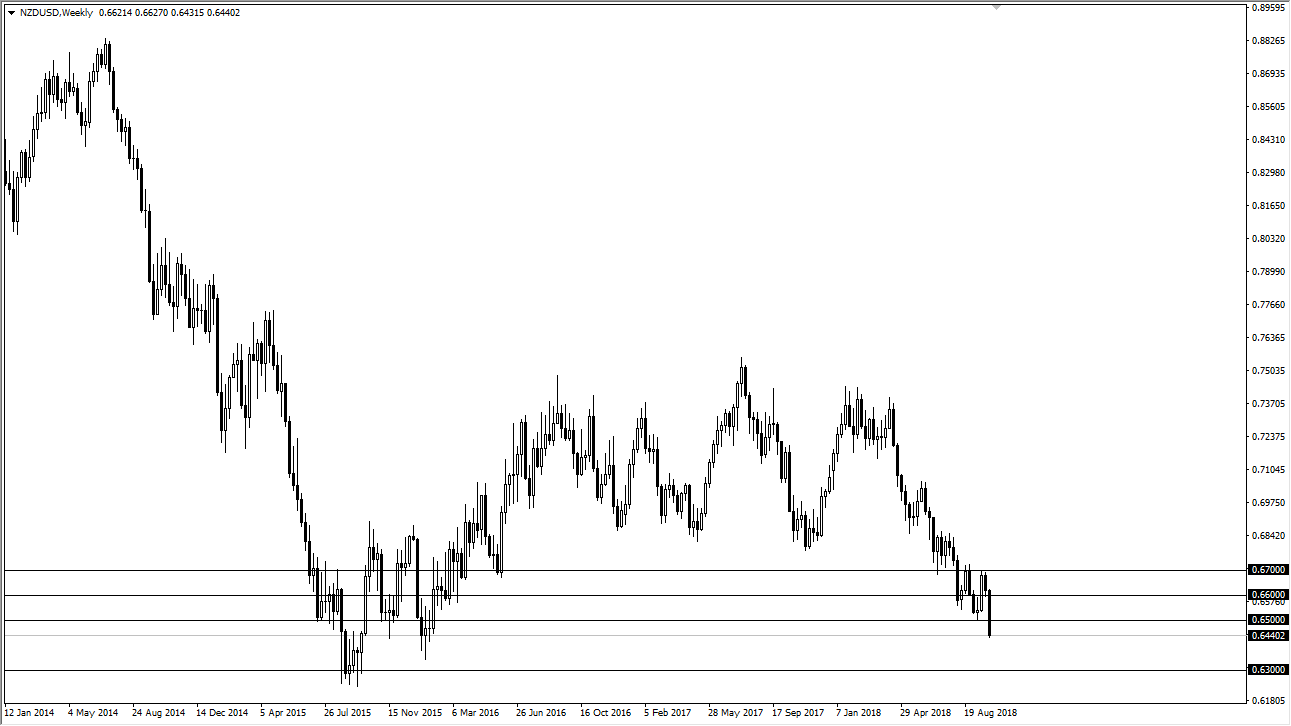

NZD/USD

The New Zealand dollar fell apart during the week, slicing through the psychologically important 0.65 handle. However, there is a lot of support underneath so I think that what we are going to see his continued selling, followed by value hunters near the 0.63 level or perhaps just a bit above there. I think that the 0.63 level should hold given enough time.

