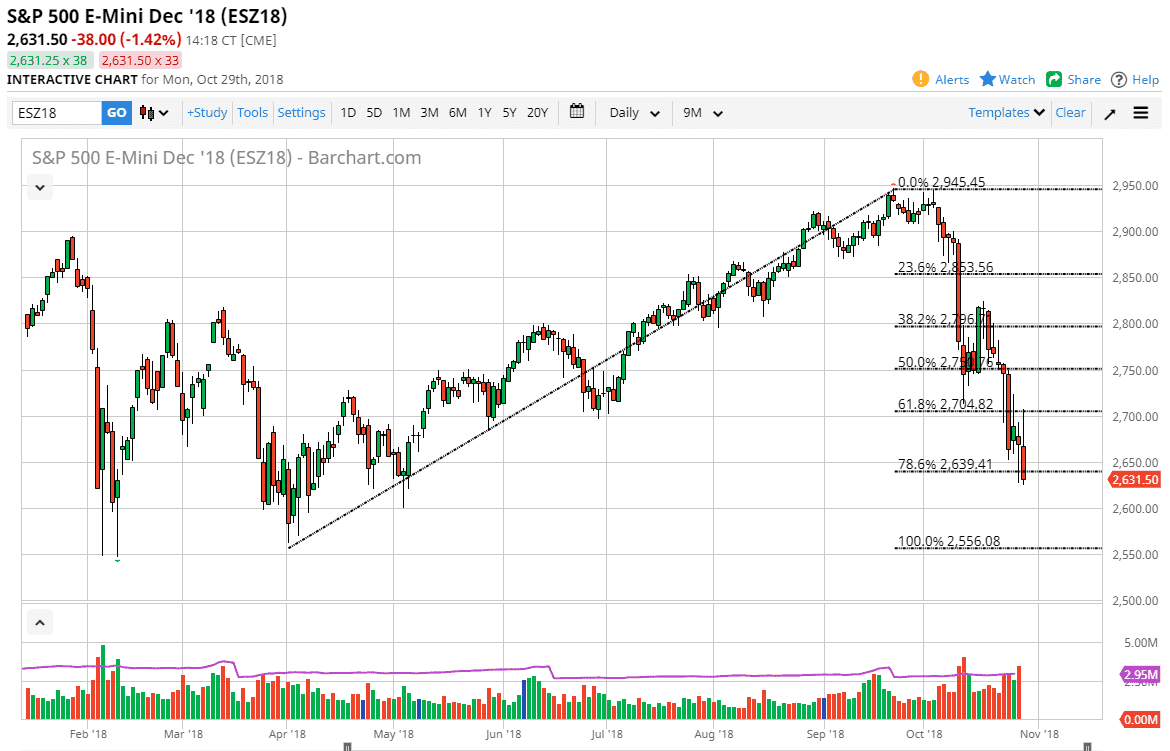

S&P 500

The S&P 500 initially tried to rally during the day on Monday to turn things around and show signs of strength in a market that has been sold off rather drastically. Ultimately, the 2700 level has been resistance in the past, as well as support, so it makes sense that there is a lot of action in that area. This is a market that some people would think that it could be oversold, but this is a falling knife. Because of this, I think you should continue to think about selling rallies on signs of exhaustion, as the market simply cannot get out of its own way. I anticipate that we will wipe out the entire move, perhaps reaching down to the 100% Fibonacci retracement level, down at the 2550 handle. At this point, I have no interest in buying, at least not until we get several days of stability.

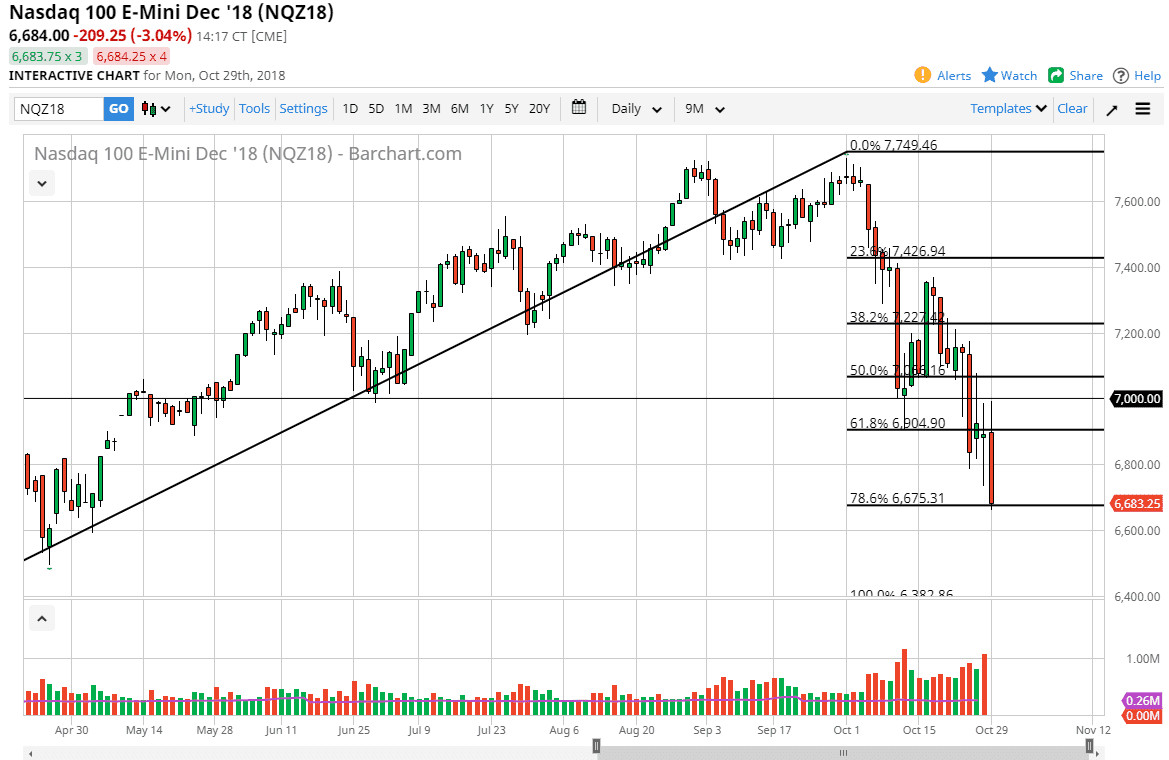

NASDAQ 100

NASDAQ 100 traders initially tried to rally during the trading session on Monday, reaching towards the $7000 level. At this point, it’s likely that we are going to continue to see sellers on short-term rallies that show signs of exhaustion, and that of course should continue to feed bearish pressure into this market place. I think we are going to wipe out the entire move, going back to the 100% Fibonacci retracement level over here as well, meaning that we will more than likely reach towards the 6400 level given enough time. With that in mind, I look at any rally of significance as a shorting opportunity, it would not be interested in this market until we get several stable days in a row, something that seems a bit difficult at this point. It’s very likely that the Asians are going to wake up and go crazy in this market as well.