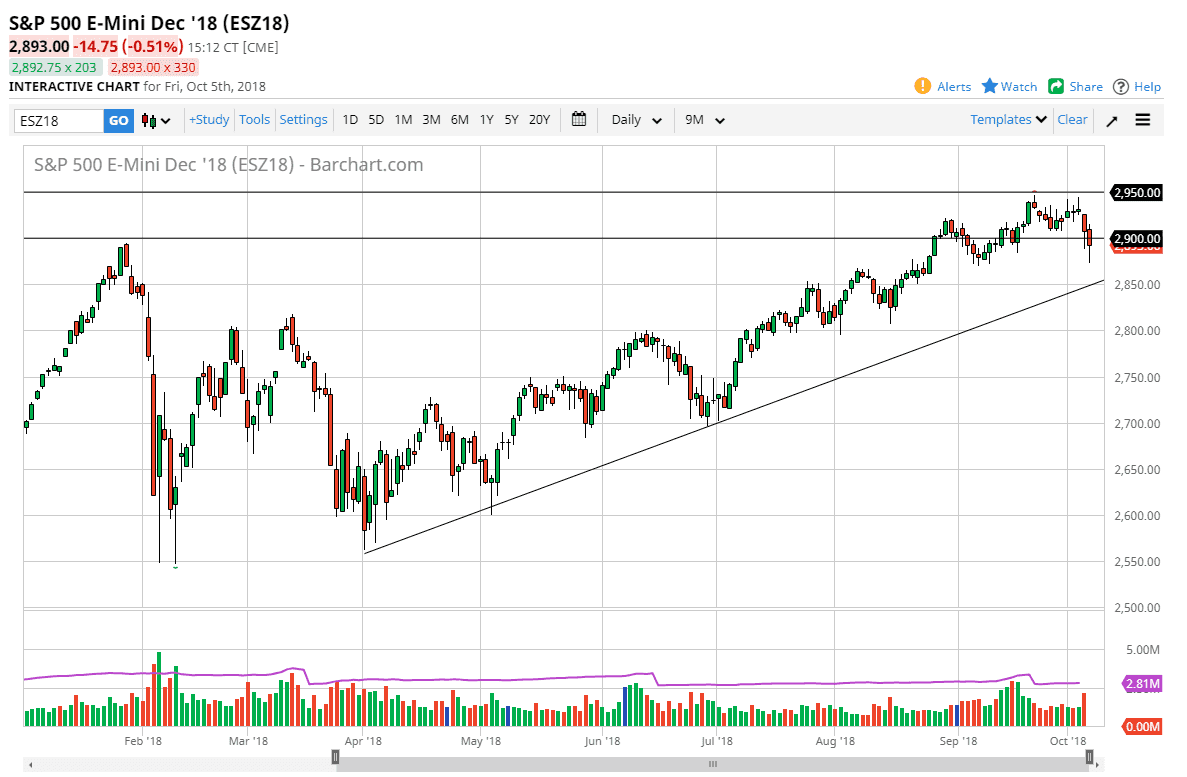

S&P 500

The S&P 500 broke down during the session on Friday, after the jobs number came out a little bit less than anticipated, but with major revisions from previous months. Because of this, I think that a lot of traders may have gotten freaked out about the possibility of higher interest rates, but quite frankly this should not be a surprise and as you can see, by the end of the day buyers came back and started picking up the futures contract again. Beyond that, we have a three day holiday as far as banks are concerned, so perhaps nobody wanted to go home short. We have an uptrend line underneath, and until we break down below there I’m not worried about the uptrend, and I’m a buyer of short-term pullbacks. This candle looks a lot like one that precedes another negative candle with laid a buying, and an opportunity to pick up the S&P 500 “on the cheap.” I will be looking for pullbacks to take advantage of.

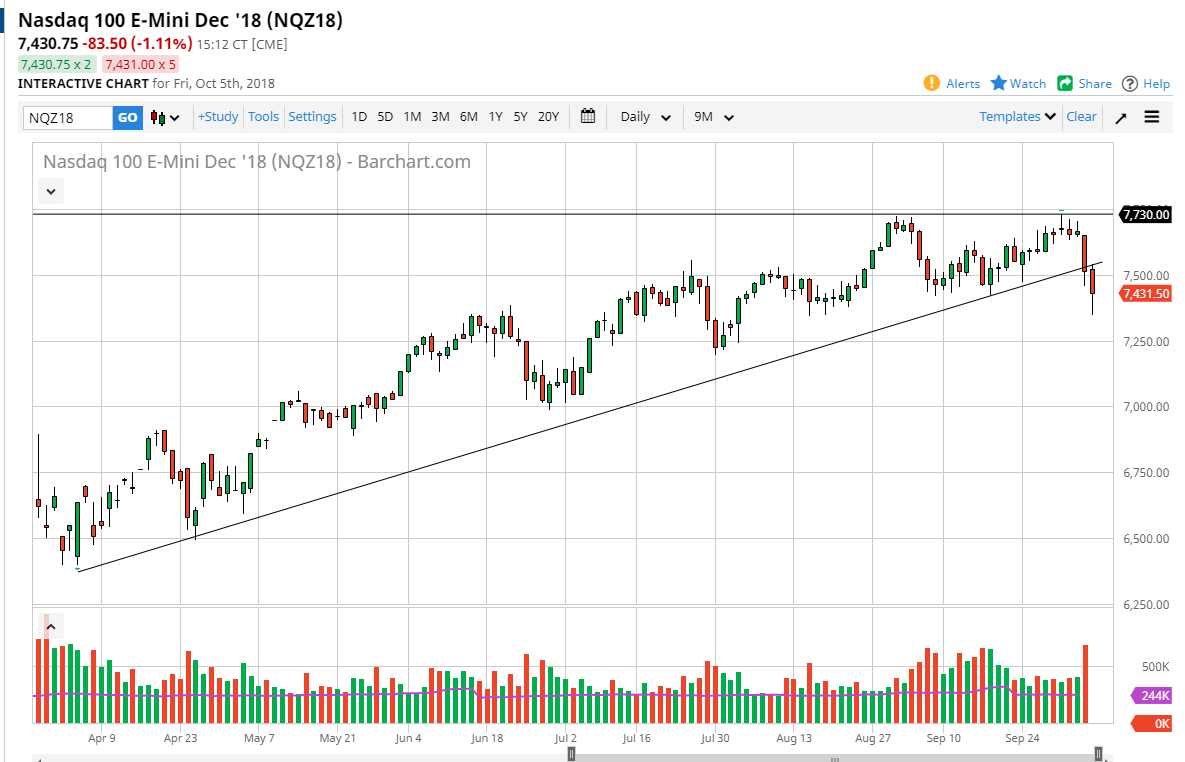

NASDAQ 100

The NASDAQ 100 has been a different story as we have broken through the downtrend line, which makes sense considering so many technology companies are hurt by the US/China trade relations spat. Ultimately, I think that there is support underneath, but I think there’s probably more damage to be done. I look for a little bit more soft trading, but I think the 7250 level will probably be rather supportive. Because of this, I think it is probably easier to simply wait on the sidelines as far as the NASDAQ 100 is concerned. I also believe that it’s probably a better trade to be buying the S&P 500 or the Dow Jones Industrial Average.