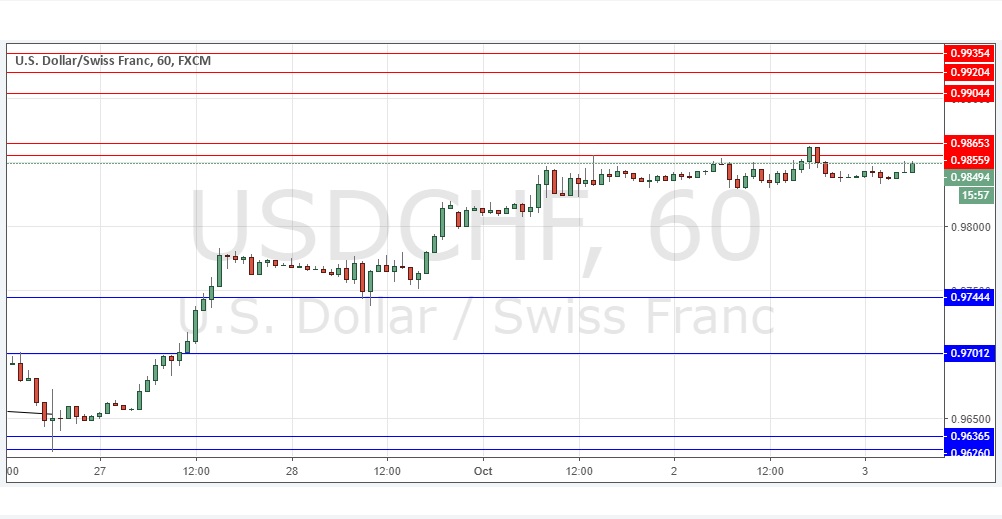

Yesterday’s signals were not triggered, as the resistance level at 0.9856 was not reached until after the end of the London session.

Today’s USD/CHF Signals

Risk 0.75%.

Trades must be entered before 5pm London time today only.

Short Trades

Go short following a bearish price action reversal upon the next touch of 0.9856, 0.9865, 0.9904, or 0.9920.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade

Go long following a bullish price action reversal upon the next touch of 0.9744.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/CHF Analysis

I wrote yesterday that it seemed quite likely that the cluster of resistance levels near above starting at 0.9856 would hold. The longer the price failed to break above 0.9865, the more likely there would be a retracement next down to at least the 0.9800 area. This was a good call and the resistance level at 0.9856 has indeed held, although the price remains broadly strong and shows no sign of falling yet. I have the same analysis today as I did yesterday but note that as there is major U.S. data due later, there could be surprising price movement.

Regarding the USD, there will be a release of the ADP Non-Farm Employment Change data at 1:15pm London time, followed by ISM Non-Manufacturing PMI at 3pm. The Chair of the Federal Reserve will be giving a minor speech at 9pm. There is nothing due today concerning the CHF.