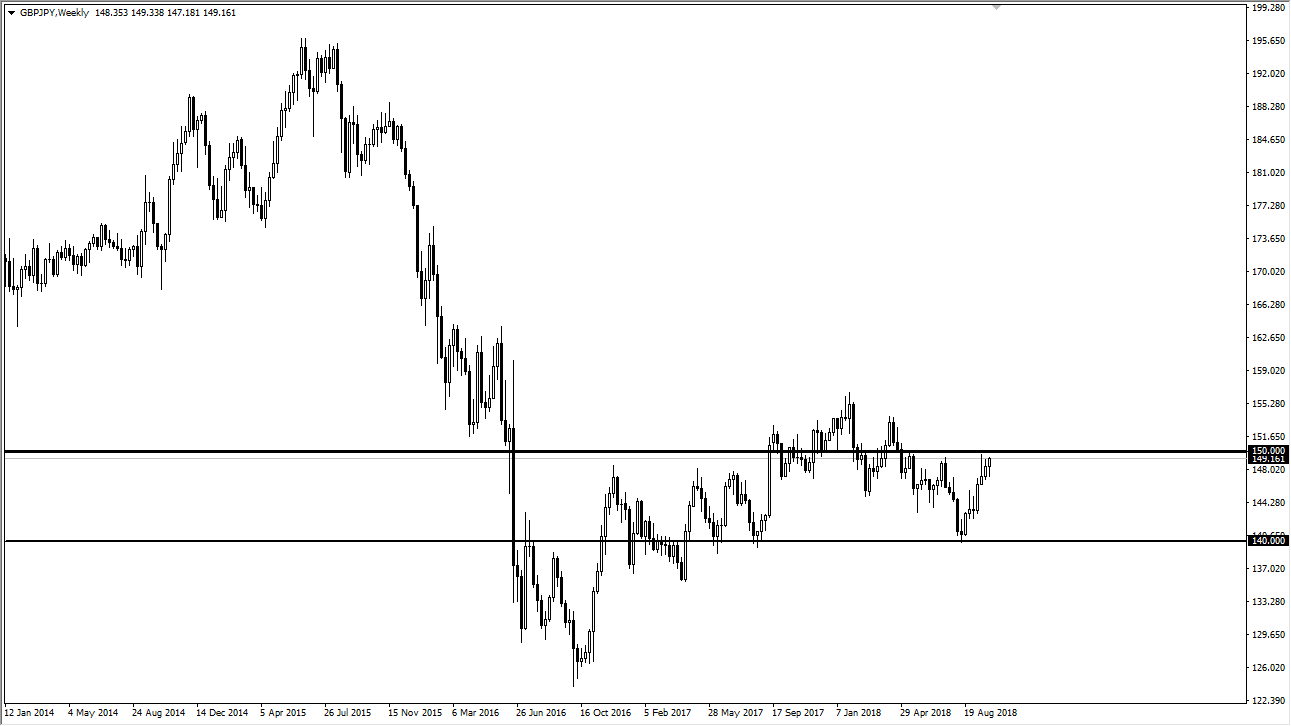

GBP/JPY

The British pound initially fell against the Japanese yen but you can see turned around to form a bit of a hammer that is pressing against the resistance at the ¥150 level. If we can break above that level, I think that opens the market up towards the ¥152 level over the next couple of weeks. Alternately, if we break down below the weekly candle, then I think we need to “reset” somewhere near the ¥145 level.

