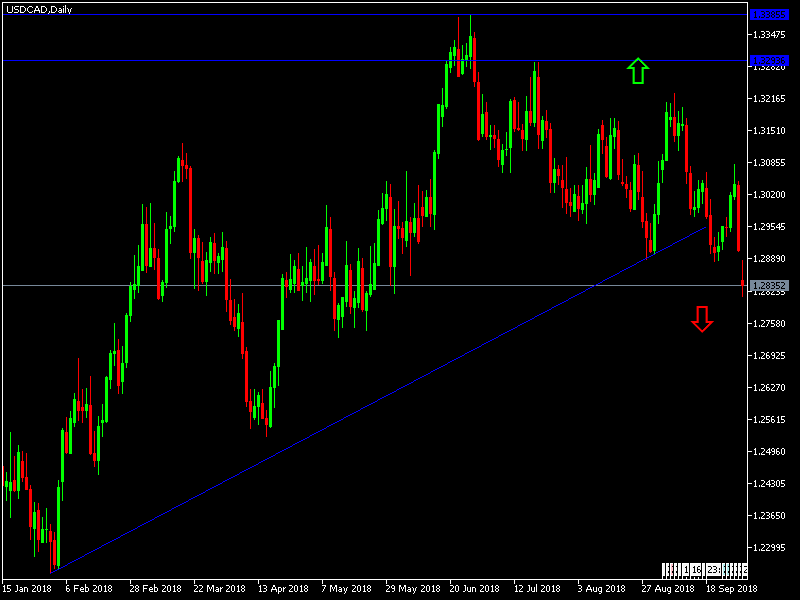

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades must be taken before 5pm London time today.

Short Trade

- Short entry after the next strongly bearish price action rejection following the next touch of 1.2900 or 1.2990.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trades

- Long entry after the next strongly bullish price action rejection following the next touch of 1.2770.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/CAD Analysis

The pair broke down for a second straight day testing the 1.2813 support at the beginning of this week, the lowest for the pair in five months, with the crude oil price reaching a record high and as a NAFTA agreement is almost finalized. In the previous analysis, we mentioned that the move below the psychological support level of 1.30 will increase the selling actions and we will see stronger bearish levels, and below the 1.28 area we will have a medium and long term good selling oreas. The US dollar is still supported by a strong US economy and tight monetary policy that have opportunities for further rate hikes.

There is nothing important due today concerning the CAD. Regarding the USD, there will be the release of the ISM industrial index and spending on construction.