Yesterday’s signals were not triggered, as none of the key levels were reached within the specified time.

Today’s USD/CHF Signals

Risk 0.75%.

Trades may only be taken between 8am and 5pm London time today.

Short Trades

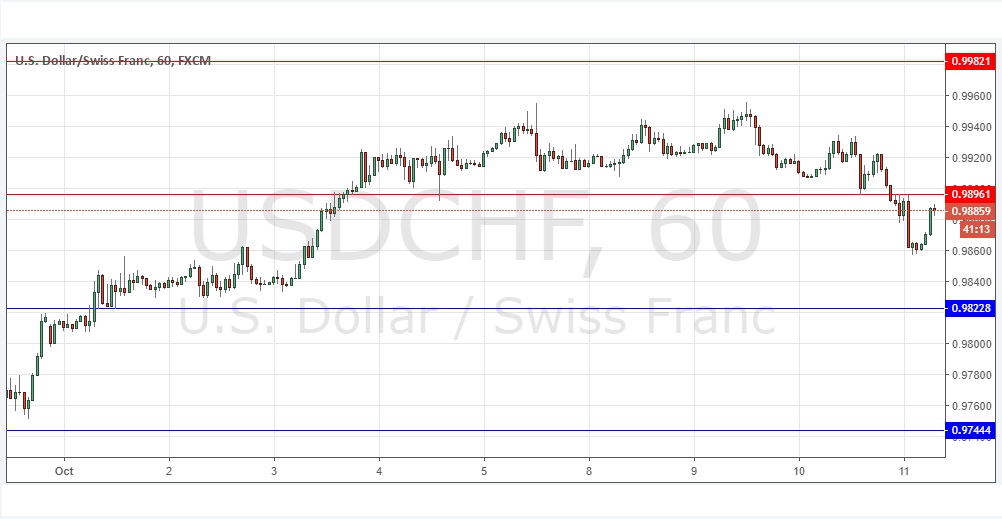

Go short following a bearish price action reversal upon the next touch of 0.9896.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade

Go long following a bullish price action reversal upon the next touch of 0.9823.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/CHF Analysis

I wrote yesterday that the best that could be said was that we are in a consolidation above 0.9900, but I had no useful directional bias. It is always difficult to forecast short-term price movements in this pair.

I was wrong, the price stopped consolidating above 0.9900 and broke below that level, although in recent hours it has come back to approach this price area again from behind. It is likely that the former support level at 0.9896 has flipped to become new resistance, so there may be an opportunity for a short trade there is there is a bearish rejection.

It is interesting that at a time where stock markets have fallen sharply, and the U.S. Dollar has fallen as well, the Swiss Franc (traditionally a safe have) has advanced so little. This suggests that there is not likely to be a great benefit in being long of the Swiss Franc, so it may be best to trade other currency pairs at present where there looks like being more movement and opportunity.

There is nothing important due today concerning the CHF. Regarding the USD, there will be a release of CPI data at 1:30pm London time.