S&P 500

The S&P 500 got hammered during the trading session again on Friday but bounced nicely from the 2650 handle. We did end up forming a hammer, so that’s a positive sign, but quite frankly the market has seen so much technical damage that I think there is still further downside. The shooting star for the previous candle of course is a sign that there are a lot of sellers above, so I think we will probably bounce, but only find sellers above. The 2750 level above should be massive resistance, and at this point I think that a relief rally is desperately needed, but more than likely we will eventually try to wipe out the entirety of the move higher as breaking below the 61.8% Fibonacci retracement level normally means just that. Stock markets are hurting, and even though we got a little bit of a bounce towards the end of the day on Friday, it’s very possible that it was short covering heading into the weekend.

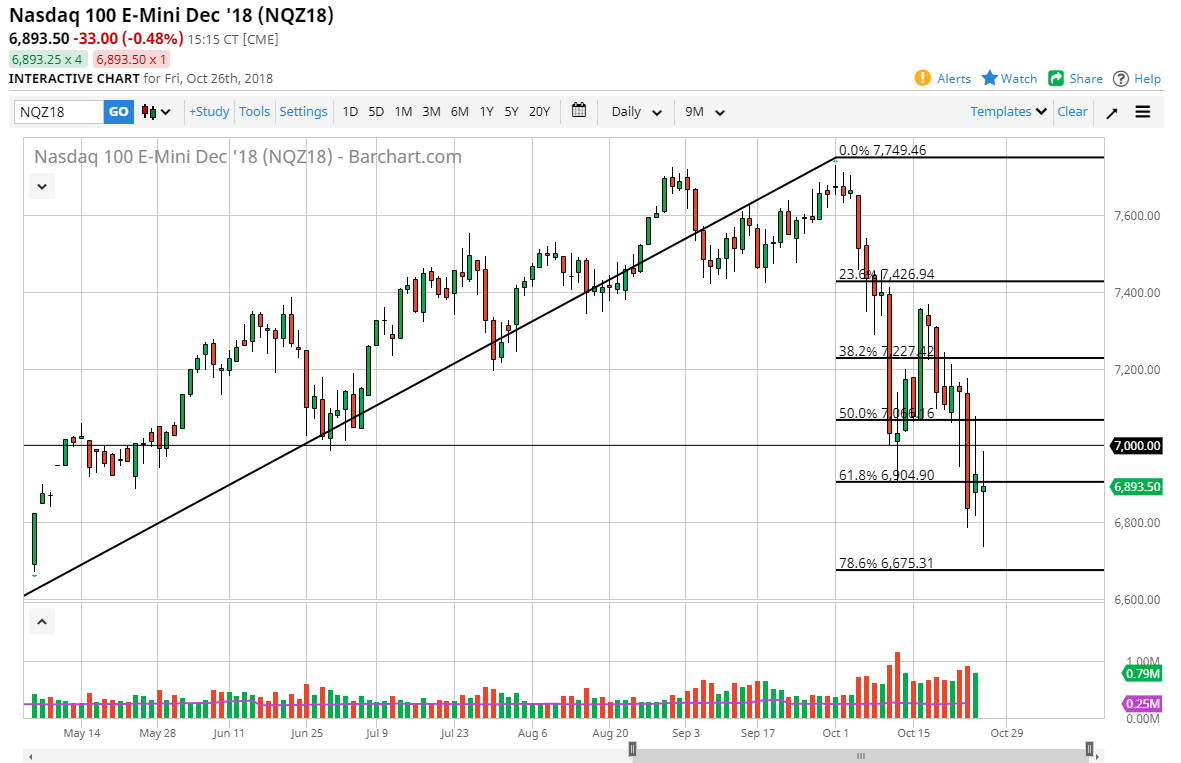

NASDAQ 100

The NASDAQ 100 went back and forth during the trading session, showing signs of weakness again. However, the 6800 level offered enough support to turn the market around, but there is a significant amount of resistance at the 7000 handle, where we could not break above during the day. If we can clear that area, then we have even more resistance above. Overall, I still feel that this market continues to face a lot of headwinds, in the form of currency headwinds, political headwinds, and of course just technical damage. Ultimately, this market is probably a bit oversold, but overall this should only offer a nice selling opportunity after we get that relief rally.