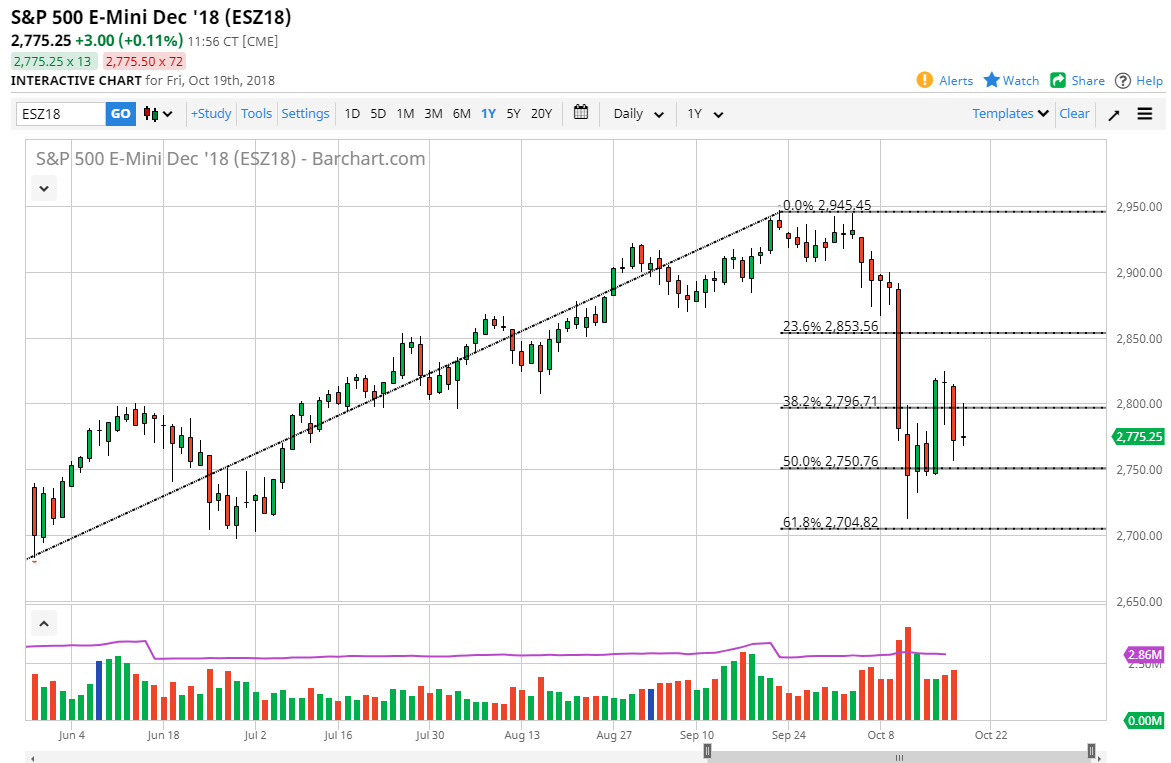

S&P 500

The S&P 500 initially tried to rally during the day on Friday, but by the time the afternoon rolled around we gave back much of the gains. That’s probably due to fear and going into the weekend but I do see a lot of support underneath. I think we will probably grind sideways overall, offering an opportunity for the market to catch his breath after this massive selloff. Overall, I think that the buyers will probably return, but if we break down below the 2700 level this market could unwind rather drastically. I also believe that the market is very bullish above the 2800 level, so be patient and wait for the market to tell you where it wants to go next. Expect volatility, but after this type of selloff a lot of times it’s the best time to buy the market as most people are far too bearish and will have to cover.

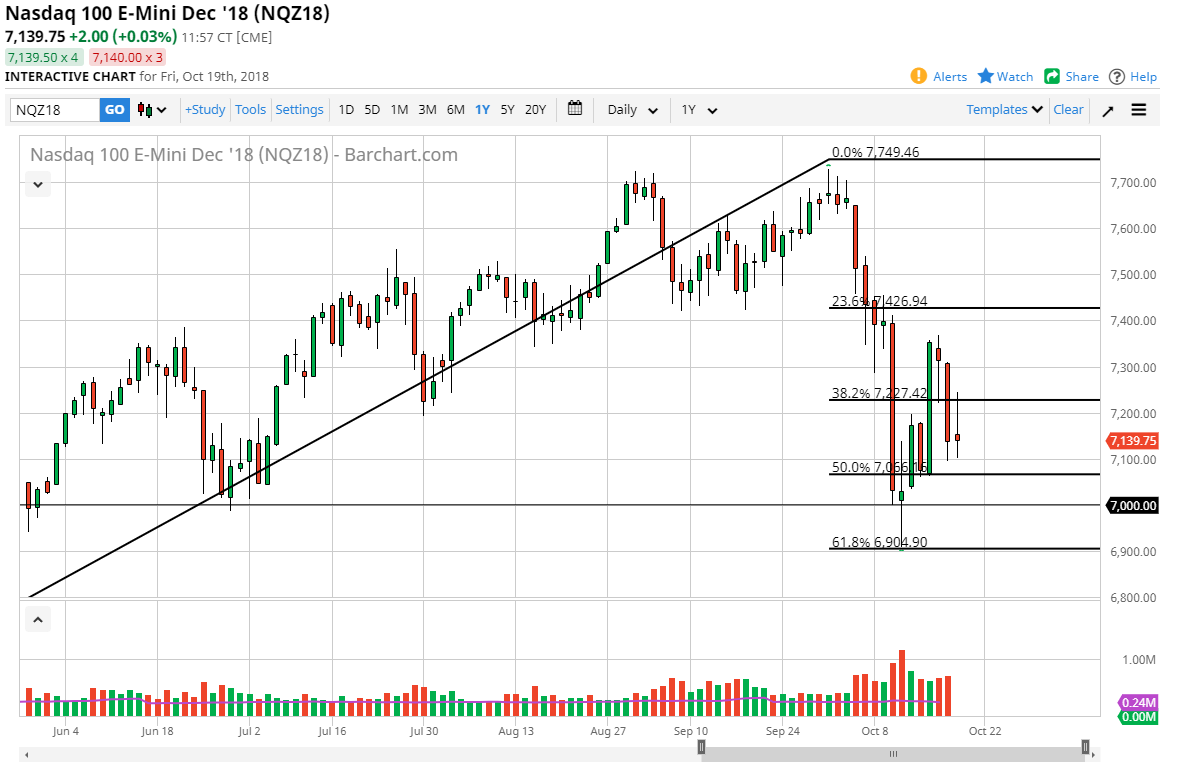

NASDAQ 100

The NASDAQ 100 initially trying to rally during the trading session on Friday but gave back a lot of the gains to basically show a lack of momentum later in the day. If we can break above the top of the candle for the trading session on Friday, then we probably go looking towards the 7400 level. The 7000 level underneath looks to be very supportive, just as the 6900 level will be as it is the 61.8% Fibonacci retracement level. This is a very technically damaged chart, but it’s not until we break down below the 61.8% level that I would be truly concerned about the longer-term uptrend. Overall, I think there are value hunters waiting to get involved but there’s so much in the way of macroeconomic issues right now it’s going to be difficult to hang on.