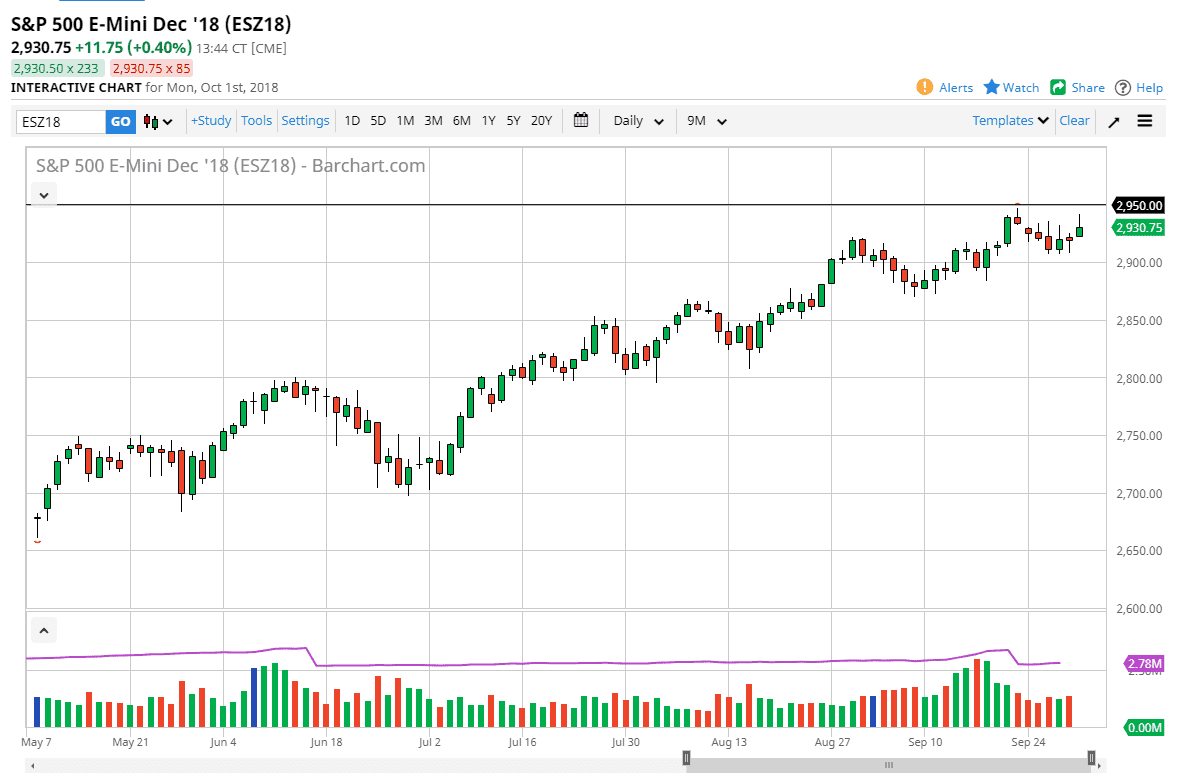

S&P 500

The S&P 500 rallied during the day on Monday on news that the United States and Canada reached a trade agreement. This was a very strong sign for markets, and of course it was one of the things that some traders had been worried about. However, towards the end of the day we have pulled back a bit and it’s likely that perhaps the 2950 level is going to continue to be of interest as the market had recently made a hi there, and of course formed a shooting star of the daily chart. However, we also have formed significantly supportive action at the 2900 level and have been in and uptrend for some time. I think at this point, it’s likely that you need to buy short-term pullbacks and prepare for a breakout above the 2950 level. Once we get above there, then I think we go looking towards the 3000 level.

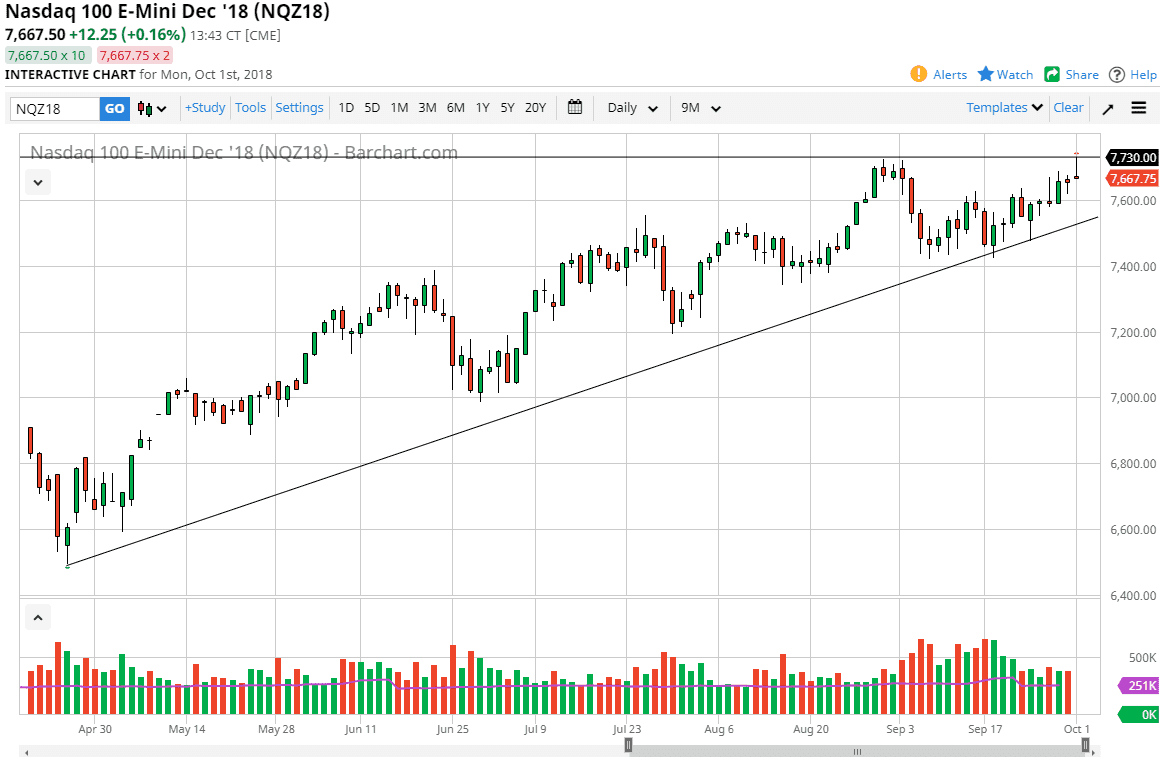

NASDAQ 100

The NASDAQ 100 also try to rally but struggled at the highs and turned around to form a shooting star. The shooting star is of course one of the was negative candle sticks we conform and the fact that we are at an all-time high suggests that we need to pull back a bit. The uptrend line underneath should continue to be important as well though, so I think that the buyers will return rather quickly. I think a short-term pullback makes a lot of sense, as we try to build up the necessary momentum to go higher. Remember, even if the US/Canada situation has been settled, the reality is that we still have to worry about the trade war and a multitude of other things such as interest rates rising over time. Because of this, it makes sense that we will go straight up.