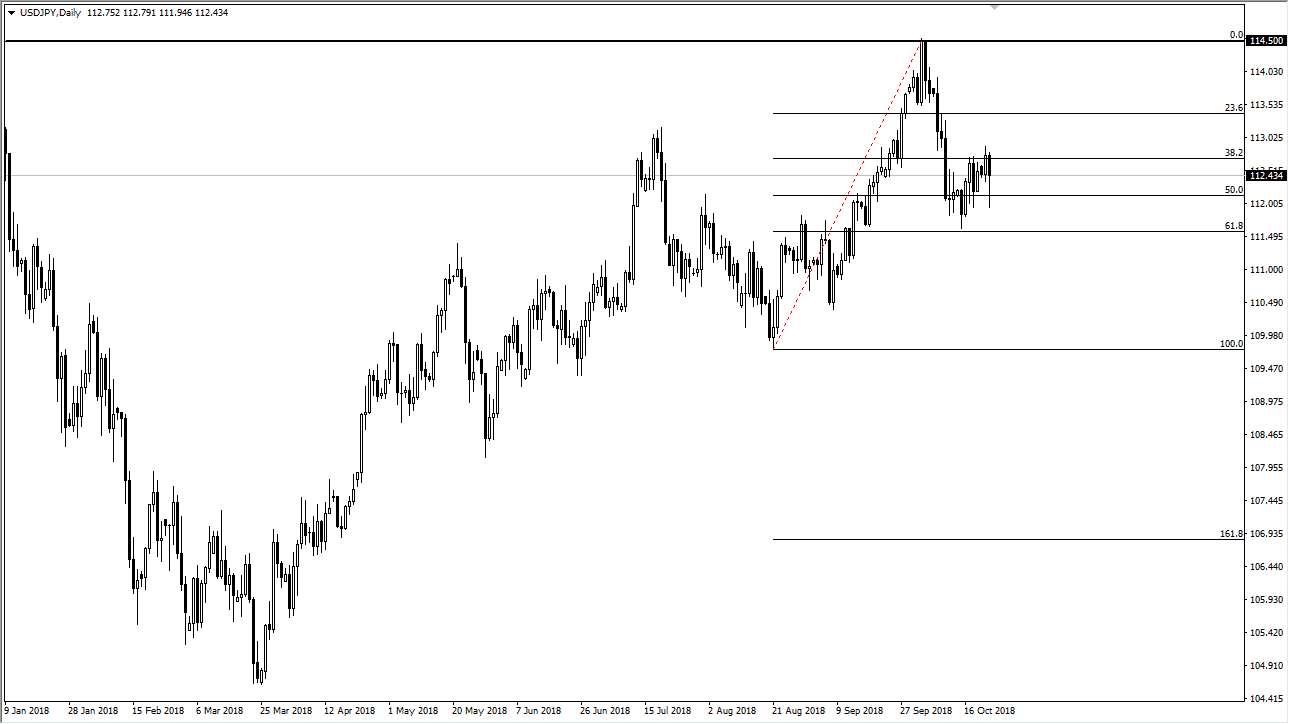

USD/JPY

The US dollar tanked against the Japanese yen initially during trading on Tuesday but you can see that we have seen a lot of buying late in the day to turn around of form a massive hammer. The ¥112 level looks to be offering support, and what initially look like a lot of trouble during the midday session, everything looks completely different at this point, and it’s likely that we could continue to see market participants grind this pair to the upside. The 114.50 level above is massive resistance, and I don’t think that we can break above there in the short term, but it certainly looks as if we may try to go finding that level. The alternate scenario is that we break down below the ¥111.50 level at the 61.8% Fibonacci retracement level underneath, and that would be very negative.

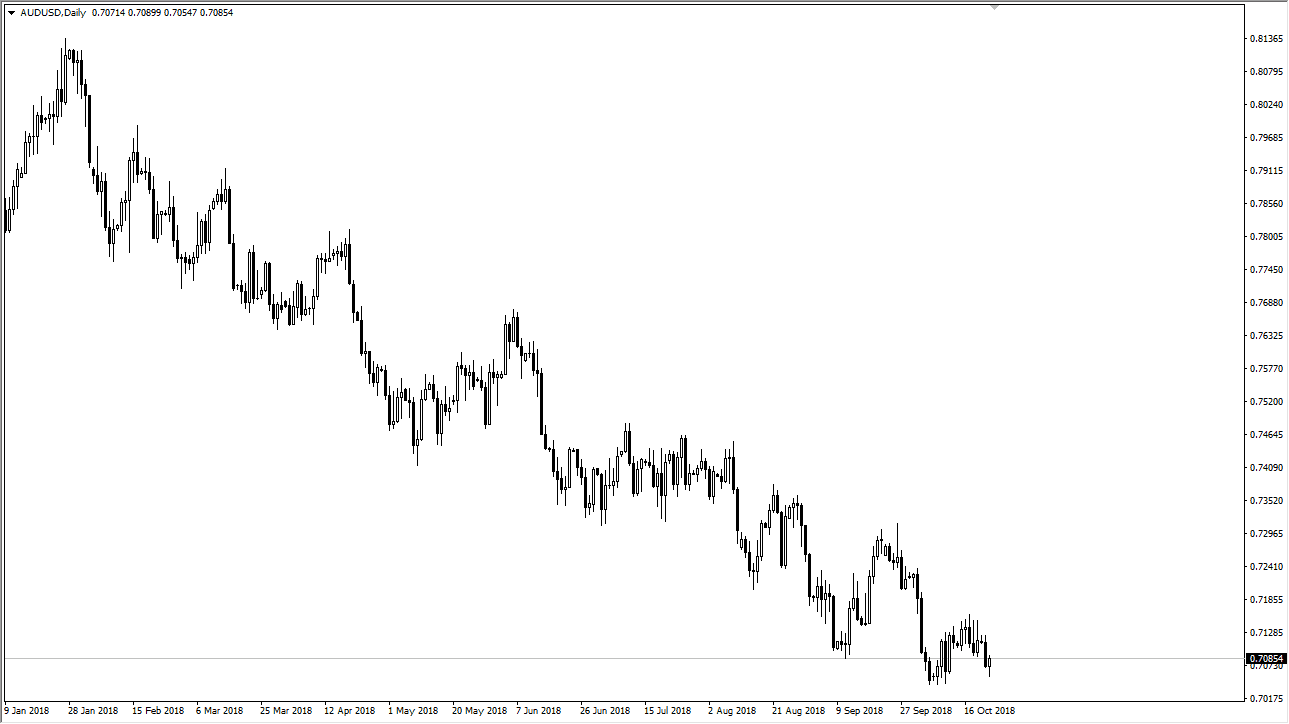

AUD/USD

The Australian dollar initially fell during the day but found support below yet again at the 0.7050 level, and it looks as if the Aussie is trying to pick up a little bit of steam. If that’s the case and it does, then I think that the market will probably go looking towards the 0.7125 level again, as we simply consolidating. However, keep in mind that whatever happens in Asia early in the day will more than likely have a massive influence on what happens with this pair. If we turn around and rally from here, this could technically be thought of as a “higher low”, which would be an extraordinarily good sign for a market that has been absolutely brutalized over the last several weeks. Hopes of a talk between Donald Trump and the Chinese President Xi in Buenos Aires have lifted the Aussie a bit.