NZD/USD

The New Zealand dollar has broken down significantly during the week but also bounced enough on Friday to form a nice-looking hammer. While I am not bullish of the Kiwi dollar, I recognize that perhaps we are due for a bit of a “bounce” from lower lows, so I think at this point you are probably going to see this market rally on any hint of good news globally, but I suspect that there are more than enough sellers above to turn that into a selling opportunity.

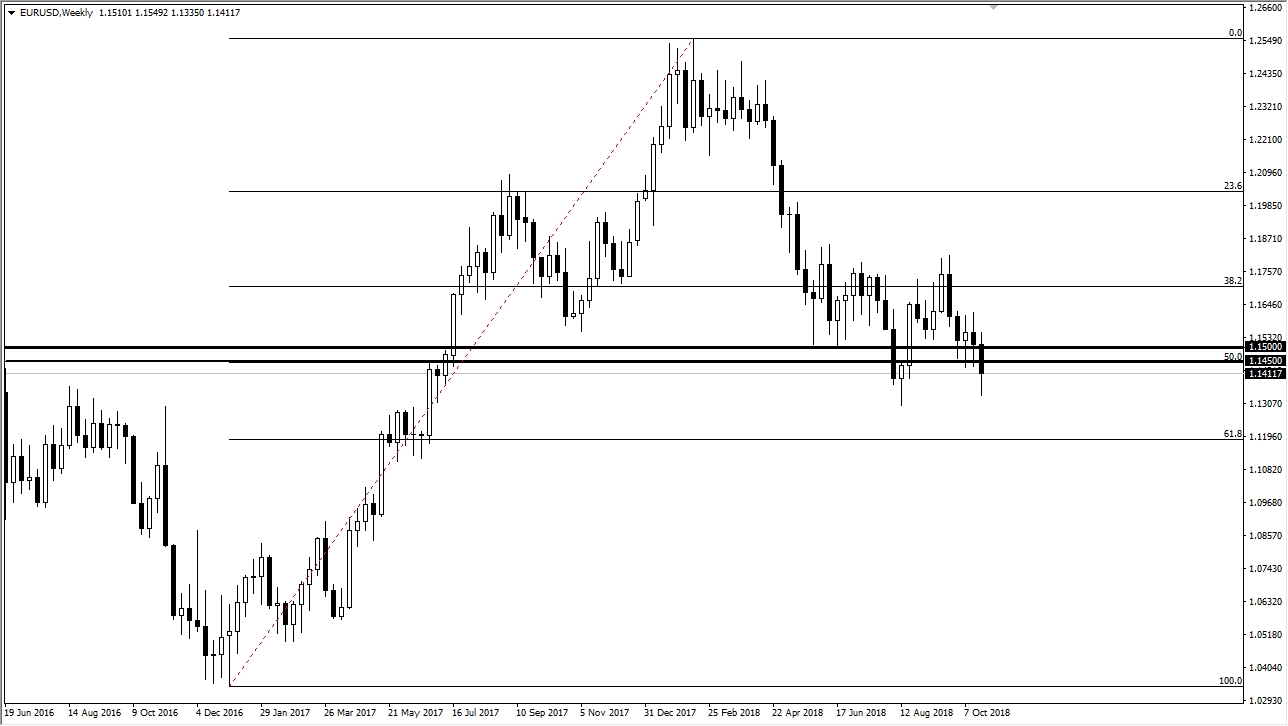

EUR/USD

The Euro initially tried to start out the week with positivity, but then sliced through the 1.1450 level like a hot knife through butter. We did not make a fresh new low though, so there is a little bit of hope. I suspect that what we will see is a short-term bounce, followed by selling somewhere near the 1.15 handle. I would not be bullish of this market until we close above the 1.15 level on the daily chart, and even then I would be a bit cautious.

