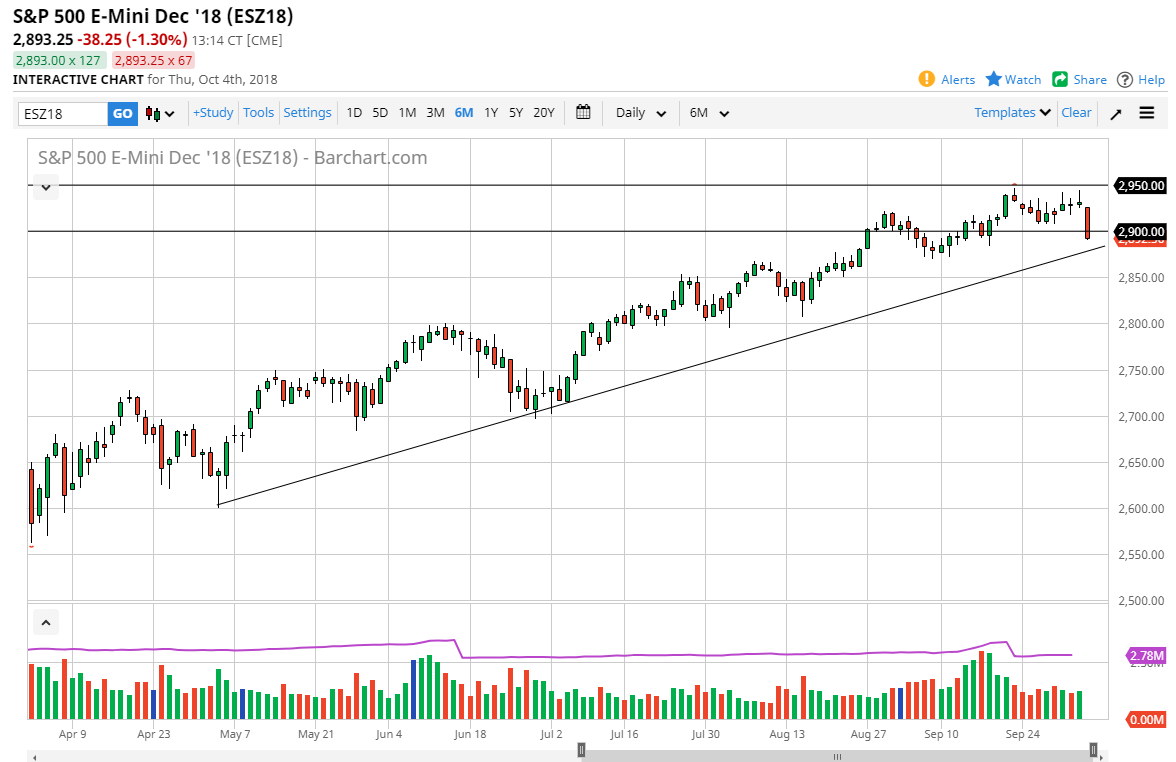

S&P 500

The S&P 500 broke down rather significantly during the trading session, breaking below the 2900 level which of course is a major turn of events. However, I see a significant uptrend line that should keep this market afloat. If we can break down below the uptrend line, then it becomes a signal that we need to start selling. The jobs number coming out today of course will have a major influence on what happens next, but I think there are plenty of buyers underneath and if the jobs number is even remotely strong, I believe that the buyers will push higher. This is a very negative looking candle though, so I think that it won’t be until after 8:30 AM Eastern Standard Time that we will see buyers jump in. Overall, I think that the 2950 level will be targeted eventually, and if we get a good jobs number that could be a buying opportunity.

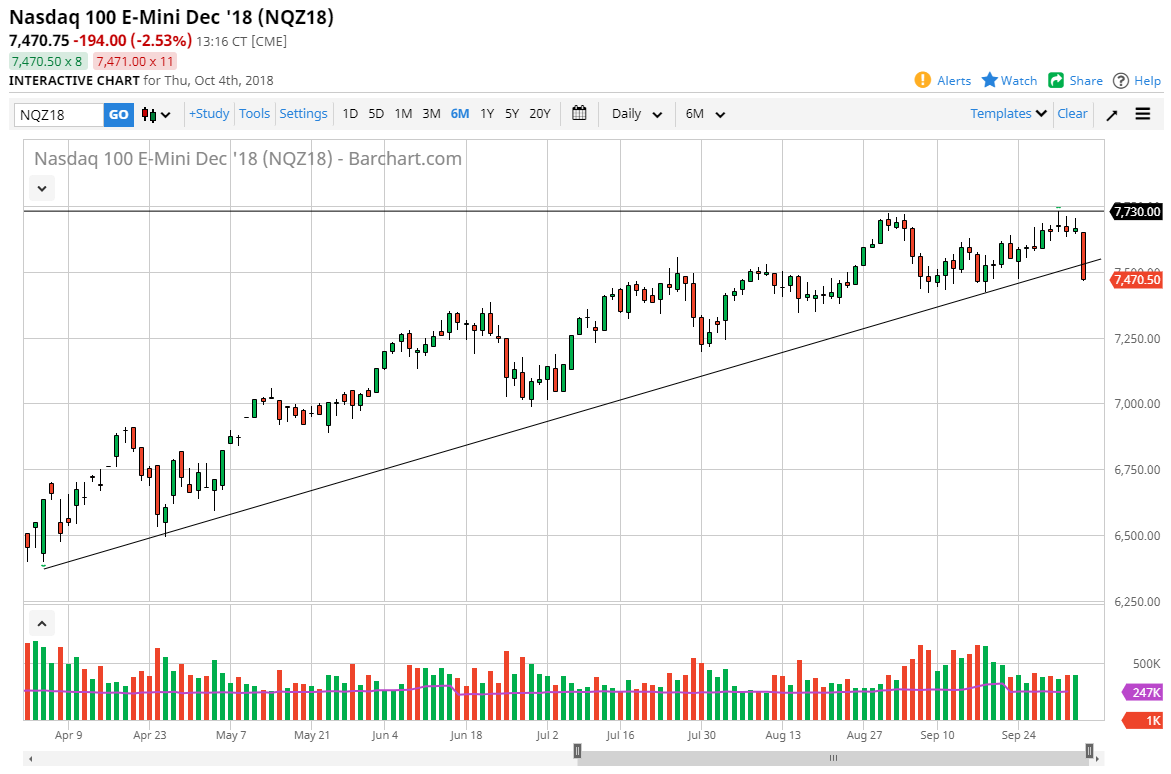

NASDAQ 100

The NASDAQ 100 has broken down significantly during the trading session on Thursday, slicing through the significant uptrend line. If we break down below there, then I think the market could go much lower but there is a bit of a “zone” extending down about 25 points or so. Overall, it looks as if the market is trying to support itself towards the end of the day though, and I think of course a lot of this might be position squaring ahead of the jobs number. If we break down below the 7425 handle, the market could continue to go much lower and reach towards the 7250 handle. A break down below there unwind this market much lower and could begin a significant move. Alternately, if we make a move above the 7730 level, then the market could go towards the 8000 level over the longer-term.