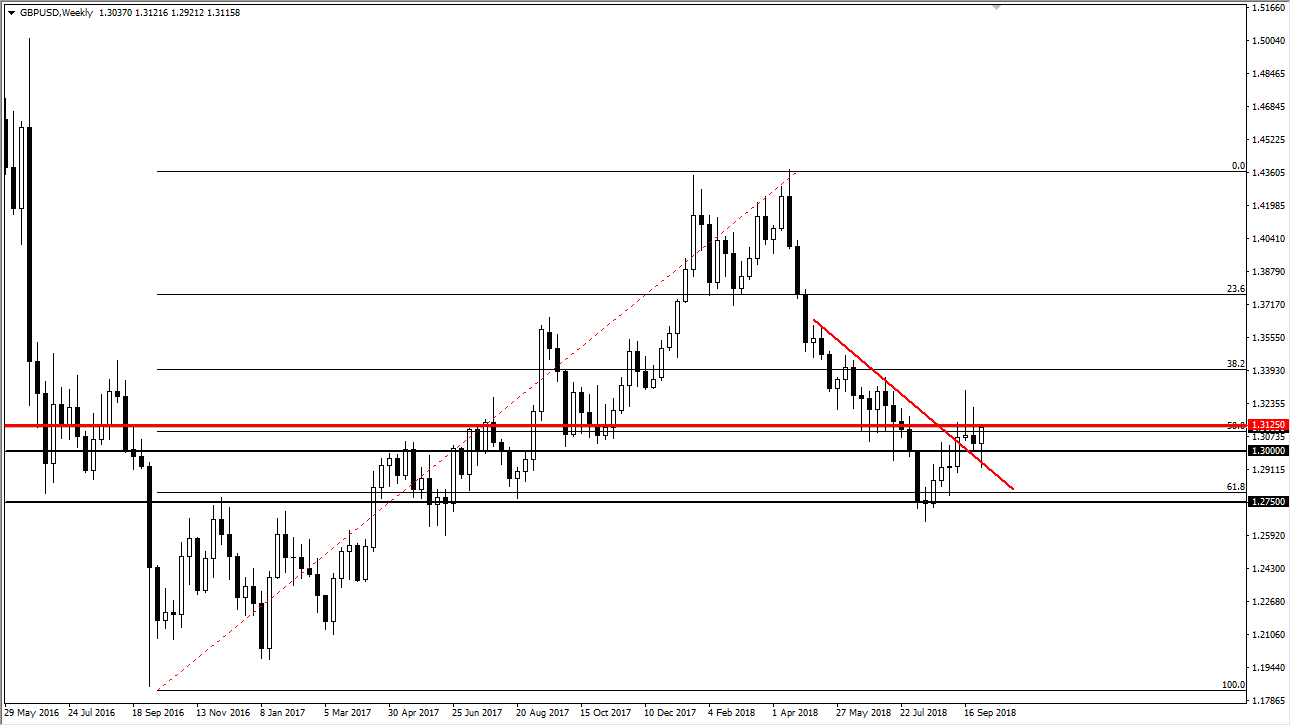

GBP/USD

The British pound fell initially during the week but found enough support at the previous downtrend line to turn around of form a massive hammer. The hammer is preceded by a couple of shooting stars on the weekly timeframe though, so it certainly won’t be easy to rally from here. I do believe that eventually the buyers will win the day, but with headlines coming out about the Brexit, we will have the occasional sudden moves in both directions. So far, it seems like every time the Brexit gets a negative headline, it ends up being a buying opportunity after a sharp selloff.

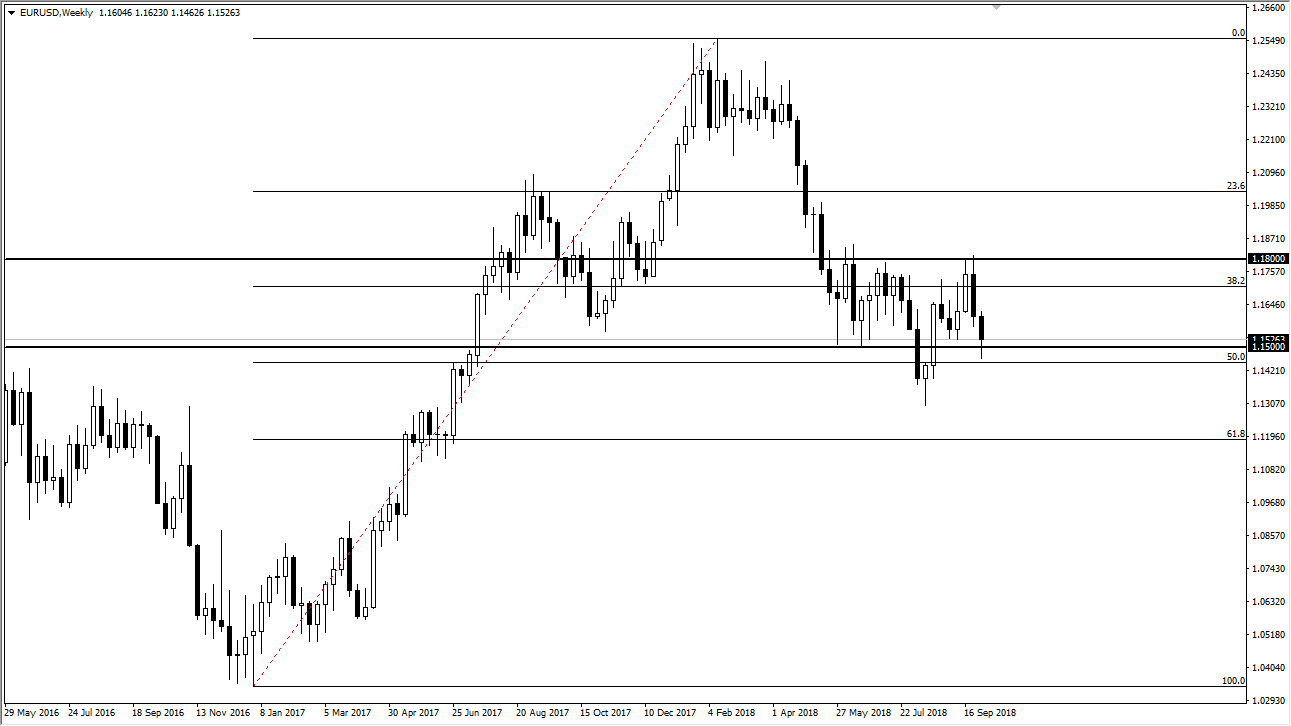

EUR/USD

the Euro fell during most of the week but turned around to show resiliency at the 1.15 handle. It now looks as if the market is trying to find reasons to rally, and I think that we may reenter the previous consolidation area. If that’s the case, then I would fully anticipate that we will try to reach towards 1.17 level, perhaps even the 1.18 level, but it may take a couple of weeks. I am more inclined to buy these dips at the moment then I am to sell them. The hammer from several weeks ago provide support as well as the 50% Fibonacci retracement level.