S&P 500, losing almost 1% at the same time the S&P 500 was recovering. Overall, the market looks likely to continue to suffer at the hands of the Sino-American trade spat, which of course still has a way to go. The 7400 level will be massive in its implications, because there is the previous uptrend line that could cause resistance. Beyond that, it’s the top of the massive candle stick from last week that has so much volume to the downside, so if we can break above and I think that the market could be free to go much higher. Short-term pullbacks at this point could be another attempt to build up the necessary momentum, because we did hold at the 7000 handle which of course is psychologically important.