S&P 500

The S&P 500 has rallied a bit during the trading session on Wednesday, reaching towards the highs again. It looks like it is going to be difficult to break above the 2950 level and considering that tomorrow is going to be Nonfarm Payroll Friday, I wouldn’t expect it to. I think in the short term we are probably going to go sideways more than anything else as traders won’t want to be exposed to too much risk. However, the ADP jobs number came out during the Wednesday session quite strong, so we may also get people trying to front run the move. If that’s the case, we could find ourselves well above the 2950 handle, and that opens the door to the 3000 level longer term, which I do in fact believe happens eventually. Pullbacks continue to be buying opportunities.

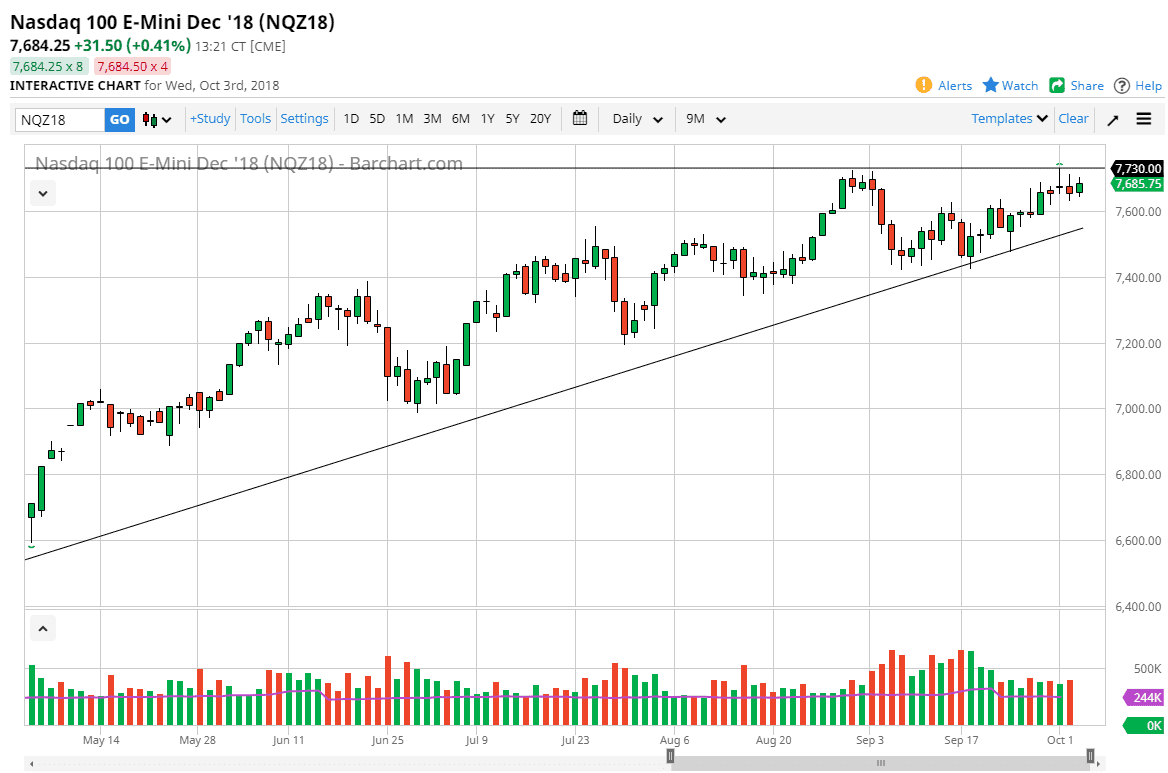

NASDAQ 100

The NASDAQ 100 has a bullish move for the trading session on Wednesday, showing that we continue to reach towards the highs again. I think that the market will probably break above there eventually, continuing the overall uptrend. I think with the jobs number coming out on Friday though, it’s probably going to be very quick when it finally does happen, and I think that it is only a matter time before we get that bullish pressure. However, it may take a couple of days. Once we do break that level I believe that the 7800 level will be the next target, and I believe that we will go even further than that given enough time. I have no interest in shorting this market, at least as long as we are above the uptrend line. The pullback should represent value.