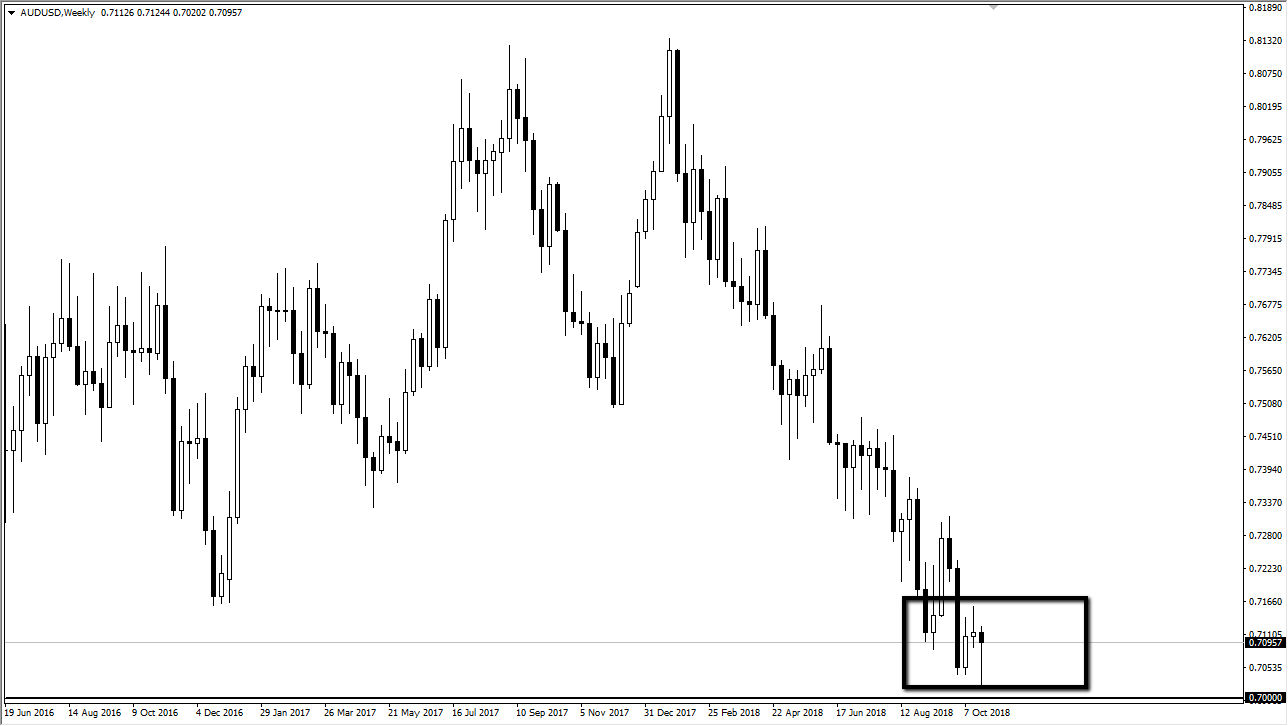

AUD/USD

The Australian dollar recovered quite nicely on Friday, reaching towards the 0.71 handle. At this point though, it makes sense that we would have a bounce in a very oversold market and of course with the 0.70 level looming just below. Ultimately, I think that the market is one that you should be selling and not buying, especially as the Sino-American relations are so poor. The previous candle was a shooting star, so I think we may have a little bit of bullish pressure ahead of us, but it’s only a matter of time before we roll back over. This would change of course if the United States and China start to play nice.

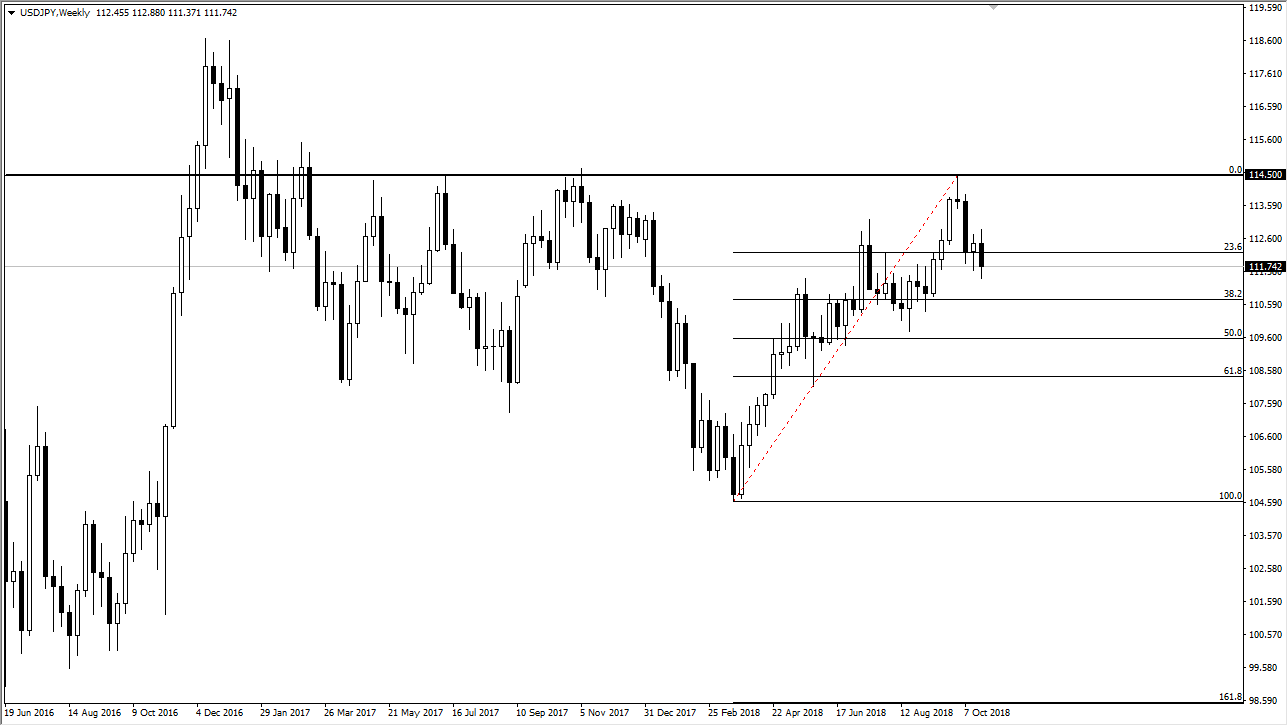

USD/JPY

The US dollar initially tried to rally against the Japanese yen this week but then broke down below the bottom of the hammer from the previous week. The question now is whether or not we can continue to find support just below? I do think it’s there, but we may need to drop a little bit lower to find it. Keep in mind that this pair has two major fundamentals pushing it back and forth, the risk appetite or lack of, and then of course the higher interest rates in the United States. In other words, this will be the best way to go against the value of the Japanese yen, as the US dollar is strong against most currencies anyway. That’s why when this pair falls, it is “less bad.”