S&P 500

The S&P 500 fell initially during the day on Wednesday, but just as we have seen several days in a row, the buyers come in and pick up the market from the bottom of the range. As I record this, we are starting to see a potential hammer forming again, and if that hammer continues to form itself, I think a break above the 2900 level signifies an excellent buying opportunity because we have a nice uptrend line underneath, and of course what could in theory be for hammers in a row. If that’s the case, and obvious support has shown itself at the 2875 level. Once we break above the 2900 level, it should open the market to a move towards the 2950 handle. Alternately, if we break down below the uptrend line that is just below, I think at that point it’s likely that we break down rather significantly, perhaps down to the 2800 level.

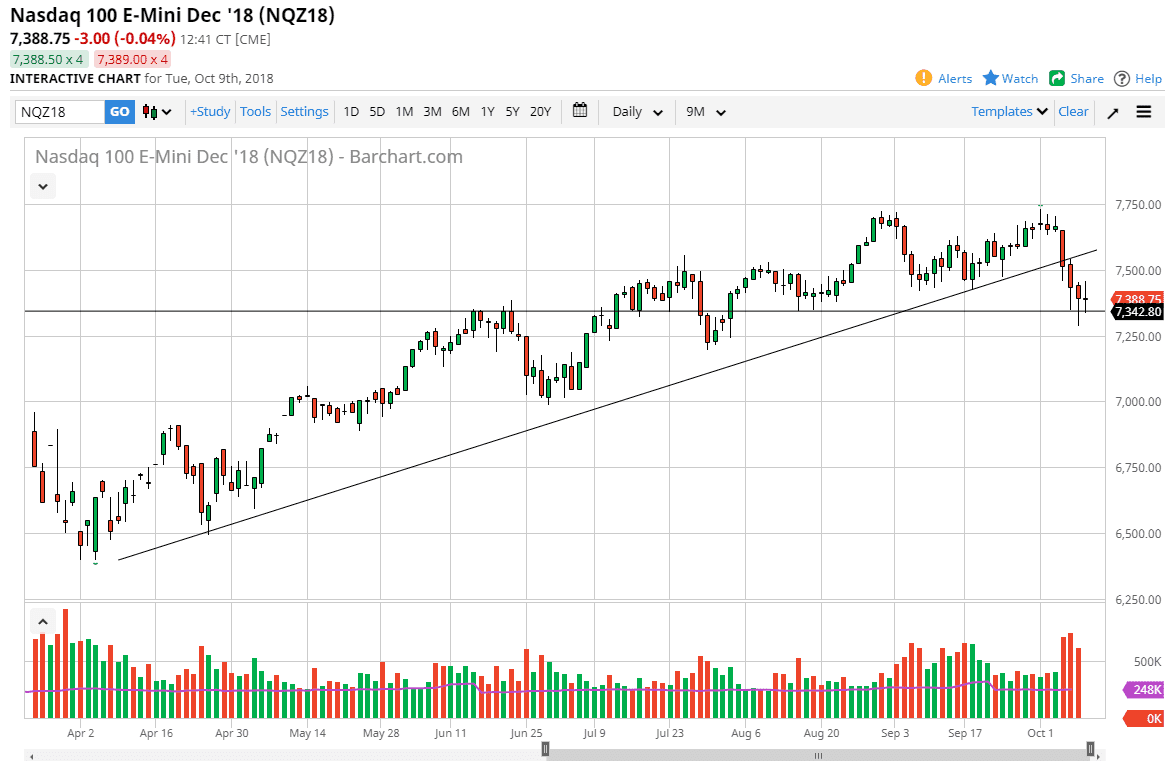

NASDAQ 100

The NASDAQ 100 went back and forth during the day, essentially showing that there is support at the 7350 range, and I think that the buyers are starting to try to pick up the NASDAQ 100 “on the cheap.” If we can break above the top of the candle stick for the session on Tuesday, then I think that the market would probably reach towards the 7500 level, and then perhaps the previous uptrend line that had been broken. If we break above that, then the market should continue to go even higher. Alternately, if we break down below the hammer for the session on Monday, and perhaps even the 7250 level, that would be a serious break down in the bullish pressure, perhaps sending the market down to the 7000 handle.