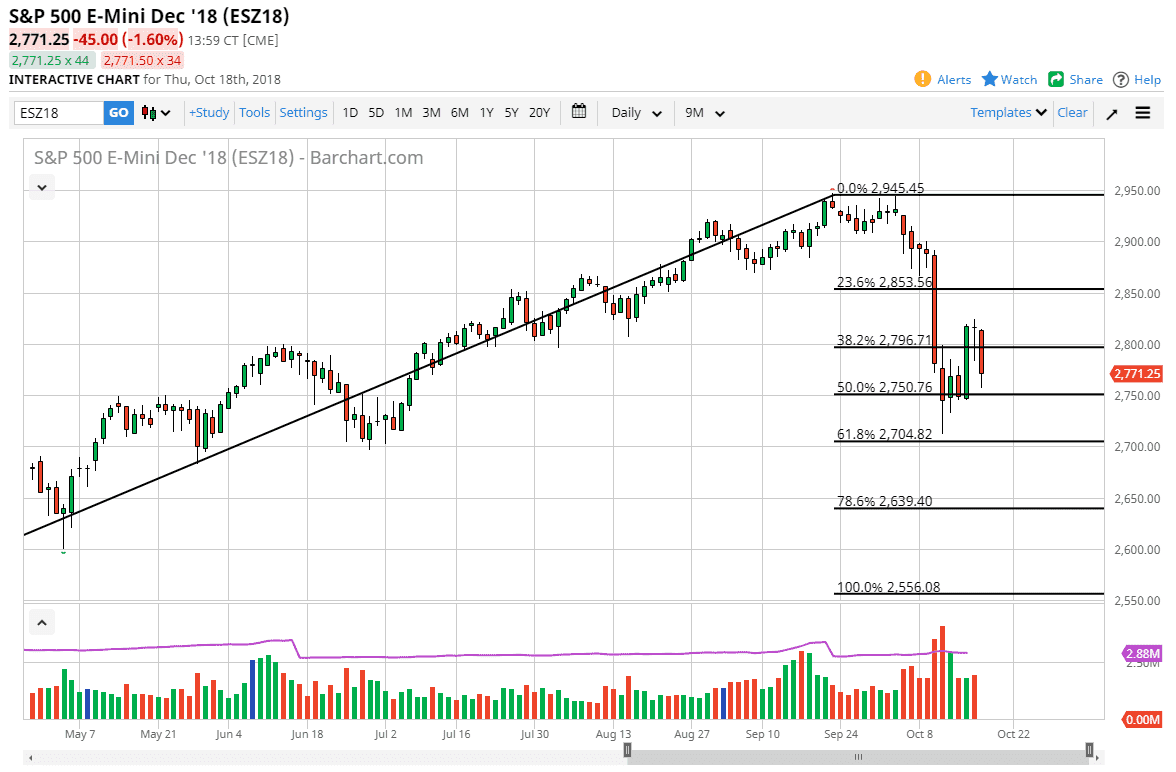

S&P 500

The S&P 500 has fallen rather hard again during the trading session on Thursday, crashing back towards the 2750 handle before bouncing slightly. This is a market that looks very vulnerable to headline risks, which of course are in abundance right now. Earnings don’t seem to be lifting the stock market like people would like to see, so at this point it looks very vulnerable and very dangerous to trade. I would be very small with my trading positions if involved, but I recognize that the 2700 level underneath must hold. If it gets broken to the downside, I suspect that the markets will really start to speed up to the downside. At this point, what we truly need to see is a couple of column trading sessions before it’s a comfortable market to start buying again.

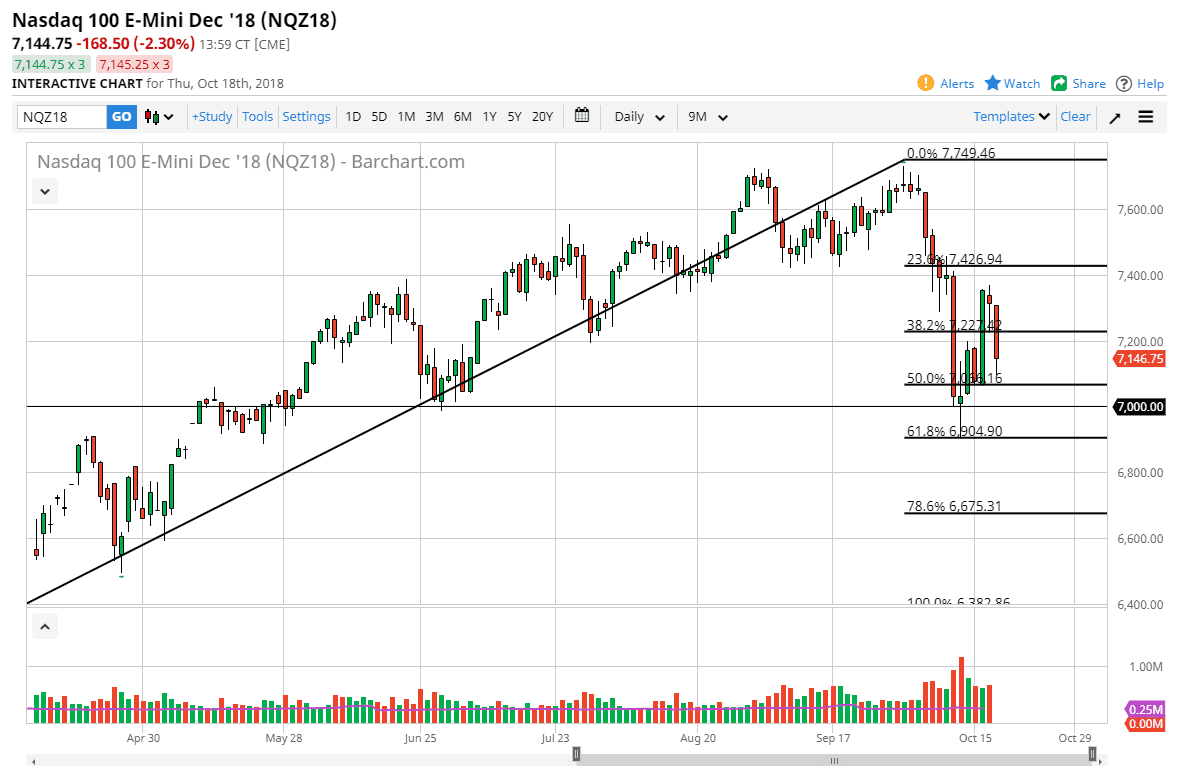

NASDAQ 100

The NASDAQ 100 got hammered during the session, reaching down to the 50% Fibonacci retracement level again. There is a lot of support underneath near the 7000 handle, so I think at this point it’s likely that we could see some buying, but if we break down below the 6900 level, that would be a break above the 61.8% Fibonacci level, and that could start more selling, perhaps pushing down towards the 6500 level. One thing is for sure, these markets are getting more volatile, not less. This is going to be a very difficult trading environment and you would be forgiven quite easily for standing on the sidelines and not being bothered. After all, don’t forget that sometimes not having a position is the best position to have. All things being equal though, I am more bullish than bearish above the 7000 handle.