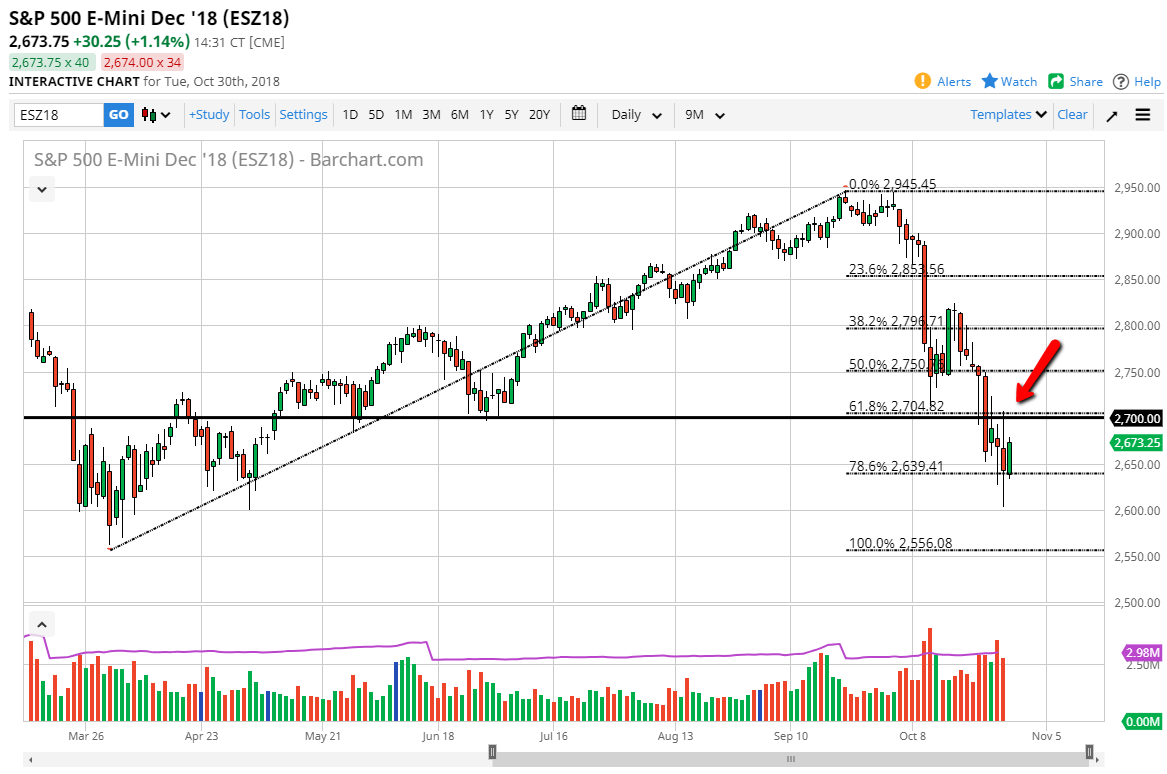

S&P 500

The S&P 500 by all metrics had a decent day during the trading session on Tuesday, which it needed to have. However, the 2700 level above has been resistive, and I would also point out that we have not been able to break above there. What I suspect we are going to see next is some attempt to get up there, but then sellers will probably return at that point. I anticipate that the overall attitude of market participants will continue to be skittish, and that it will take very little to spook the market again. If we get a daily close that break significantly above the 2700 level, then I might begin to think about having a bottom in place. Right now though, I think this is more of a “dead cat bounce.”

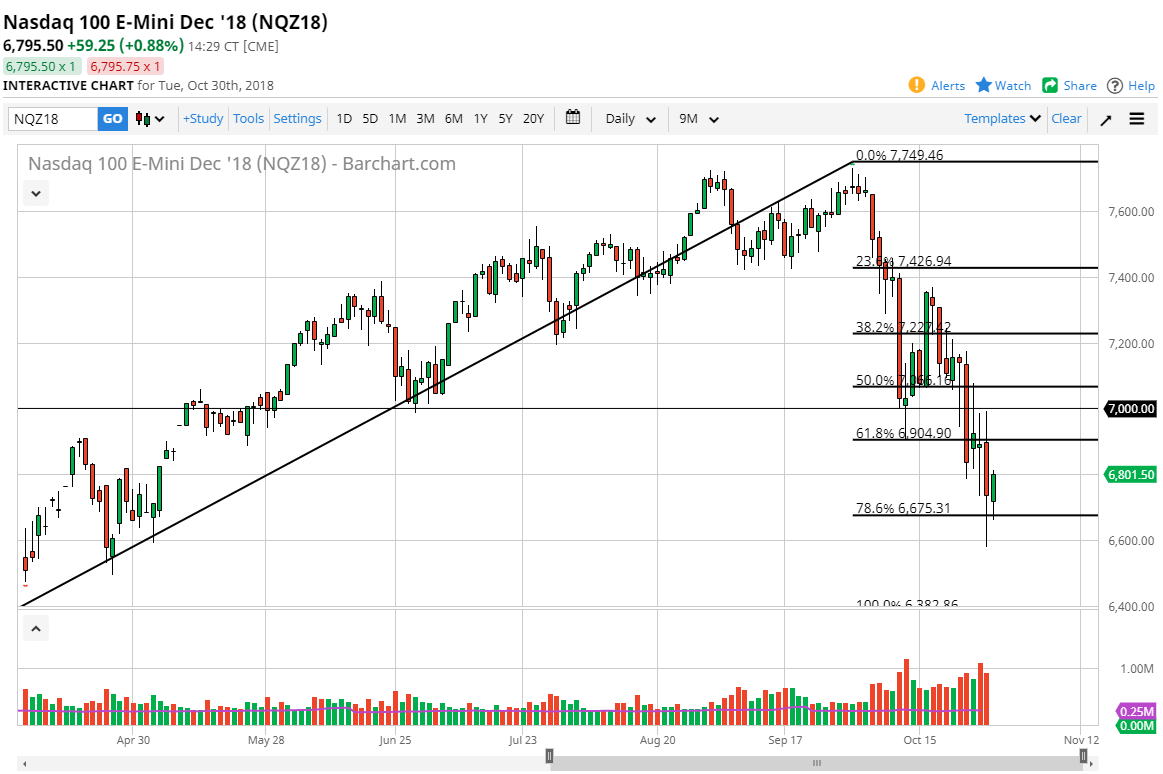

NASDAQ 100

The NASDAQ 100 also bounced a bit during the trading session, reaching towards the 6800 level. However, I think in this market the 7000 level is the most crucial level to pay attention to, so therefore I would be very cautious about jumping in at this point. I anticipate that we will see more sellers at the 7000 handle, and that we could see exhaustion there. He could end up being a nice selling opportunity. However, if we can break above that level significantly and on a daily close, then we could start to see the market home to grips with the idea of having put in a bottom. There are far too many headlines out there moving around that could continue to weigh upon this market though, so I don’t think we’re quite there. When you look at the chart you can see just how brutal the selloff has been, so a day that sees a 1% gain isn’t that big of a surprise.