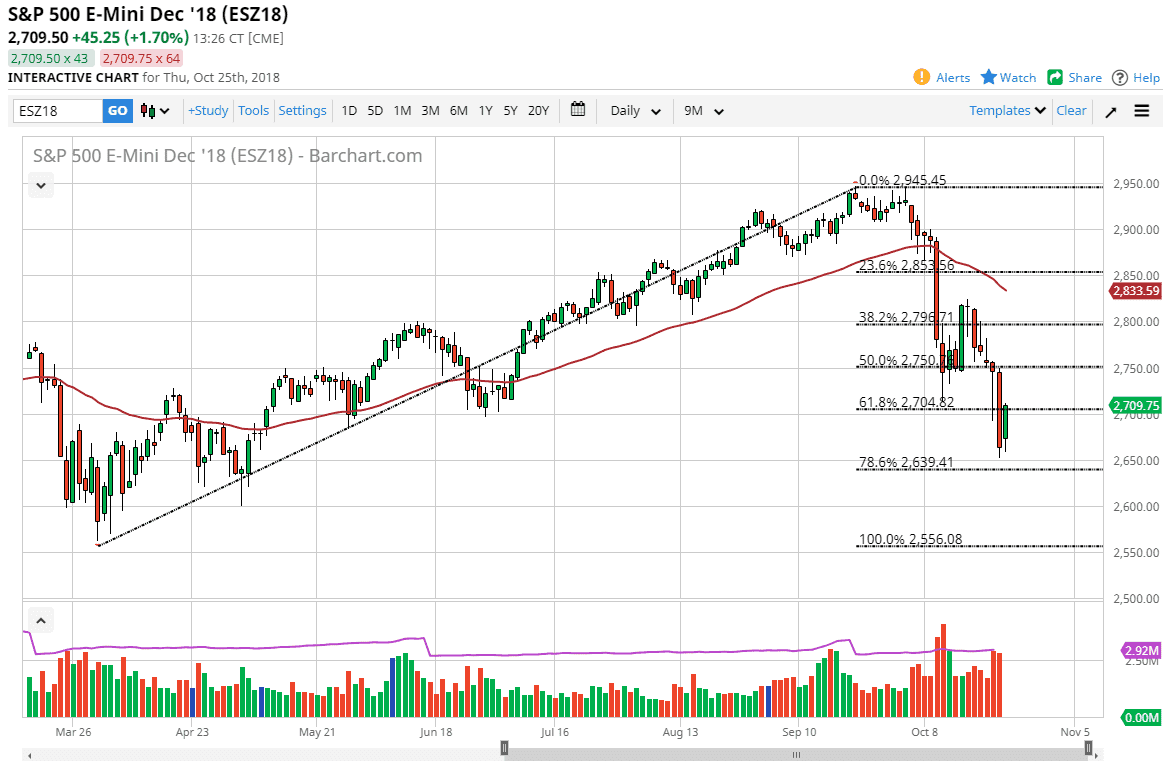

S&P 500

The S&P 500 gapped higher at the open on Thursday, and then reached towards the 2700 level. At this point, if we can break above the top of this candle we could continue to go towards the 2750 level, but I think there’s been a lot of structural damage, so I would be very leery about jumping into the marketplace at this point. Even though this has been a very good day, you can see just how far we fell. I anticipate that we will be looking at an opportunity to sell at higher levels. In fact, I’m not comfortable buying the S&P 500 until we break above the 2800 level, which would take something special happening to do. It looks as if the overall risk appetite is failing right now, and even though we had a good day, we have a long way to go before recovering.

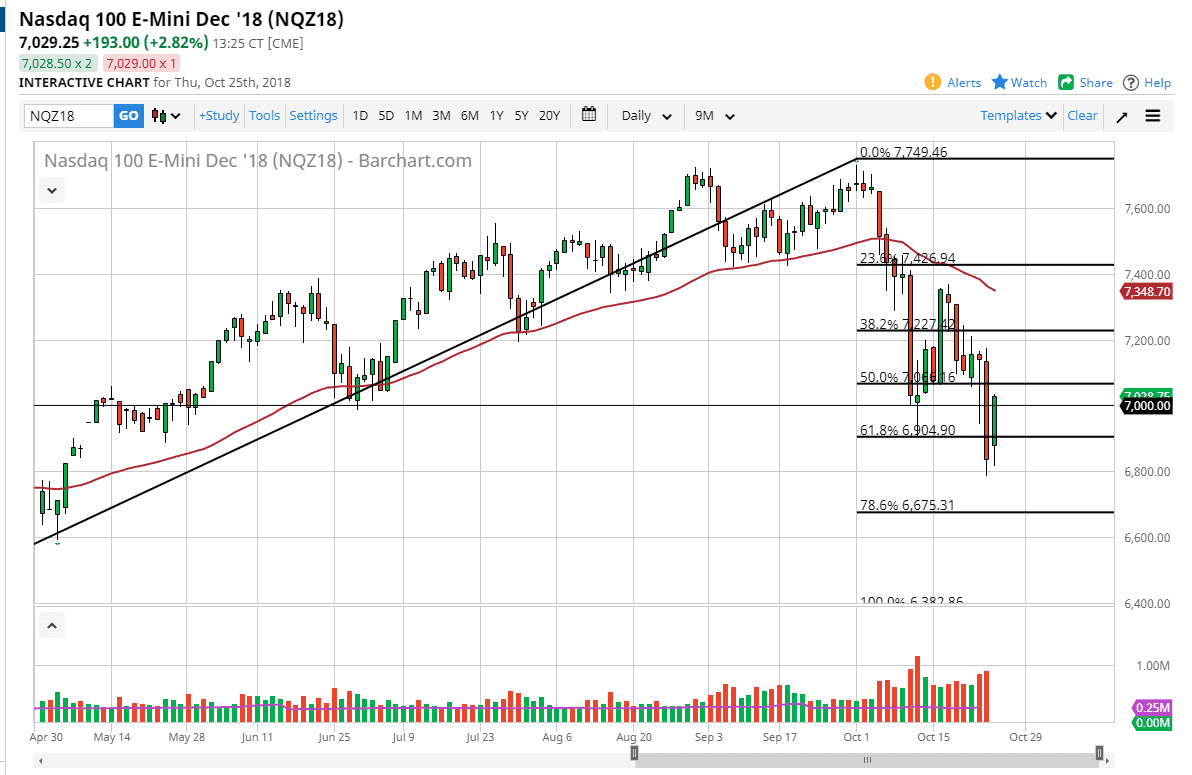

NASDAQ 100

The NASDAQ 100 of course looks very much the same, as it had been extraordinarily negative. What I find interesting is that even though this market is rallying quite nicely, currency markets are favoring safety currency such as the Japanese yen. This continues even though we have rallied through the session. It is because of this that I am very leery about buying, and suspect that a short-term chart might give you an opportunity to start selling closer to the top of the candle on Wednesday. Ultimately, this is a market that I think continues to see more volatility, but quite frankly we needed to bounce after that major breakdown as markets can’t go in one direction forever. I’m very cautious about taking on risk, especially in the stock markets are now.